So you’re saying that you think Buffett is a luckbox? And all the other successful value investors along with him?

That’s a good point that it might be better to compare the after hours pop to the previous close rather than factoring in the FB-driven pessimism. But I still think if they announced $4.85 or whatever, that they’d be up quite a bit less. Keep in mind the quarter dropping off the TTM was like $14 or something, so an EPS around $4.50 drops their annual EPS by about $10 and takes the P/E ratio quite a bit higher absent any price movement. I think a lot of retail investors, maybe the vast majority, just looked at that estimate and thought, “Meh, AMZN is going to beat, they always do.”

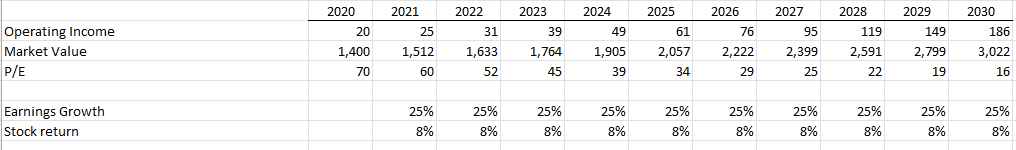

At some point, Amazon is going to stop growing substantially, simply by running out of room in a best case scenario. Bezos will weep, for there will be no market share left to conquer. At that point it will need to be valued as a value stock and not a growth stock, so you’d expect a P/E around 15 to 25. Maybe 30 on the high end.

It’s currently trading at a P/E between 70 and 80, which is pricing in an expectation for an immense amount of continued growth to end up eventually settling on a value-oriented valuation with a P/E in a normal range.

My point is that while it may be possible, it’s incredibly unlikely they will be able to get that big. Just like while it’s possible TSLA is someday going to have like 80% or 90% of the market share of the global automobile market, it’s absurdly unlikely and that’s why their valuation is absurd too. They’re not worth 17 Hondas or three Toyotas or 12 GM’s.

I don’t, that’s my point.

Perhaps, maybe the blood is done with in the tech growth sector. Maybe there will be no more -25% days for any of these “blue chip” stocks. I don’t think so, though.

I think the efficient market hypothesis folks would be well served to go sit at a 5/T or T/25 table and ask the whales what they bought recently, how much of it they bought, and how much research they did (1). Then watch a day of CNBC and just listen to the words coming out of the mouths of hedge fund managers and investment managers (2). Then go really in depth on a complicated stock for days/weeks, get a good understanding of its value, and then read all the analysts’ coverage of it (3).

My favorites:

-

A guy probably worth $1M to $3M put $20,000 into Moderna early in 2020. Obviously this worked out incredibly well for him. At the time, I was curious why he was so confident. I asked him why he bought it, “I dunno, I googled vaccine stocks and it was the first result.” Then I asked him about their track record, research, and trials - he knew absolutely nothing about it. He Googled vaccine stocks, and put $20K into it. This is not a lone example, most have a little more reason behind them, but they are almost always level one reasons that do not factor in the current price of the stock at all. I have a buddy who bought Amazon because they got Thursday Night Football and he thinks that’s going to cause the stock to go up about 10%. Granted the info was already public, and the impact on their bottom line is not at all substantial, but it didn’t stop him from moving a chunk into it.

-

A billionaire hedge fund manager in late March or early April of 2020 proclaimed the pandemic over, said it was just like the flu, it wouldn’t require any additional shutdowns, wouldn’t cause much death, and we’d be back to normal in a couple of weeks. He lived and worked in NYC at the time.

-

Moderna has put a lot of resources into treating cancer. Somewhere in the neighborhood of 25-40% of the reports that the usual companies (Morningstar, Zacks, etc) are putting out make zero mention of it when talking about their pipeline. Like this should be within the first 5-10 minutes of research on the company! Just look at their pipeline!

Now, there are like 5,500 stocks on the NASDAQ and NYSE, and obviously even more globally and OTC. Maybe 90% are efficiently priced, maybe it’s even higher. But there is definitely a healthy amount of inefficiency in there IMO.

Keep in mind as well that some stocks are too small for hedge funds and institutional investors to even consider. So there’s nobody raising in to correct an inefficiency if retail investors do stupid stuff.