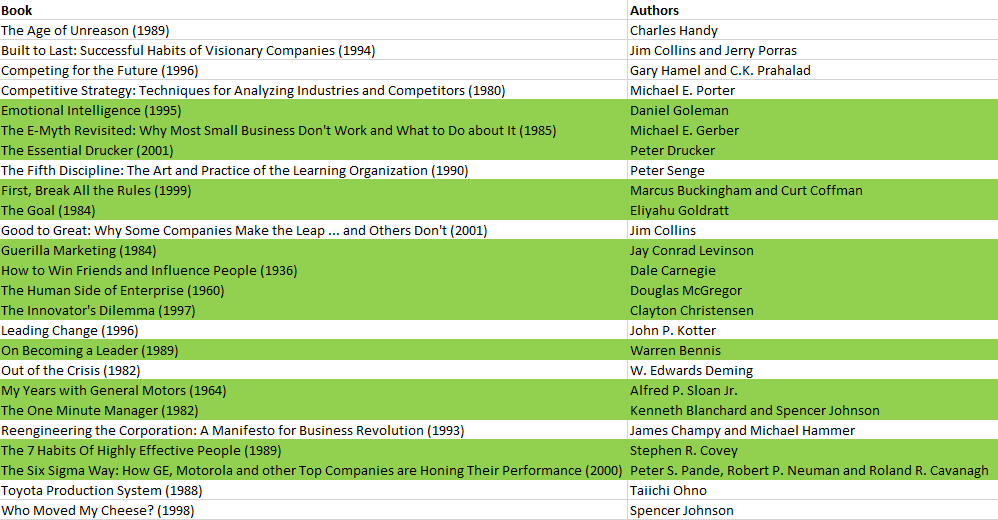

I can’t keep track of all of the fake books I read from 10+ years ago. It’s basically a minefield because so many of them turn out to be complete bullshit (again talking mostly about business and pop psychology). For example, I remember people slurping this when it came out, and it appears to still be a huge slurp:

#1 Best Seller in Business Pricing. He also wrote this, along with a few other titles as well:

How it’s going:

https://www.science.org/content/article/fraudulent-data-set-raise-questions-about-superstar-honesty-researcher

And when they say fraudulent data, they mean it in the most literal and cartoonish way possible:

For example, a set of odometer readings provided by customers when they first signed up for insurance, apparently real, was duplicated to suggest the study had twice as many participants, with random numbers between one and 1000 added to the original mileages to disguise the deceit. In the spreadsheet, the original figures appeared in the font Calibri, but each had a close twin in another font, Cambria, with the same number of cars listed on the policy, and odometer readings within 1000 miles of the original. In 1 million simulated versions of the experiment, the same kind of similarity appeared not a single time, Simmons, Nelson, and Simonsohn found. “These data are not just excessively similar,” they write. “They are impossibly similar.”

His co-authors bolted, correctly pointing out they had nothing to do with this data file. Ariely realizes he’s pinned on that issue, so of course he [wait for it] denies fabricating the data himself and strongly implies it must have been manipulated by the insurance company that provided it. That doesn’t make any fucking sense though:

https://twitter.com/datingdecisions/status/1427931450171662340

Right, and like, how would they even know exactly what to fake and by how much? It’s not even remotely plausible that happened. And of course, all of the communications with this alleged insurance company who cannot be named due to confidentiality have been lost. Also,

The timeline is also hazy: Ariely mentioned the study in a 2008 lecture and in a 2009 Harvard Business Review piece, years before the metadata indicates the Excel file was created. Ariely says he does not remember when the study was conducted.

The odometer study has resurfaced other worries about Ariely’s work. In July, an expression of concern was attached to a paper he published in 2004 in Psychological Science; in that case, statistical errors could not be resolved because Ariely was unable to produce the original data. In a 2010 NPR interview, Ariely referred to dental insurance data that the company involved later said did not exist, WBUR reported.

This dude has a lot of books that are popular in this space. So, I guess what I’m saying is be careful what you read.