I think time will tell about Powell. Maybe it is an impossible position (especially with covid) and yes he doesn’t bow down to either party but he does bow down to equity markets, at least in my humble opinion.

As an aside, with Fed certainty, could stonks hit ATHs again despite megainflation?

Or because of it.

I think I’m going to unload my COP (Conoco), XM (Exxon) and BP tomorrow. COP and XM are back to pre-covid highs (COP is all time high) which was always supposed to be my exit point. BP is the red-headed stepchild that will never catch up.

Between that and my ill-timed venture back into and then out of UCO, I’ll be out of oil stonks for a while. Considering holding the proceeds as dry powder, but also thinking this war could be over in a few weeks and stonks will stonk to the moon.

Inflation was the only thing the market was clamering to this last year. I’d assume we go lower in the near future.

Remember this guy? A handful of years ago he made waves by paying his employees a reasonable wage in Seattle… Now he can barely fill his open positions!

https://twitter.com/DanPriceSeattle/status/1502124425352732676

There’s a theory in economics called efficiency wages that says companies should pay above market wages and their employees will be extra productive in return. It seems that not everyone subscribed to this idea.

Am I missing something here? It sounds like he is saying the exact opposite of that in the tweet.

You’re missing, or I failed to express, sarcasm.

Thanks. I miss that a lot.

Nickel trading halted again!

How the hell is a commodity halted at just 8% down? Wat

I assume you saw Matt Levine’s discussion of this yesterday?

This morning the LME reopened for nickel trading, but quite gingerly. LME announced that it would only allow the price to move up or down by 5% from its previous close. That close was itself sort of artificial (since it ignored all the canceled trades from Tuesday).

This was arguably a strange thing to do. The reason that LME suspended trading and canceled trades is that it thought (and many traders thought) that the market price of nickel futures did not reflect the “real” value of nickel, because of, essentially, glitches in the financing of some big nickel traders. The prices “were becoming disconnected from, I believe, physical reality,” said the head of the LME.

Arguably the point of taking a whole week off trading was to let investors think about things, line up the appropriate financing, and come back ready to move nickel to the right price. There is no reason to think that last Monday’s closing price of $48,078 per ton was the “right” price; that price already reflected some dislocation from short squeezes, and was up 66% from the previous week’s close. (It also did not reflect real trades that happened on Tuesday morning and then got canceled.) The LME might have said “right, we are going to give everyone a week to get their financing in order so that no one is forced to buy or sell due to margin calls, and then we’re going to let the market open and move back to the real price, no matter what that is, but probably a lot lower than $48,000.”

And in fact the nickel news over the last week pretty much has been about how the trader with the biggest short position — Chinese nickel tycoon Xiang Guangda’s company, Tsingshan Holding Group Co. — has been lining up financing to avoid getting forced out of its short. Which was not that hard to do, because Tsingshan produces tons of nickel, so as the price of nickel goes up (and it loses money on its short) the value of its assets goes up. So banks should be happy to lend Tsingshan lots of money to, essentially, hedge its nickel production, and in fact the banks did agree to do that.

More generally, the point of shutting down an exchange when prices move too far is that you think that those prices probably do not reflect fundamental supply and demand. At any given moment on any given exchange, there are only some traders trading; they have risk limits and financing constraints, and if the price gets out of whack they might just turn off their computers and go home. And then whoever’s left can move the price in weird ways. But when the exchange shuts down, it (1) pauses trading, so there are no more weird price moves, and (2) sends a strong signal to the market “HEY THINGS ARE MESSED UP, COME GET SOME FREE MONEY.” Anyone who wasn’t hanging around at the time of the shutdown — banks, hedge funds, nickel producers, industrial users, anyone with an interest in nickel prices — now has an opportunity to show up. So when the market reopens , after a long enough time, everyone who thought “hey that price is way too high (or low)” can show up and sell (or buy) and the price will get back to normal.

