Bitcoin probably

I’m 31. I’ve already put aside $400k to buy a property that my pop and his wife will live in and I can use as a base. This is just money sat there that I won’t need. I gave a buddy $170k to help him open a dispensary and he says I can turn it into equity or have it back next year. He’s doing well and might open up another so I might see if he needs more. It was a whole lot less complicated when I was poor.

I would be a bit cautious here, your bank may refer you to a product salesperson at the bank who just wants to put your money in expensive funds. I would highly recommend looking for a fee for service advisor with good reviews.

Yeah - fuck those guys.

True but honestly it’s way safer than what most people would wind up buying stonks on their own.

Sure, but fee for service advisors were designed specifically to fill that gap between “DIY stock picking” and “high cost fees as a % of assets for dubious value”.

Alright I’m not a financial advisor to be very clear, and the advice to see one for a flat fee up front and no ongoing fee is good advice, but if you don’t want to take the time for that… It sounds like you’re looking for some fairly generic advice with a big priority on it being simple for you?

-

Make sure you’re maxing out your tax advantaged accounts for retirement. That’s the SEP-IRA if you’re self-employed, Roth IRA, and an HSA if you have an HSA eligible health insurance plan. If you’re not doing that, you’re paying more in taxes than you need to.

-

The simplest thing to do is probably just to put it all into VFFVX, which is a Vanguard target date fund based on a retirement year of 2055. They’ll adjust the allocations to decrease the risk as that date gets closer. You could lump sum it in, or dollar cost average it (Say $33K a month for the next 12 months). Historically, lump sum comes out ahead, but with a lot more variance. Dollar cost averaging trades time in the market for less risk of buying right before a crash. My advice right now would be to dollar cost average. That’s a lot of real money for most people, and the market is extremely volatile right now.

If you do that and don’t touch it for 30+ years, your odds of coming out ahead in the long run are extremely good.

(Edit: Removed part because I realized it’s probably less simple than you want, given you’d have to re-allocate it periodically.)

With the money you want to gamble a bit with, I’m not super comfortable giving you advice on pouring $150K into one or two stocks or whatnot, and since it’s your gamble, it depends on what your goals/views/expectations are.

But the riskier portion of my portfolio has a lot of MRNA, BNTX, KT, Bitcoin and Ethereum, and a little bit of Solana (like 1/10th the amount of BTC or ETH). For the crypto you’d have to get on a crypto wallet site to buy it, or pay a big fee on an exchange traded fund. Taking on some long-term exposure to emerging markets seems good to me, that can be done with SPEM. I don’t consider that as a risky part of my portfolio since it’s not a single stock, but most would consider it a lot riskier than say the S&P or a Vanguard target fund.

I’ve had crypto for years. Used to play at Seals. Brag was a buddy needed cash in Hanoi 2017 so he sold me 2 BTC for $5k cash. I set up a new wallet on my phone because when I’m away I don’t have access to anything. Sent the recovery code to my secure email then lost the phone. Didn’t bother recovering the wallet until 2019! I’ve still got BTC,LTC and bought some OMG because OMG!

Have you got into that NFT game? Way too complicated for me but a couple of buddies have made heaps.

I need to, I started in the Discord here and then paused a week or two later for the WSOP, then it’s felt like life was a whirlwind the last 2 months. It’s been that thing at the top of my to-do list that I keep pushing for chaotic life stuff.

Cool - my buddies say it’s really time consuming and a lot harder than it was 6 months ago. Lots of shady stuff happening. How’d you get on at WSOP? Haven’t been since 2014. If I’m around next year I’ll try to go for a week.

Well that’s not what I wanted to hear haha… It was frustrating but roughly breakeven, I think down a couple thousand. One deep-ish run, in the smallest buyin I played. 13K runners, I went from top 5 out of 350 people left to out in one orbit + two hands. Ran JJ into QQ SB vs BB, next orbit ran KK into AA SB vs BB, next hand HJ opens, I jam AQ on the button, he snaps KQ and binks.

Bricked hard for a long stretch with no cashes, then min-cashed the biggest event I played (the Main) to offset a lot of the min-cashing lol… That’s tournament poker for you!

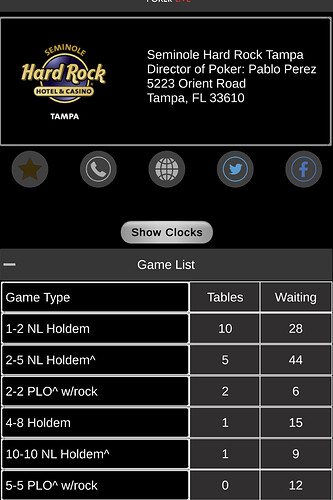

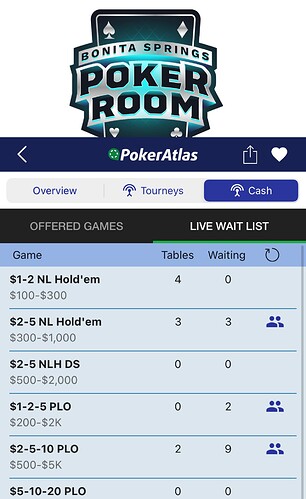

Can I get a quick overview of live poker in FL? Haven’t played since Black Friday.

I don’t play there, but I know people that play the PLO in the Jax and TB area and the HHs are nutty.

What stakes?

I’m sitting in a poker room now for the first time in a month due to covid. There are 30 people on the PLO list and one table. They are unlikely to open another table. I am theoretically here to play PLO. It’s 3 PM on a Tuesday

MSFT reports AH, gonna be big mover on market id imagine

we are currently megadrilling into close so thats probably not a good sign

MSFT: $51.7B v $50.1B Expected EPS: $2.48 v $2.29

down 5%

LOL

Morning: NOT STONKS

11AM to 2PM: VERY MUCH STONKS

2PM to 4PM: NO LONGER STONKS