So after the split it’s only up 0.4%. Seems reasonable.

If I am a financial institution with $1M us dollars in customer deposits and the equivalent of $2M USD in liquid assets, as long as I keep $1M in US dollars, what I do with the second million should not generate any currency risk relative to the deposits whether I put it in dollars, rubles, dogecoin, or tulip bulbs. The risk is only the risk of the currency or commodity I choose to hold, right? What am I missing?

Here’s my thinking. Under liabilities:

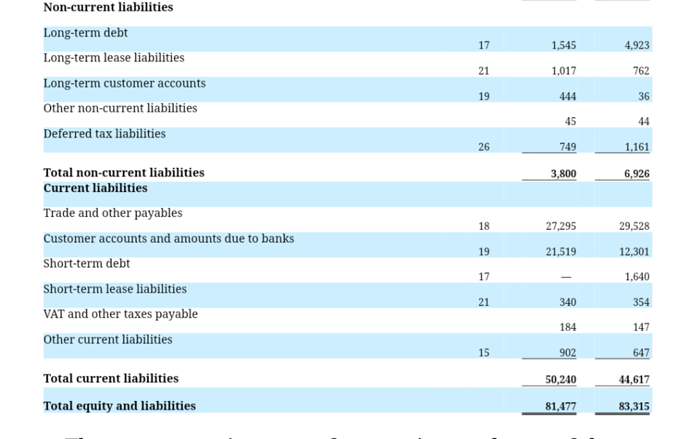

The vast majority of customer deposits are in rubles, so that’s a big chunk of 12,301. If most of their trade and payables, and short term debt are also in rubles, a huge chunk of their 44,617 would be in rubles.

Then you circle back and they’ve got ~40,000 in cash held in rubles.

I think there’s a reasonable chance these are cancelling each other out and somewhere between 50% and 90% of the cash on their balance sheet that is not customer deposits and is not earmarked for ruble-denoted debt is in dollars, euros, or other currencies.

If so, the damage being done to the ruble and the Russian economy would mostly be contained to their forward earnings and would not be catastrophic on their balance sheet.

Also the numbers there are more than a year old, and assuming they’re being smart about their risk, they’d be avoiding leaving anything in rubles that didn’t have to be as the buildup to the invasion happened.

I mean if you were running a Russia-facing fintech how long would you leave your profits in rubles before converting them to something safer?

I don’t know if I’m doing a really bad job explaining myself, if I’m missing something really obvious, both, or neither, but…

Let’s say I run a fintech helping message board users transfer funds around, and my balance sheet is filed in UPcoin.

I have 20 million UPcoin in assets, and 10 million UPcoin in liabilities. 100% of my liabilities are customer deposits and they’re in all sorts of different real world currencies.

I keep 10 million UPcoin worth of assets in the matching currencies of the customer deposits so that I have no currency risk on my customer deposits, right? So I’ve got a lot of dollars, some Euros, some rubles, some yen, etc.

Now the other 10 million worth of UPcoin is my profits from charging you guys obscene fees. Business is business, and all. I can put that into anything I want. UPcoin, dollars, bitcoin, gold, etc. As long as it’s liquid it’s going on the balance sheet as cash and equivalent short term investments.

The thing is, my book value is entirely the second 10 million. So if all of my customer deposits were in rubles and rubles went to zero, but the rest of my assets were in dollars and they stayed level against UPcoin, I’d then have 10 million UPcoin in assets, 0 UPcoin in liabilities, and my book value would remain 10 million.

My future earnings would be wrecked and thus my valuation would suffer, but I would still have the same book value.

Did that imaginary example make sense?

We would like to highlight QIWI’s strong financial position with negative Net Debt and an equivalent of RUB 35.5 billion of cash and cash equivalents as of the end of 3Q 2021. Our business has limited exposure to currency risks, as majority of our operations and over 98% of cash balances are nominated in local currency.

That was from March 4th. That combined with the decomposition posted above (yeah I know it is dated) leave me hard pressed to think they hold a lot of US dollars.

Your explanation makes sense if thats what they hold, but everything they have filed and are telling you is that they hold Rubles.

