I’ve never really paid attention to I-Bonds, but the recent increase in inflation seems to have pushed them into pretty great value right now. They’re offering roughly 5% for the next year, exempt from state income taxes, and are exempt from federal income tax to the extent that you use them for qualified higher education purposes.

Gold standard is an a/b test. You can’t do that here since that would mean denying access/pretending we live in a world where the show doesn’t exist for some of your customers. You can get around this by developing models that do attribution to each series of every dollar spent at Netflix. This is how most companies do attribution for all marketing spend. There are multiple ways to do this, won’t get into it here, but I’m 99% that’s what they do. I’m sure these models are very robust and take into account historical information they have. My company (and Netflix I’m sure) has systems to verify if the attribution model results are correct depending on the situation.

Yes, you won’t be able to pre-hoc guess if a certain number of episodes will lead to more revenue, you can only observe effects after you apply the treatment. Can’t really do two treatments (e.g. different number of episodes) for different people. Just have to guess/use trends of episode count vs money made over time (after accounting for various factors, e.g. more limited run series can get higher views b/c higher budget per episode)

They won’t be modeling directly to share value, most likely to revenue (and perhaps profit). It most likely will be Data Scientists or Machine Learning Engineers doing this sort of work, not a typical analyst

So apparently Zillow went out and bought like 4,000 houses using their algorithm. They wildly overpaid and have stopped buying houses. Lol Zillow.

Reading this thread, I think I realized that a Netflix mini-series about a team of analysts for dystopian television series has much more promise then the actual Squid Game show, which I found middling, and generally uninsightful. Although maybe this would be better for HBO, idk.

I would take that number with a huge grain of salt and consider that report part of their marketing strategy for Squid game/Netflix.

Of course the $900mm figure factors in the benefits from the marketing strategy you speak of, which will accrue to the benefit of stakeholders in perpetuity. Do you even business analyze, bro?

These…appear real?

https://twitter.com/3vansutton/status/1449835270556184579?s=21

https://www.telegraph.co.uk/news/2021/10/17/wont-brits-pick-vegetables-30-hour/

As is common in agriculture, his pickers receive a ‘piece rate’, whereby they are paid more the harder they work, but are guaranteed the living wage as a minimum, which is £9.50 an hour; hard-working staff receive more than £20 an hour.

we’re too lazy/soft as a society to do physical work like that is the answer to those questions

Regarding the bond/stock positive correlation, low interest rates, and inflation: this is a terrible situation for people nearing retirement or in early retirement. I’ve been exploring bond alternatives for a while, and finally hit on a place to put my remaining cash that was supposed to go to bonds. It’s the Fidelity Strategic Real Return fund (FSRRX). It’s got a lower risk factor than stock funds, and probably slightly higher that traditional bond funds. It invests in commodities, real estate loans, bank loans and other floating rate debt, and TIPS.

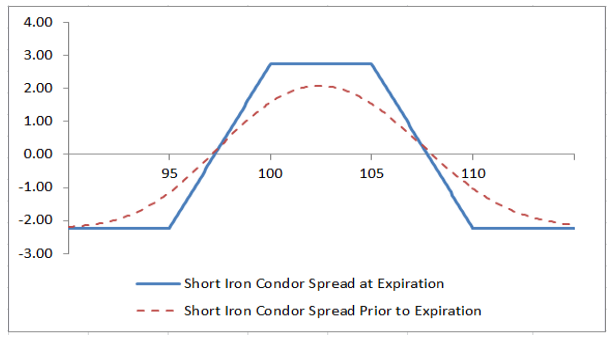

The other area I’m exploring is an options strategy that can imitate bonds, but without the inflation and interest rate risk. I found the theta gang, which sells time value of options. The tactic is to use a short iron condor, which is a 4-leg play, involving two credit spreads, one above and one below the price of the underlying. It limits both upside and downside, and makes money if the underlying stays within the range of the spreads.

I’m interested, and have time to study it, but not sure I want to commit to an active investment strategy, as well as jumping in to 4-leg plays as opposed to writing covered calls. I applied for options trading, but they didn’t give me the spreads level (2+ in IRAs, 3 in taxable) yet. They did give me a margin account though, which is confusing and a bit scary. For the time being, I’ll just keep learning.

On another note, is all technical analysis bullshit, or is there anything there? I thought prices are a random walk, and trends are maybe kinda sorta related to fundamentals and the overall economy/market.

I have actually wondered about this for years. Not the general question, but Netflix specifically.

A lot going on in this post.

I’ve seen this sentiment stated a lot, but I think it’s mostly due to people:

- focusing on nominal rather than real returns, and

- focusing on likely lower expected equity returns without considering that their current portfolios are much higher than they would be in a world of higher expected returns.

