So we know there’s a zero percent chance that Musk will actually buy Twitter, but if he did he would quickly figure out that the whole ‘platform for freeze peach’ thing is a lot harder in practice than in theory.

This is sad. I started posting on the Motley Fool in 1999. And even though I haven’t posted there for 7 years or so, I still have a lot of fond memories.

Didn’t they go from reasonable investment advice resource to scammy-type stock-tout pay service a long time ago?

They did, but the value I got was from all of the community members posting on the boards across a variety of topics. Just like UP!

https://twitter.com/MaxBoot/status/1514570168730636290

sounds like Max should start his own microblogging platform? Or is this line of argument going to be shortly out of fashion again?

The geniuses at Wedbush actually think it will happen

Yes it will happen right around the same time as the million robotaxis, the Tesla semitruck and the AI robot servants.

Yeah I don’t disagree, but I don’t think they’ll be significantly less true than last quarter, and I do think consumer spending is likely to drop off sharply sometime soon - wouldn’t shock me if this set of earnings reports showed that.

As someone who thinks about financial statements all day, I’m curious what you mean by this.

For completeness and reference of the thread:

I also think it’s unlikely fwiw

Yes

Here’s the filing language:

On April 13, 2022, the Reporting Person delivered a letter to the Issuer (the “Letter”) which contained a non-binding proposal (the “Proposal”) to acquire all of the outstanding Common Stock of the Issuer not owned by the Reporting Person for all cash consideration valuing the Common Stock at $54.20 per share (the “Proposed Transaction”). This represents a 54% premium over the closing price of the Common Stock on January 28, 2022, the trading day before the Reporting Person began investing in the Issuer, and a 38% premium over the closing price of the Common Stock on April 1, 2022, the trading day before the Reporting Person’s investment in the Issuer was publicly announced.

The Proposal is non-binding and, once structured and agreed upon, would be conditioned upon, among other things, the (i) receipt of any required governmental approvals; (ii) confirmatory legal, business, regulatory, accounting and tax due diligence; (iii) the negotiation and execution of definitive agreements providing for the Proposed Transaction; and (iv) completion of anticipated financing.

I don’t give a shit how rich he is, he’s not going to put $40 billion of his own cash in this. And I have trouble imagining that anyone would put up billions of dollars to invest alongside him.

I’m speaking from an Australian tax regulation perspective so potentially it is coloured by that but the accounting techniques used to reach high profit figures whilst earning little or negative taxable income (admittedly a lot of this is multinational transfer pricing) have made myself, and many smarter more experienced colleagues, view accounting GAAPs etc as a joke. So, yes, maybe I’m cynical but it seems like the ability to report a profitable performance is in itself a skill distinct from making a profitable company. Of course I know you know more so I’m probably just talking out of my ass (you are genuinely one of my favourite posters here).

It’s hard to comment on this at the aggregate level, but if you have some particular companies in mind, I’d be happy to talk through their financial statements to see if I end up agreeing with you.

They’d all be companies the Australian government has current multinational tax audits on lol, so impossible (though many here would probably be able to guess some).

Coming back to this, it seems like I was pretty wrong in saying that adjustable rate mortgages (ARMs) are common. This report suggests that they represent only 4% or so of all mortgages. I’m very surprised by this, and I assume this % was much higher 5 to 10 years ago.

We moved here in 2010 and started with an ARM - it had a fixed rate for the first 5 years, and could then adjust each year afterwards based on an index (LIBOR, probably), with a cap on how much it could adjust in any given period. Since mortgages can be refinanced with no prepayment penalty, I think that mirrors the economics of what you described. In a world where the ARM introductory rate was substantially lower than the 30-year fixed rate and where the expected life of the loan is like 5-7 years (because of the likelihood of moving or refinancing), it seemed like a no-brainer.

But your post did prompt me to look back to a proposal I got in 2006, when my wife and I were considering buy a house in Chicago. Here’s how crazy things were:

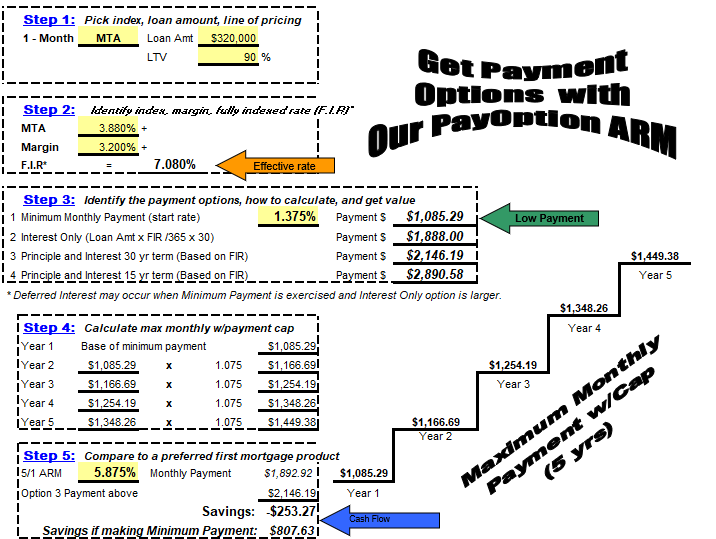

To narrate this document:

"You want to borrow $320,000. Here are your options:

- You can take out a normal 30-year fixed rate mortgage at 7.08%. That would result in a monthly payment of $2,146.19.

- You can take out a normal 15-year fixed rate mortgage at 7.08%, which would increase the payment to $2,890.58, but obviously cut the number of payments in half.

- You could take out a 5/1 ARM (like the one I described above) at an intro rate of 5.875%, which would give you monthly payments of $1,892.92 for the first 5 years.

But those are boring! What if you I told you that you didn’t have to pay any principal amount at all? If you just pay the interest each month, your payment shrinks to $1,888. How great is that!

But I’m saving the best for last. What if I told you that you didn’t even have to pay the full interest? Instead, you just pay an intro rate of 1.375%, resulting in initial payments of $1,085.29. That’s almost a 50% discount from the 5/1 ARM option, and more than a 50% discount from the 30-year fixed rate!

You may be curious about which option you should take, so I have helpfully labeled this final option with a green “Low Payment” arrow and a blue “Cash Flow” option.

Yes it is true that this results in negative amortization, but only dumbass accountants use words like amortization, so this is not a problem."

I’d love to be a fly on the wall of the investment bank desperate for Tesla business when getting a call from Elon to line up financing for the twitter takeover.

You mean Twitter won’t accept TSLA?!

- After seeing how much money flows into right wing media companies, it wouldn’t surprise me if there were at least a few rich libertarian types who were willing to throw some money into “free speech” as an investment in advancing their political goals even if the investment didn’t pencil out as a pure dollars and cents play.

2,) On the last few episodes of the Pivot podcast, Galloway has talked about how he had been talking to some folks about trying to take over Twitter. He didn’t name names, but the way he described them it seemed like they were non-ideological folks who just thought there were ways to more effectively monetize the platform. Now, some of those folks might not want to sign up for Mr. Musk’s wild ride, but some might…

I mean, if Musk actually buys twitter (highly unlikely), it will almost certainly hemorrhage users and lose lots of money. $50 billion is a fucking ton of money, very very few individuals have the kind of liquid money to meaningfully participate in a transaction that size and they aren’t going to risk that much money alongside Elon fucking Musk. Also traditional financing is probably off the table because there isn’t any cash flow to service debt.

So true. Softbank put $17B into lol WeWork, so there is a lot of stupid money around, but someone would have to make a bet 3x as big to buy Twitter.