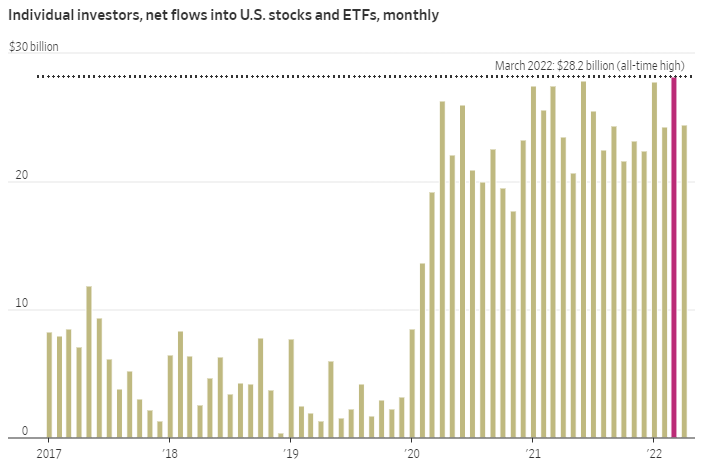

Don’t forget that the entire stonk market is propped up to some degree by millions of americans who dump money into it passively via 401(k)

The math behind crypto is pretty fascinating, but this is probably not true. There’s no benefit to using a distributed, trustless network to track something like ticketing when there’s already a central, trusted entity (the venue or the venue’s agent) who could do it instead. The technical problem is much harder, and it’s provably impossible to make a solution that works as well as the venue just having a database that keeps track of all the tickets that have been sold and who owns them.

The more plausible use cases to me are weird backend chunks of the financial system like bills of lading and whatnot. But the downside in those cases is that nobody trusts anyone else and they probably want some way to reverse transactions if they get screwed in some unexpected way, which is somewhat inconsistent with how crypto works.

NFTs as artworks that people want for aesthetic reasons, I totally believe in.

401(k)s are only about 10% of the market I think, but if you extend this to include the general tax-advantaged retirement space (401(k)s and legacy DB plans an personal IRAs) then it’s more like 1/3 of the whole US stock market is dedicated to “pensions” for Americans. But not all of that money is passive, there’s still plenty of active management in pension plans.

if alan greenspan had to read this shit every time the market went down, it would be stonks every day

Yeah and another way to think of it is that if you could go back in time to 1995 and buy up whatever trading cards you wanted, almost everything you bought would end up worthless. But if you snagged a gem mint 1986 Fleer Michael Jordan, you would probably only pay a few grand for it at the most. They went for like 750K in the big run up, and are still worth like $150-250K, so they crushed the stock market.

Are sports cards a scam and a pump and dump? I dunno, some are, some aren’t. But if you gave 9 year old me like $100K to put into sports cards in 1995, and explained that the goal was to buy stuff that would be worth lots of money in the future, my choices would almost certainly have beaten the stock market over the last 27 years, because I’d almost certainly have gotten an MJ rookie card and a Mickey Mantle rookie card if they fit under the budget. I also would have bought too much Philadelphia stuff that’d mostly be worthless, but it wouldn’t matter because those two cards alone would crush it for me.

This is what I think will happen with NFT art.

You’re conflating US market with global market. About 50% of Tesla’s ~1.2 million annual production/sales are produced in China and sold abroad (this has come to a halt due to Covid, as an aside). GM’s 2.8 million sold in 2019 was USA-only, and accounts for like 40% of their global sales.

https://www.wsj.com/articles/buy-the-dip-believers-are-tested-by-markets-downward-slide-11652197077

Some interesting stuff here

Chris Johnson, a 30-year-old individual investor who runs an online trading community called The Wealth Squad, has been among those encouraging small traders to remain steadfast. “Every asset class has a down cycle,” he tweeted in April, on a day when the S&P 500 dropped 1%. “Those who survive the down cycles come out of the cycle much wealthier.”

Mr. Johnson, an army veteran turned full-time trader who splits his time between Houston and Las Vegas, has taken advantage of recent market swings to scoop up shares of companies he plans to hold for the long haul. That has helped him amass large positions in companies such as Roblox Corp. , Coinbase Global Inc. and Shopify Inc.

Each of the stocks has fallen much further than the broader market, with all three down 67% or more this year. His Roblox and Coinbase positions are now worth about $200,000 and $35,000, respectively. Still, he said he isn’t worried because he believes the companies are industry leaders and the stocks will eventually rebound.

He said he has used the more recent market turmoil to double down on cryptocurrencies, which have tumbled alongside stocks, to help bring down the average cost of tokens in his portfolio. At the moment, he said, “I see opportunities in crypto that I’m not seeing in the stock market.”

Mr. Johnson said he has been trying to be more diligent in taking profits in his own portfolios. In addition to stocks and cryptocurrencies, he said he also has a portfolio of real-estate properties.

They can get a royalty on every single resale. Right now they could sell you a ticket for $100, you could re-sell it for $1,000, and depending on the platform that you use they get none of that. If they go to NFTs, they can charge whatever fee they want on every resale. Plus they can basically eliminate fake tickets from the marketplace.

I remain quite curious what’s going to happen as Boomers are forced to draw down on these accounts. It’s going to be a lot of downward pressure on the market, and we’re just starting to get into that range. Like my parents are old enough now to have required distributions from their retirement accounts.

OK, but what percentage of GM’s sales were trucks? What percentage were government contracts? Both are unavailable right now to Tesla, as far as I know. Government is too owned by oil companies to go electric yet. Maybe in 10 years that changes.

Billions of people don’t have this in some pretty key areas, and I’d say it’s a coin flip at best whether that situation gets better or worse in the coming decades.

Time to not stonks again.

Isn’t DCA just stoically continuing to buy forever rain or shine?

It is the value of discounted future earnings. The discount rate is your expected return.

I agree, with an important caveat: I think you overestimate the “obviousness” of winners with the benefit of hindsight, especially when at the time there is no guarantee that there will be any winners (MJ doing better than any other card doesn’t necessarily mean that it increases in absolute value), which is the rub with NFTs as well. I can say with high confidence that “bored apes will be among the highest-valued NFTs” but I can’t say with high confidence that “bored apes will increase in value.” But yea.

I think the meaning depends on context. Often times it comes up in the discussion of when best to invest a lump sum of money, with the options being invest it all ASAP or invest in equal installments over a longer period, with the latter being described as dollar cost averaging.

The stock price represents the current value of a company - which includes future earnings obv. But it won’t factor in the collective changes over decades of things like population growth, increase in innovators, the affects of new businesses entering the market, untapped tech, longterm inflation and so on. Those all have played a role in raising the market but doesn’t necessarily raise the stock value of an individual company.

I agree 100%, I’m not saying there are guaranteed to be winners in NFTs. But likewise in 1995 there were no guarantees any cards would be worth much money.

Paper tickets are rapidly going away in favor of centralized databases, some of which already exist. Lots of nice vents are already paperless and you need an app to get in.

Still can be resold on third party sites without royalties to the original ticketer.

So, then using the fact that cards did appreciate from 1995 as justification for picking winners in NFTs is basically just assuming your conclusion.