NOT TSLA

Maybe this will price of the model 3 go down! /s

Man, bloodbath.

And I’m staying out of the thread but lol crypto.

The price of everything will be going down.

Kind of annoyed I’m not eligible for my 401K yet at new job. Still 30 days away. Would like to be buying on sale. Still making my smaller weekly contributions to taxable.

Seems reasonably likely will be more on sale in 30 days.

Maybe. Maybe not. All I know is I can’t predict it.

I guess if it’s 50/50 then it is indeed reasonably likely to be more on sale in 30 days.

Who the hell knows what the market does but nothing is on sale right now.

The markets love a good war so maybe Putin will save us.

When insider info doesn’t work, she can always pull some strings to get some favorable legislation passed to help the stock. Ain’t corporatism grand?

It appears I put in $38k and could have maxed at $61k?

Looking at what is happening now I might just wait until the dust settles lol

I don’t even own a car.

(I’m grunching, so apologies if the next 20 posts I’m going to read soon make this repetitive.)

I mean keep in mind I said in my opinion, I’m not saying it’s guaranteed or I’m the smartest guy in the room.

I believe stocks are dramatically overpriced and valuations are dramatically out of whack. History tells us that if I’m right about that, sooner or later it’s going to rectify itself one way or another. I believe that some combination of Fed rate increases and bad earnings reports are going to trigger it, and soon.

There are a ton of more complex reasons and thoughts, but I’ve laid out a lot of them the last week or so ITT, so I won’t put up another wall of text. One I haven’t mentioned is that I think the amount of fraud and sketchy business behavior nationwide has skyrocketed, and I’m not just talking about publicly traded companies. I also suspect that regulation of corporate filings is about as weak as it’s ever been. I also think there are plenty of accounting tricks that people way smarter than me about business accounting would probably understand, and my slightly educated guess/feel is that it’s probably pretty easy to move some numbers around and pad earnings for a couple quarters, but at the end of the day sooner or later you’re borrowing from Peter (aka future earnings reports) to pay Paul, and it has to matter at some point.

Market is already down 12% from the peak so whatever crash has happened has already happened to a significant degree. Obviously it could go down another 30%, I have no idea, but this is why not bothering to try to market time is great. I obviously wouldn’t have sold at the peak. Would I buy back in now? I don’t know. It’s extremely stressful to think about, while I don’t feel stress about the market dropping at all. Making the decision to just stick to an asset allocation no matter what actually decreases stress enormously because you don’t have to make any decisions. And since you can’t make any bad decisions (you’re not making any decision) you can do no wrong! Very relaxing.

Dang it’s currently not a shortable stock in IBKR. I’ll keep checking each day and probably hop into a short myself.

You might like following Scorpion Capital, my favorite of the short firms. So far they’ve mostly targeted biotechs and every one of their shorts has been a home run. ALLK is the only one that would have been a sweat given that the report was in 2019, but eventually that stock crashed from $84 to $8 in one day last month.

Next piece they put out, I’ll probably short the ticker before even reading the report. Their last two reports caused immediate drops. I’ll short, then read the report to decide what price to cover at, if any. I’m still short BLI and DNA, and I at least plan on riding DNA into the pennies.

Thanks for sharing this.

ruh roh

Man is poker pro even a thing anymore? I’ve played a lot on and off and been real lucky especially with staking a friend who binked pretty big but fuck that. Only “pros” I know would have been better off getting a job or working for themselves. You seem to be really up on all the stocks and investment stuff. Are you a professional advisor? I probably need one or I’ll end up donking off six figures.

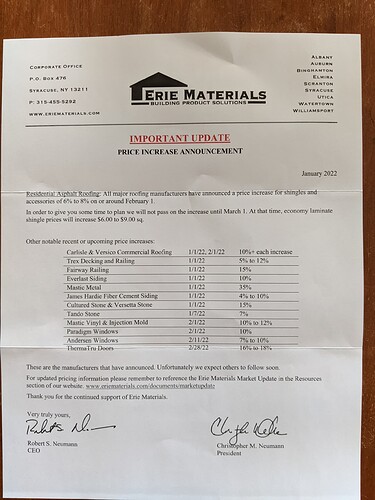

Yeah, there’s at least one more wave of price increases coming in these kind of businesses. Input suppliers margins were largely crushed in Q3 and that cost increase was going to be pushed to customers in Q4/Q1. Still tight enough supply for most things that the increases should stick even if we get some cooling of end market demand. Would expect generally, would need like a 5-10% income increase over last year to maintain the same purchasing power over first half '21, will see where it goes after that.