Oh the other thing is they’re officially headquartered in Cyprus so saying the “majority of our operations…are nominated in local currency,” could mean they are keeping a majority of their cash on hand that isn’t directly cancelling out ruble denominated liabilities in Euros. That would match what was laid out above, as they have more Euros than dollars as of December 2020.

If that’s true they’d have to have at least 51% of that portion of cash in Euros, which would proportionately mean 42% in Dollars and 7% in other.

I don’t think it’s a lock that I’m right, but I think it’s realistically quite possible.

Yeah, that’s almost certainly not what those words mean in that type of release.

Hope it is though!

Thanks, we’ll see. I’m glad I kept it to a much smaller position than usual on this one due to the volatility. Even if it goes to zero I’m beating the market on that batch of investments, although I need it not to go to zero to be beating staying in cash.

This is technically true. But why would you put your excess liquidity in currency that is completely unrelated to your operations? You need to pay your employees’ salaries, your utility bills, your taxes all in Rubles. And your primary shareholders live their lives in Rubles. Why would you hold U.S. dollars or Euros?

It seems super likely to me that you are confusing assets and liabilities. Maybe you’re not, but let’s just make sure. When a customer deposits money on a platform, that deposit simultaneously:

- increases cash and cash equivalents on the asset side

- increases customer accounts on the liability side

Maybe that was unnecessary, just making sure.

Anyway, what you’ve said here doesn’t make sense. First you say that they’ve got 44,617 in Ruble-denominated liabilities. I agree with that. Then you point out they have 40,000 in Ruble-denominated cash offsetting that. I agree with that, too!

But then you say this:

“somewhere between 50% and 90% of the cash on their balance sheet that is not customer deposits and is not earmarked for ruble-denoted debt”

There is no remaining cash on the Balance Sheet! You’ve already accounted for almost all of their cash and cash equivalents when you offset the Ruble-denominated liabilities.

Let’s step back and look at the totality of their Balance Sheet.

As of the end of 2020, this was the vast majority of their assets:

- 47,382 in cash and cash equivalents. As discussed above, virtually none of this is in US dollars or Euros.

- 10,813 in goodwill, which in no way should be viewed as a US $ item

- 7,445 in trade and other receivables. Note 13 doesn’t mention anything about currencies, and since their business is primarily in Rubles I assume that their trade receivables would also be in Rubles.

- 5,799 short-term loans and 214 long-term loans. Note 12 doesn’t mention anything about currencies, so I’d again assume that these are primarily in Rubles unless given direct evidence otherwise.

- 3,495+2,888 in short- and long-term securities and deposits. Note 30 says this:

Debt securities of the Group mostly consist of RUB nominated government and high-quality corporate bonds with interest rate 7.0%—7.6% and maturity up to January 2023. Some of debt securities are pledged (Note 27).

Long-term loans generally represent RUB nominated loans to Russian legal entities and have a maturity up to six years. For the purpose of fair value measurement of these loans the Group uses comparable marketable interest rate which is in range of 7-35%.

There is zero evidence that I can see that they’re holding US dollars in any meaningful amount.

I’m making this a separate post because it’s a really stupid analogy, but I think it might offer a different way to look at things.

Let’s say you operate a very basic company - CW Poker. The company pays you a salary and the company’s earnings are your poker earnings offset by your salary, the cost of your accountant, your travel expenses, tournament entry fees, and taxes. Since you play almost exclusively in the US, all of your expenses are paid in US dollars. Sometimes the company lends money to other players, and other times it borrows money from players. Those transactions are in US dollars, too.

It would never occur to you that CW Poker faces any currency risk, right? All of their assets, all of their liabilities, and all of their revenues and expenses are denominated in US dollars. Moreover, all of the investors in CW Poker are domiciled in the US.

BUT

Suppose you are awice, and you believe that the US dollar is worthless. In fact, you don’t own US dollars or even transact in US dollars. Strictly bitcoin. You like the idea of CW Poker as a concept, but you know that any firm relying upon the US dollar is bound to fail. So you convince a trustee to buy a bucket of CW Poker shares and create depository receipts denominated in bitcoin. So now, you can buy shares of CW Poker with bitcoin, and your shares will be quoted every day in bitcoin. Life is good.

