It’s funny how hard it is for me to parse finance talk. I don’t have that problem with any type of scientific literature. I understand most of the words and probably the gist of it, but it’s not easy to get the whole picture of what that tweet is saying to me.

I mean like any scam the verbiage of the stock market is purposefully complicated. That’s why you need to hire super expensive fund managers to handle it for you.

I mean, it’s not something that I am expecting to see but 18k is just putting us back to around Trump’s election date and would still be less than the average setback of our recent recessions.

You guys have got me panicking about my plan to finish my book then sell my condo in early 2023.

My understanding is that Ford sold 8.8M shares through a deal with Goldman Sachs, wherein Goldman is the middle man buying the shares from Ford and unloading them on others. Goldman gave them $26.90 a share and it closed Friday at $28.79, so Goldman will be trying to unload them without taking too big of an L, but this news will send the stock crashing tomorrow I would think. Also Amazon owns a bunch of RIVN, so this is bad news for them.

I assume Goldman was contractually obligated to do the deal, as it seems like kind of a bad spot for them to have to do it over a weekend.

I could be wrong on the details, though.

Larry Summer’s whole thing about inflation not going down without unemployment going up makes sense to me. If the job market is hyper competitive, salaries will keep increasing creating a loop towards higher prices and ingrained expectation of prolonged inflation is reinforced it.

Good thing we’re turning away millions of people at our southern border who just want to work the kinds of jobs Americans don’t want anyway.

It sounds like the lockup clause would normally end on a business day, but the lawyers forgot to include “business day”, so it ended on a Sunday. Ford most have been the first or only one to notice this and is unloading their pile of shit before everyone else can/does tomorrow.

Right but they own like 100M shares and could only get rid of a block of like 8.8M so they aren’t getting out from under much of it. This should hurt Ford’s stock a lot too if the consensus is that Rivian is worthless.

I think it’s more that major investors are bailing as soon as the lockup period ends.

It will just be a few million clownfish all panicking and swimming down bringing down the net and fucking things up - after that it should be back to business.

Holy not stonks.

GREAT BUYING OPPORTUNITY ALL HAIL THE GREAT AND GLORIOUS MARKET THE MARKET GIVETH AND THE MARKET GIVETH SOME MORE.

I’m old enough that this is now my third crash. It’s crazy how fast it flips.

We all knew shit was completely fucked up. Rivian trading for more than GM having never made a car, Tesla valued at a trillion dollars, million dollar bored apes, Door Dash at $50 billion and every “pre-revenue” idea out there getting 9 figures of funding.

But that all went on for like 3 years after we knew something was wrong, during which the market doubled!

“Black Monday”

“The Dot Com Bubble”

“The 9/11 Crash”

“The Global Financial Crisis”

“The COVID Crash”

“The Biden Bubble”

Unfortunately unironically yes. The whole way down.

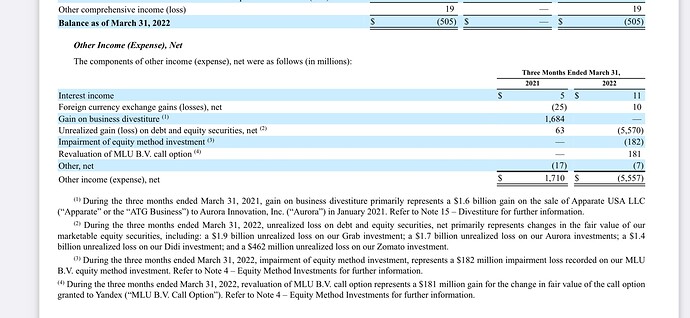

During the three months ended March 31, 2002, unrealized loss on debt and equity securities, net primarily represents changes in the fair value of our marketable equity securities, including: a $1.9 billion unrealized loss on our Grab investment; a $1.7 billion unrealized loss on our Aurora investments; a $1.4 billion unrealized loss on our Didi investment; and a $462 million unrealized loss on our Zomato investment.

Thought this was interesting …

CPUC ISSUES PROPOSAL TO AUTHORIZE FIRST DEPLOYMENT OF

DRIVERLESS AUTONOMOUS VEHICLE PASSENGER SERVICE

SAN FRANCISCO, April 29, 2022 - The California Public Utilities Commission (CPUC), in ongoing efforts to support transportation innovation, today issued a proposal that would authorize the first participant in its Autonomous Vehicle Passenger Service Driverless Deployment program. With this

proposed authorization, Cruise LLC may offer passenger service in AVs without a driver present in the vehicle. The proposal will appear on the CPUC’s Voting Meeting Agenda no sooner than the June 2, 2022. The public can comment on the proposal on the proceeding’s Docket Card

https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M472/K498/472498854.PDF