It irrates me so much that a bunch of my mutual funds have tsla in them. I’d buy one that specifically said it didn’t.

I need to set a reminder to check that tweet again in 21 hours, when the poll closes so I can either sell or hold my TSLA.

America is so fucked…just completely full of 0-level thinkers.

if it matters to you then you should vote. This indifference is what is ruining the country. Be a part of the process. Be the change you want to see.

Yea skydiver, stop complaining and get active

Amazing timing!

https://twitter.com/nancytracker/status/1457097326862946304?s=21

Thread: makes me want to buy BRK.

https://twitter.com/chrisbloomstran/status/1457044320482172932?s=21

Still don’t and probably never will understand TSLA’s valuation, but it appears to have Ford’s CEO’s attention:

https://twitter.com/SatishGannaman2/status/1457018339071447043

Berkshire Hathaway sounds like the name of a retirement home and their stonk costs like a million dollar per share. How can it outperform TESLA. They don’t even have any Bitcoin on their balance sheet, NGMI

It could happen though. I remember reading Buffet quotes about how he didn’t invest in tech companies like Apple because he couldn’t understand them, and now BH is aflush in Apple stock.

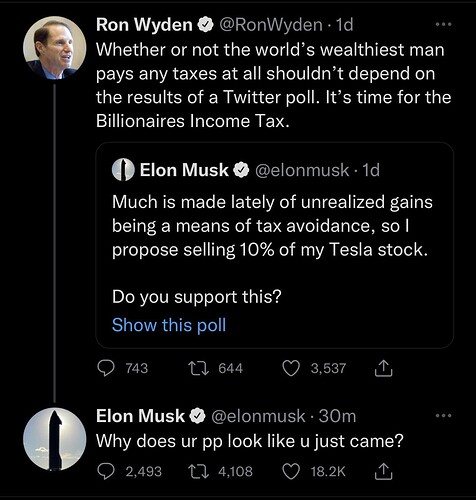

Gonna need Ron Wyden’s pp to come all over Elon Musk’s face.

I thought this was fake:

Matt Levine is the best.

Not legal advice or anything, but if you wake up at night thinking about JAIL because of crimes you’re doing, don’t put that in email. Maybe also stop doing the crimes, but definitely don’t, like, manifest your jail dreams in email.

(Incidentally Cammarata, in addition to his alleged involvement in this scheme, is the chief executive officer of a small-cap public company called Investview Inc., “which delivers financial education, technology and research to individuals, as well as cryptocurrency packages, through a subscription-based multi-level marketing model,” a truly nightmarish sequence of words. Investview put him on leave when they found out about these charges, which involved activities “completely independent of Mr. Cammarata’s activities on behalf of Investview”; presumably the selling of cryptocurrency packages through multilevel marketing is completely on the up-and-up.

By the way, the 10-year treasury is at 1.44%, lol INFLATIONNNNNNNNNNNN which you still see all over our dogshit media.

I don’t get why anyone gives a shit about a measure that doesn’t even include house prices. Are the lower and middle classes more fucked now than they were previously, yes, but no there’s no inflation wew

Rivian has delivered 146 cars. It lost $1 billion last year and is on pace to lose $2 billion this year.

It is going public at a valuation of $70 billion today.

People love news stories about how milk is more expensive, as evidenced by the recent dogshit story on CNN.

With housing, there is still abiding faith among the technocrat overlords that no matter how expensive a house is, it is still a good investment because housing prices always go up. If we have another 2008, well no problem we’ll just go pull Ben Bernanke out of his underground lair and get him to fix it.

But inflation prices do include rent??

Well I can’t speak for America but in Australia house prices are up 30% since covid and rent is down. What lucky renters I guess lel

DoorDash has announced quarterly earnings. Assuming I’m looking at things correctly:

-

Current quarter revenue was $1.275 billion, which was a 3.2% quarter-over-quarter growth rate and a 45.1% year-over-year growth rate. The q-o-q rate is the first single digit growth rate in the company’s history. (Lowest previous was 10.4%).

-

Their gross profit margin is 52%, which is surprisingly low considering that their topline revenue is already on a net basis. That is, revenue isn’t the dollar amount of food that customers order (that’s gross order volume), but rather the company’s cut of that order. It’s very strange to me that the company then incurs a >45% cost of revenue. Even stranger is that this number hasn’t actually improved that much over the prior two years.

-

Operating loss is $100 million, more than double the same quarter last year,

-

The company was trading yesterday at roughly 15 times trailing 12 month revenue (about $65 billion market cap compared to $4.5 billion in last 12 months revenue).

Of course the stock is up 14%.