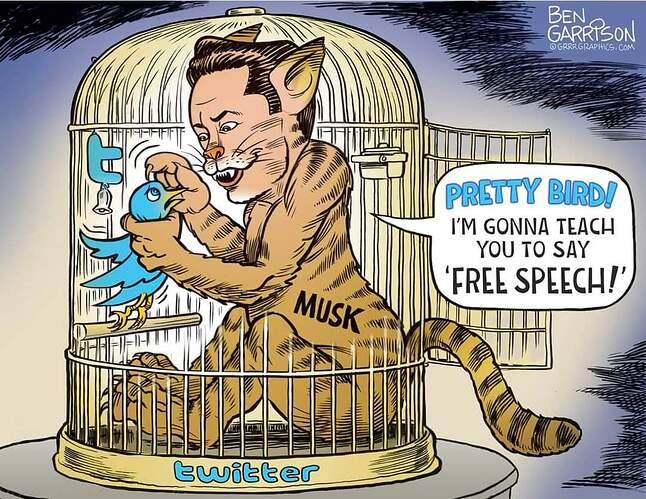

Most accurate Ben Garrison comic ever?

I have no idea if he thinks Musk pwning Twitter would be a good thing or a bad thing.

Insanely specific request: There was a company several years ago that was facing a large lawsuit. They settled that lawsuit with a big number (in the billions), but announced at the same time that they had already accrued that loss on their Balance Sheet, so there wouldn’t be any Income Statement hit from the settlement in the current period. But they just hadn’t clearly disclosed that prior accrual, so investors didn’t realize they had done it.

Does anyone know what company/lawsuit I’m thinking of? For some reason, I want to say Budweiser, but that doesn’t seem to be it.

Loved this quote from Supermoney that I found online regarding bubbles.

“We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know, by the rules, that at some moment, the Black Horseman will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time, so that everyone keeps asking, ‘What time is it? What time is it?’ But none of the clocks have any hands.”

Johnson and Johnson asbestos?

Recent talc cases? Or am I thinking of something completely different?

I think the one I’m thinking of is somewhere in the 2005-2015 time frame.

Netflix -24% RUH ROH

I don’t think this is what you’re looking for but BP was able to finagle most of their $20B settlement to be tax deductible.

Yeah, I don’t think this is it either. Most settlements turn out to be tax deductible. I think the distinction is between voluntary settlements (which are deductible, to the best of my knowledge) vs. regulatory fines (which are not).

Pretty crazy, but also not surprising? In my house, I’ve got Youtube TV, Amazon Prime, Netflix, HBO, and Disney+. Netflix is easily the first to go if I had to cut something.

There’s an investing truism that I’ve always attributed to Buffett (I’m not actually sure if that’s right): In the battle between content creators/owners and content distributors, the creator/owners will always win. Netflix is basically a joke now that all of the content owners are pulling their stuff to host on their own platforms. (Unless the distributor has a regulated monopoly.)

It seems like Netflix realizes this and has plowed infinity money into original content, but they just aren’t making good enough shows. Most of the top talent only seems to go to Netflix after someone else passed.

I have HBO to watch exactly one show, and it isn’t even on the air right now. Their app is awful. Yet I still pay. Netflix just doesn’t have any content I care about, we keep it so my wife can watch British bake off.

Maybe that was always how this was going to work out. Just like how Tivo came out of the gate strong, but then became niche when all of the cable/Sat providers built their own DVR boxes.

But if Netflix is willing to pay top dollar, why don’t they get their pick of good shows? I wonder if it’s because the studios/established players will blackball production companies who go to Netflix.

I think Netflix is spending too much on movies. When they were producing “can’t miss” content it was when they were making the best shows.

I think a big part of it is top talent having first look deals elsewhere. But by now you would think they could just pay enough to get those too. Maybe their famously awful culture is a big clash with creative types?

They need to fire their content people, shit like Red Notice? Cmon.

Yeah I was scrolling Netflix and watching random snippets yesterday for first time in months (I mooch accounts off a friend) and was shocked by how shitty the content was, especially the trending (new) stuff. Albeit I am in Australia where the library is extremely limited (especially syndicated stuff) but the content I see on Amazon and a couple of our local streaming services is way more interesting.

@Riverman I hope you ended up shorting SAVA?

Nope. Just too much of a wimp. I’ve never been so sure a company is a complete fraud. But I felt pretty strongly Tesla was a disaster at $200…

This one was arguably much different because there was/is massive evidence of actual fraud, not just a capital incinerating unprofitable business run by a douchebag.