It is not just Tsingshan, by the way. Here is a Bloomberg News story about how “Trafigura Group, one of the world’s top oil and metals traders, has been holding talks with private equity groups to secure additional financing as soaring prices trigger giant margin calls across the commodities industry.” I don’t think that the right reading of that story is “Trafigura, a huge commodity trader, has lost a bunch of money on commodity volatility and needs more money.” That’s possible, but in general big traders do well in periods of volatility. Instead the story is more likely to be something like “Trafigura is making tons of money in this volatile commodity environment, but it needs lots of financing to keep doing that.” (“New sources of funding could give Trafigura firepower to take advantage of market opportunities even at high price levels,” says Bloomberg News.) When prices are dislocated, there is a lot of money to be made, but you need a lot of financing to make it.[1]

Given that dynamic it might have made sense for the LME to just reopen without any price limits: “Stuff got real weird last week, so we’re going to forget about it and start over from the beginning; whatever you want to pay for nickel now, after a week of careful reflection, is going to be the price.” With enough notice that might get you a good price, probably better than 5% up or down from last Monday’s somewhat dislocated price.

But, whatever, LME came back with a 5% price band, and then promptly (1) did some trades outside of the price band and (2) canceled them retroactively, oops oops oops oops oops:

As detailed in Notice 22/064, the LME reopened the Nickel market at 0800 (with the pre-open starting at 0730) on 16 March 2022. As the market opened, the uncrossing algorithm discovered an opening price of US$45,590 (which was the lower daily price limit, i.e. 5% below the prices published in Notice 22/067) for 3-month Nickel. Unfortunately due to a systems error, LMEselect then allowed a small number of trades to be executed below this lower daily price limit.

The LME immediately decided to suspend Nickel trading on LMEselect while the system error is investigated.

All Nickel trades executed on LMEselect at the lower daily price limit will remain. The small number of Nickel trades executed on LMEselect below the lower daily price limit will be cancelled.

Oh, nickel. Anyway it’s fixed now and the market reopened. The LME will not, however, generate an “Official Price” for nickel for some time:

A key element of the day’s activity is discovery of the Official Prices, which are used by the industrial metals community around the world. …

Having previously held discussions with the physical industry, the LME had announced (in Notice 22/064 in particular paragraph 25) that it would not publish Official Prices if the market had reached its daily price limit during the period within which the relevant price is being determined on a given Business Day. This is because physical users preferred not to have Official Prices which they had been unable to trade (which would be the case if the price were at the daily price limit).

The daily price limits have been constructed in order to help the Nickel price to find its natural level over the coming days in an orderly fashion. The LME will commence publishing Nickel Official Prices as soon as these are discovered without a daily price limit being engaged during the relevant Ring trading session.

Basically the LME is set up to produce the wrong price for nickel for the next few days, in order to slowly ease into the right price. Seems like an odd choice.

Lucky call perhaps, but it’s been a good run since then. The company reports earnings next Wednesday. I think the big charging sector share price losses after BBB failure was an overreaction.

Yeah it isn’t financially engineered to the nth degree to maximize the short term stock price. People feel like owning something real in times of major uncertainty.

Spidercrab is rich we get it

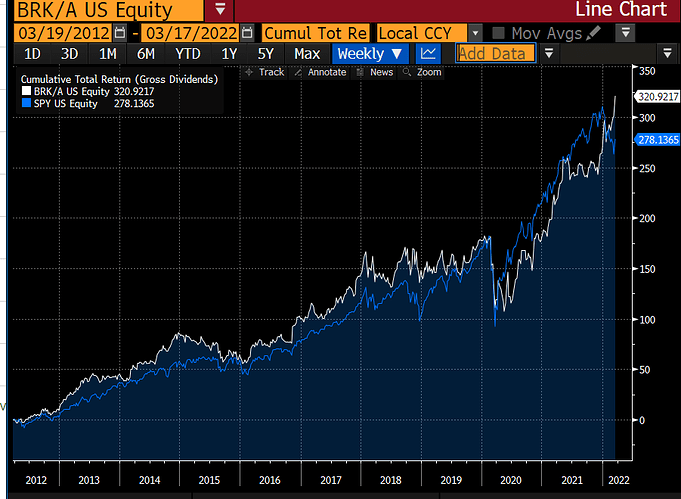

All that graph really shows is that just in the last couple of weeks, Berkshire’s 10-year stock performance is just slightly better than the S&P 500.

I’m not rich, but this recent period of Berkshire exuberance is definitely an odd feeling that I haven’t experienced in a long time.

[Side note, why is it so hard to find a website that graphs dividend-inclusive total returns?

Side note 2, can’t wait to have the standard internet argument of what constitutes “rich”.]

Think it’s pretty clear.

Rich = don’t have to work. Something like 25x expenses saved

Very Rich = private aviation

Mega Rich = the assholes who do whatever the fuck they want and pay no taxes

Big sigh of relief from Todd Henderson.