Here’s the question:

Suppose awice came to you and said, “I am convinced that the cash and cash equivalents disclosed on CW’s Balance Sheet must be primarily held in bitcoin. After all, if you were running a US-facing poker company, how long would you leave your profit in fiat dollars before converting them to something safer?”

What would your response be?

- Yes, despite all evidence to the contrary, and for no apparent business reason, I have chosen to keep most of the funds in bitcoin.

- Of course not. My business operations are conducted primarily in dollars. I have repeatedly told people that I do not have any material currency risk; if I funded my dollar-denominated operating expenses with bitcoin, I would face enormous currency risk. And I have disclosed in my financial statements that I do not hold material amounts of bitcoin.

Your posts here seem to be in line with the first response. I lean strongly towards the second.

This is very kind, and I just want to say that I enjoy it as well - I like reading financial statements and talking about them. So when people like CW post ideas like this, I view it as an opportunity to talk about stuff that I enjoy talking about.

It’s kind of a wake up call that despite all the bullshit we are super fortunate to have the amount of transparency offered by the public markets in this country. The fact that stocks move exactly when information is released to the public, not before, is a testament to our regulatory framework.

Because the currency that’s related to their operations is not stable, and they have far more liquidity than they need for week-to-week or month-to-month operations.

I understand that and have the entire time.

Well as of 12/31/20 they had 47,382 in cash and 40,040 was in rubles. So there was 7,300 left over, which is about 117 RUB per share at the 12/31/20 exchange rate. The exchange rate then was about 74 RUB to the dollar, so that’s about $1.58 per share. In the last three quarters, they’ve put most of their earnings toward decreasing liabilities, and their liabilities have decreased by about $2.93 per share, but their cash has only decreased by about $0.37 per share. So the difference is another $2.56 per share that does not have to offset ruble denominated liabilities, and could conceivably be in whatever currency/short-term store of value they please.

Add it up and it’s $4.14 per share. If it’s in Euros/Dollars/anything but Rubles, they have a pile of cash that’s still worth something. If it’s in Rubles, they got wrecked.

Based on how they’ve handled cash excess of customer deposits in the past, I think there’s a chance.

Well, this is pretty much my situation except I don’t borrow or lend among poker players, but I’ve been freaking out about inflation for about a year lol, just ask @boredsocial. I’ve considered putting a chunk into other currencies.

So I’ve essentially just sold a chunk of my business for bitcoin, right?

But in this case, there would be a business reason! As a poker pro, I have to keep a sizeable amount of my net worth pretty liquid and I don’t have the appetite to risk putting that bankroll in equities, so my options are pretty limited on it. As a result, I’m exposed to inflation risk. If I’m making $X a year at my stake and spending $Y a year on living expenses, but due to inflation I’m suddenly spending $2Y on living expenses and still only bankrolled to make $X, I’ve got an existential problem!

So I buy some I-Bonds and debate putting some of my bankroll into euros, gold, bitcoin, etc. Or maybe I buy some commodities. My goal is to make it so that if my expenses go to $2Y, maybe my position appreciates enough in some of those to offset it and increase my effective bankroll.

It’s a little different, but in the case of QIWI they’re dealing with exposure to an extremely unstable currency and they operate across several countries and are headquartered in Cyprus, which uses the euro. Their risk if they’re in rubles isn’t a few percent here, 5% there, maybe 10% at worst.

I’m always glad to hear you enjoy this stuff and it’s not like doing extra work on your own time or something!

I definitely don’t understand this math. Or at least, I don’t understand why these numbers would suggest a greater concentration of US$ or Euro.

As of 12/31/2020, they had a combined $1.35 or so per share in US Dollars and Euros. That represents about 13% of their cash and cash equivalents. If they didn’t add to (or use) those US$ or Euro balances, they continue to have roughly $1.35 or so per share in US Dollars.

