You have high confidence on the ability of an individual amateur investor to identify alpha (greater than market risk-adjusted returns) and successfully implement it over decades. It looks to me that you generally view firms where assets and earnings are being highly discounted (i.e. this microcap building supply house) as being comparable in risk as something like Home Depot. The logic being, if I can buy earnings at a 8-10% discount instead of a 5% discount at a comparable risk profile, then I have generated alpha.

Perhaps you’d acknowledge that the risk of the APT investment of HD is higher, but how do you go about determining whether you are being properly compensated, and how much work does it really take to maintain this analysis? To be clear, I do believe that APT has higher expected returns than HD (just not risk-adjusted).

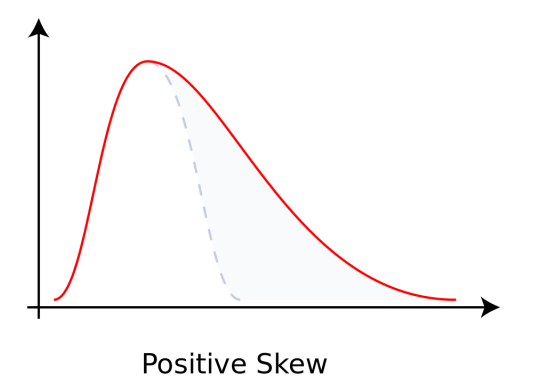

If you don’t have a good way of quantifying this, you are opening yourself up to a lot of personal behavioral risk as you try to stick with this strategy over 30+ years. As mentioned, returns of individual stocks have positive skewness. Most stocks simply don’t do very well, and the overall returns of a diversified portfolio over some period of time can always be explained by outsized performance of a small number of stocks.

If this strategy of picking individual value stocks is a significant component of your overall portfolio, I’d suggest you evaluate just how detrimental it may be to your long term net worth if perhaps you are overestimating your skill and knowledge and/or ability to deal with your personal investing biases.

We both agree that these types of small-cap value (conservatively priced, good profitability history) have higher than average expected returns. Your explanation would be that it’s market inefficiency, mine would be different. I might suggest simply tilting your portfolio to something like: https://www.avantisinvestors.com/content/avantis/en/investments/avantis-u-s-small-cap-value-etf.html. Here you can own 600+ of these stocks with no work and drastically reduce your behavioral risk. AVDV is the int’l version of this fund with over 1200 stocks.

I see you write things like “this is that extremely rare 5% of the time that the market can be beaten”, when referring to general inevitably of the market correcting significantly over some known timeframe. That indicates that you think you can generate alpha not just in microcaps, but in the broader $50 trillion+ US market, and I’m certain you cannot.