i think the argument is more that they will always bail the rich people out when they get into trouble, not that they will never allow a correction in the market to happen. we are still only back to where we were when Biden came into office, i would say rich people are still doing just fine right now.

The apes were right!

https://twitter.com/forbes/status/1524781850543235075?s=21&t=lEAAUfbcMlcDTdU9VfC9zw

The memers are rallying.

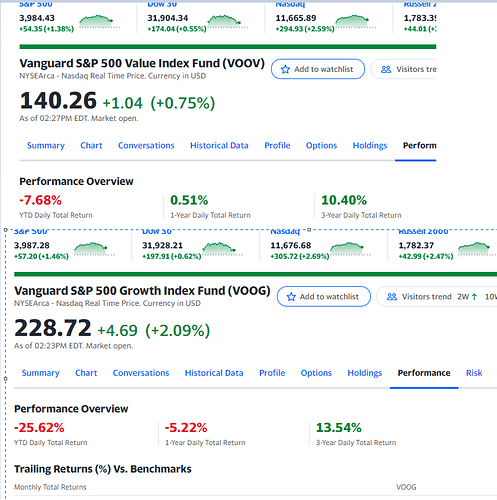

DJIA and S&P 500 are within 2 percentage points of where they were on inauguration day. NASDAQ is already lower by 15%.

Midterms are going to go great.

Here’s UP’s next big merger arbitrage opportunity

Lol Elon gonna spend $44B and sell the burned out wreckage off for parts.

I’m perfectly content with ATVI and IBA, thank you very much. Not betting on Elon.

Yes, clearly that is what the Fed’s willingness to rocket the real interest rate to a usurious -7.5% means.

Coinbase went from $41 to $58 a share today. Wtf?

I haven’t looked at the specifics since they reported earnings the other day, but before that they had a decent balance sheet if I recall correctly. I want to say their book value was around $25-30 and they are profitable in the TTM despite a bad quarter. So maybe people thought they were good value.

Edited: Just looked and it only went up like $5 a share today. They had about $7.70 per share in crypto assets in their last balance sheet. Maybe they disclosed what that was in and relative to the value it was marked at on 3/31 it’s doing better than people thought? BTC is down like 33% since then.

Correction over?

“It’s called ‘The Left Can’t Meme’!”

3 or 4 more days like this and I might check my balance. For now though - there be dragons.

dead cat bounce. its not unusual for some of the most green days to occur during bear markets

The S&P

1/3 4,796

1/27 4,326

2/2 4,589

3/14 4,173

3/29 4,631

5/12 3,930

That’s 470 down, 263 up, 416 down, 458 up, 701 down…

YTD -778, -16.23%

Don’t see why that trend couldn’t/shouldn’t continue a while longer. And throughout, you’ve seen a rotation out of some of the most overvalued companies.

Sarcasm noted but I’m not even disputing that. It’s that you can make the expected cash flows anything you want and are limited only by your imagination. Here’s one of the biggest bull cheerleaders ($1300 target) from just a few minutes ago. Did you have Tesla owning a major MINING OPERATION in your “all future states of the world” distribution when determining the cash flows? Have you been down the national security clearance rabbit hole yet? If not, hit another shot of that espresso and get ready.