Suppose they manage their cash holdings on a constant proportionate basis. As of 9/30/2021, they have 37,478 in Rubles in cash and cash equivalents, so that would mean they’d have about $1.08 of their cash and cash equivalents in US$ or Euro.

Is there any evidence at all, anywhere, that they have acted to increase their holdings of US$ or Euro?

No, you sold a chunk of your business for dollars. A trustee acquired some of those shares and sold units representing those shares for bitcoin. But that transaction didn’t affect you or your company at all.

I would recommend forming an IPS (investment policy statement), if you have not done so.

I see comments from you positively comparing your performance to the market over a short period of time. I contrast this with some other statements about how you are willing to bail on your value strategy if it’s not going well. I think you may be vulnerable to a lot of short-term behavioral bias. It might be a good idea to get your goals and triggers down on paper as a guide for future decision points. Then you just run the plan.

Which was also roughly the amount that they had that wasn’t earmarked for customer deposits and other liabilities likely owed in rubles, so if the increase amount was handled similarly, it would have ended up in Euros and Dollars.

You’re looking at it as a percentage of overall cash. I’m looking at it as a percentage of cash left over after subtracting the liabilities from the ruble portion of the cash balance. It’s a very high percentage of that, and their net position had improved from 12/31/20 to 9/30/21, so if that’s what they’re doing it will have increased. This next report should be pretty indicative, assuming they actually file it given that the MOEX is closed.

Just their statement claiming everything is fine and their past practices. I mean unless they stated it plainly, there would be no way to know right? Like there’s no way to track their transactions.

I don’t take their everything is fine press release at face value but it would also be pretty pointless to lie to prop up investor confidence when the stock is halted, right?

I guess my response is that in this scenario where I was extremely worried about dollars, the course of action you laid out wouldn’t impact it at all then, so why would I do it?

But also if I IPO’d and the shares were trading in Bitcoin, wouldn’t I be selling shares that I unloaded for Bitcoin? I guess it would depend on how the deal was structured with the trustee.

I get where you’re going with the example, I’m just not sure it’s a close enough parallel to the QIWI example.

That’s a good point. I know I need a sample size to draw any conclusions, but I also know that would take a long time and I don’t want to risk 5-10 years of this to build a sample size if things are going poorly. My comments so far are sort of like saying it’s 1-0 in the top of the first inning, I know there’s a lot of time left to draw any conclusions.

As for the sample size, I’d rather give up on the strategy erroneously due to not realizing I was just running bad and risk losing out on future market beating returns than to continue to follow the strategy erroneously due to not realizing I was losing to the market and blaming it on sample size.

That does make me prone to short term bias, but I’m also evaluating some of my trades qualitatively along the way when possible.

I’m not sure there’s a way to build a sample size without risking a lot of years of time in the broad market. I guess if I’m behind the S&P after a year I could give myself like 5-10% of the portfolio to continue to build a sample with and invest the rest in index funds.

Expanding on your last post, what would you suggest, given my desire to take a run at it in the current market?

I will also add that if the market crashes in a big way before I exit these positions, I don’t plan to just go bargain hunting for value stocks with the rest of my cash on hand, I plan to pile the dry powder into index funds and not fuck around. I have not yet defined that degree of crash that would trigger that, which I know is a leak, but I also know it’s more than a day or two of circuit breakers away and I’ve been super busy so I keep pushing it off. It’s > a 25% drop from here before I’d start working money back into the index funds.

I don’t have a specific suggestion for an IPS (given our differing views on risk-adjusted returns, EMH, etc). Just to say that your approach puts you at significant risk of behavioral bias, so it’s a good idea to keep yourself honest.

A highly concentrated (i.e. undiversified) small-cap value portfolio with above market expected returns could underperform for decades (like 4+).

I’m not sure it’s been discussed, but I think an underappreciated risk of any stock-picking and/or market-timing strategy is the opportunity cost of keeping your cash (i.e., “dry powder”) out of the market.

It may not be the most important factor, but it’s a pretty significant headwind you have to overcome if you’re going to come out ahead.

LOL 7.9%. It’s gotta be way more than that.