Stonk market probably likes Russia not being SWIFT banned, no?

Yes, market bounced on the news/announcement that sanctions are a joke, imo. Seems pretty dumb to bet on them not escalating though given that we are at the beginning of the beginning stage of this.

Pretty sure the only argument needed against efficient market theory is what we see in the last 30 mins of sessions lately (both stonks and not stonks).

Wow wtf at stock chart. I’m assuming sanctions are just another wet lettuce.

BP drilling today - they must have some connection to sanctions.

They own just under 20% of Rosneft

What do you mean?

it was a joke. swongs are a couple standard deviations higher than normal peacetime swings.

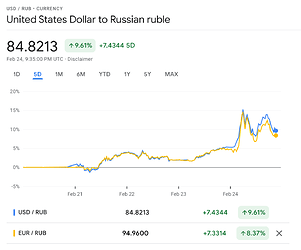

no idea how to trade that. maybe forex, but can’t imagine that’s available to retail accounts

Oh ok, gotcha.

US carries a fair bit of blame for why the UN is so toothless. (just saying)

Disney a real market leader in fun, new ways to get COVID.

Man stonks love war.

And commodities just absolutely tanking the last 1.5 days, after initially surging on the invasion news. Weird.

My first guess is complete naivety about how bad this war is going to get, not being able to see past today’s headlines.

Only other thing I can think of where the war continues to escalate and the West won’t necessarily completely tank economically: a deal has been cut with Saudi Arabia to save the day on energy production

But even grains are locked limit down today. Ukraine is a very big exporter of corn, 16% of global exports, and also wheat and barley. It’s hard to see how any grains are leaving Ukraine any time soon. And their planting season is just about here. It’s hard to see how they grow even close to a normal crop this year.

Not sure, maybe can shift around use/consumption patterns to account for it? As a simpleton thought, just stop using so much damn corn syrup as sweetener to solve corn problem?

My worry here is at some point they have to target Russia’s energy economy with sanctions at which point everything drills again. But it would be soooo typical for us to retest ATHs for some reason (Powell delays rate rises due to this).

Berkshire Hathaway just reported full year 2021 net income of $89.8 billion. Lol GAAP.