Are we talking about baseball cards? The vast majority of baseball cards have not appreciated very much if at all since the 1990s. If anything the experience of sports cards in the 1990s is a cautionary tale for speculative investors.

I’m not prognosticating about whether NFTs will go up or down, I’m just pushing back on the argument that “These are obviously all worthless scams, they’re jpegs, why would anyone pay for a jpeg?” with the “Why would anyone pay for cardboard with an athlete’s picture on it? I dunno but people have been for like 70 years and counting…”

I think there are similarities between trading cards or other collectibles and NFT art, and I think dismissing NFTs out of hand is an oversight. That’s all I’m saying.

Sports cards in general. But yes that’s why I think they’re a good analogy. I mean the vast majority of cards available to be bought in the 1990s became worthless, but the overall market cap of trading cards has almost certainly gone up significantly and the astute purchaser of trading cards in the 90’s probably did well, but the ones who swept in when the market cratered and bought up the right stuff probably did even better. Maybe I’m wrong about that? I dunno, it follows logic to me though.

I will say I think it’s far more difficult to predict what NFTs will be worth something in 20 years than what trading cards would be worth something, but maybe that’s just because I know sports and I’m not an expert on digital art.

Well sure actual paper cards that you hold in your hand, grandpa.

But what the rights to claim ownership to a pointer to a mass-produced slightly-variated jpeg of a card that lives on a server somewhere, issued by some trusted authority that everyone loves like opensea? Is that something you’d be interested in?

If the results posted in the Crypto thread are accurate then they are not wasting money but making money.

Most of GM’s slaes (like well well >50%) are crossover SUVs or trucks. Tesla doesn’t make trucks yet.

But a critical thing you’re overlooking is that GM cannot make money building a four-door sedan in the American market. Tesla can make money building those. Lots of money.

I’m not saying TSLA is valued correctly or not, whatsoever. I don’t know nor really care (I’m an index-only guy). I’m just saying that looking at GM’s position as a ceiling for TSLA isn’t very useful.

A true horror. We need computer code to do somesthing about this ASAP

I will say this - if there was a low cost diversified index fund (subject to securities regulation) of NFTs I would be more comfortable holding that than trying to pick individual NFTs. I don’t pretend to be an investing genius but I am very, very confident that stock selection is a fool’s errand for 90%+ of the population, including me, and I’m not sure why I would abandon the principles of passive index investing just to access speculative NFTs.

There are some products coming out in Ontario that are actual securities regulated investment funds that hold crypto, for example. I considered putting 5% of my portfolio in crypto for diversification purposes but ultimately abandoned the idea because the products are too expensive. But if the market for products evolved and we can get some credible index of cryptocurrencies I may reconsider.

A diversified NFT-holding index fund would almost certainly lose a ton of money. The reason people can make money is that the markets are super inefficient and beatable, not because your average NFT value will go up.

I mean, they don’t have to be apple to apple for the comparison to hold. It seems unlikely Tesla not only becomes the #1 manufacturer but by a more dominant position than the current #1, unless you believe that consumer auto purchasing behaviors will drastically change or that the market won’t be able to compete with Tesla. Valuing TSLA as the #1 auto manufacturer seems like the bull thesis. Granted you can add in some of the battery business, too.

If that’s the case then I’m not that interested in investing. Again from the long history of useful lessons from the stock market, trying to play the arbitrage game as an individual investor is usually a fool’s errand. If NFTs are really a good place to put your money, then they should go up in value on average. If you have the secret sauce to pick 'em then I wish you well, but that’s not for me.

Yeah, treating NFT’s like stocks would be disastrous. Collectables and art are much more appropriate analogies, but with markets moving 100x faster.

It’s not that simple. Some people (like me) are down money, though the folks that got in early are up quite a bit (shocking!). There is still money to be made, though like most things in this world it’s easier for those who have already made money to make more money than it is for someone starting fresh.

Michael Jordan has a huge global fan base that current NFTs don’t. I don’t think they are comparable at all. Furthermore sports trading cards are a market that established itself over many decades. It’s not like a Mickey Mantle card went from 0 to 7 figures within a year or two.

They don’t have to become the #1 automaker by units sold to be the most profitable and valuable–by far. I think that’s kind of what bob’s post was getting at: even if Tesla’s growth flatlines from here, they’re plausibly ~tied (with Toyota) for the most valuable automaker in the world despite having just 10% of Toyota’s global units sold (Toyota is also the #1 automaker in the world by sales; GM is #4 if you combine Hyundai and KIA).

Easily solvable. Tickets can be linked to a name and that name can only be changed when you sell it over their official platform.

Is this a serious question? If so:

A stock’s price should be the discounted expected value of future cash flows. As those future cash flows are realized and/or get closer in time, their present value increases.

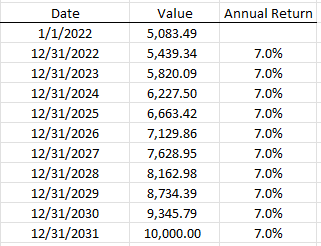

This is easy to see with bonds. Consider a 10-year zero-coupon bond priced to yield 7%. You buy it on 1/1/2022 and it matures on 12/31/2022. You pay $5,083 when you buy it, and the value should progress like this assuming that everything goes as planned:

So, every year, the expected return for the bond is 7%, even though everything about the bond’s earnings was priced in when you bought it. Similarly, you don’t need continued positive suprises to earn a return from owning stock - if earnings and cash flows are exactly correctly priced when you buy the stock, you should earn the discount rate implied by the market’s price of that stock.

Correct. If this went away, the entire stock market would collapse.

Yeah, this is a scary thought for sure.