Yes, savings account yields are low, and bond yields are low, and nominal expected equity returns are probably low. But inflation is low, too. So those low yields aren’t really hurting your purchasing power. And presumably you were invested in equities as they skyrocketed in the last 10 years? Would you prefer that your portfolio be 25% lower in market value, but have 2% higher expected returns per year going forward?

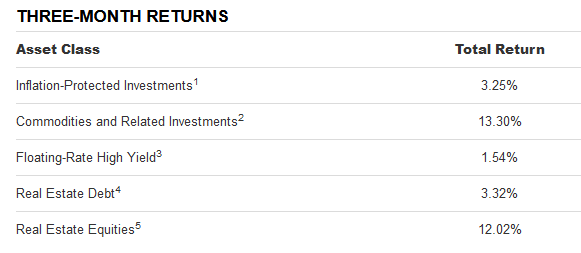

The list of things the fund invests in is technically true, but it’s strange to lead with commodities and real estate debt, and it ignores their equity holdings. The fund has:

25.64% in inflation-protected debt (presumably TIPS)

25.58% in floating-rate debt, where the interest will be tied to some measure of inflation

So more than half of the fund is inflation protected debt.

19.12% is in “Commodities & Related Investments”

9.25% is in Real Estate Debt

~20% is in Real Estate Equities and Commodity Equities

It’s just a weird-looking package of assets, and it’s very hard for me to think of it as a bond substitute. Like, focusing only on the debt component, 48.44% is U.S. Government (so risk-free), while about 45% is low credit quality (BB or below). What is the goal of holding this weirdly polarized combination of debt?

You get the same sense of weirdness when you look at the composition of returns:

Not surprisingly, the debt instruments yield a very small amount, and most of the juice comes from the riskiest pieces - commodities and real estate equities. Again, hard for me to view this as being a bond substitute.

Plus it has an expense ratio of 0.75%, which seems like a crazy amount to pay for a bond substitute.

Seems like you want to be in short-time high yield savings accounts. Or TIPS.

It seems like–for this portion of your assets–you’ve moved from a goal of risk-free preservation to… something different. Just to be clear, you’re talking about investing in something with this payoff structure:

It’s true that your losses are limited, but so is the upside. I have no idea why anyone would choose to think of this as a bond alternative. Nothing about this investment is risk free, plus you get eaten up by bid-ask spreads.

Good - you should be enjoying your retirement, not wasting your time engaging in risky options trades!

Oh no. Please don’t do this. Not because covered calls are especially risky, but they’re just emblematic of the entire set of complicated strategies that aren’t likely to accomplish what the investor wants to accomplish.

At the end of the day, there is no free lunch. Everyone wants what you want - a safe, high-yielding investment. And lots of strategies involving derivatives can seem very attractive. Like writing covered calls: Look, it’s the best of both worlds! If the stock goes up and the call gets exercised, that’s great because you got a positive return. And if the stock goes down, you lose money on the stock but you get to keep the premium, which is better than if you just owned the stock.

But you’re selling off the potential upside of the stock, which is why writing covered calls isn’t really a way to juice your returns. You can accomplish the same thing (less upside, but less downside) by just owning a higher cash/stock ratio. And that’s the secret behind all of these option strategies - you can generally accomplish the same thing cheaper by just holding a different cash/stock allocation.

To me, this is like asking if the earth is round. Technically it’s not - it’s an irregularly shaped ellipsoid. But for 99.99% of the population, it’s correct to think that the earth is round and act accordingly. Same thing for technical analysis. Some people (Renaissance Technologies comes to mind immediately) have demonstrated a consistent ability to earn substantial returns via technical analysis (I guess quantitative investing more generally). But you can’t actually invest with RenTech. So then you’re left trying to figure out what strategy to follow, or what manager to invest in. And I feel fairly confident that the average person (including me) has zero ability to distinguish good vs. lucky TA managers, or to identify a good strategy versus the infinite number of data-mined strategies that will not generate positive abnormal returns in the future.

There’s something amazing about the fact that a regular person can easily construct a well-diversified low cost portfolio by just owning a few passive funds. Anything beyond that is almost certainly going to be fancy play syndrome for the vast majority of individuals. If option strategies are something you enjoy, then great, sell some iron condors or whatever and view it as entertainment. But don’t think of them as “one small trick that Wall Street doesn’t want you to know about”.

Thanks for the detailed reply; I’ll read it again and reply when I’m more awake.

I don’t get too worked up about short-term craziness in stock prices. But if you had told me in January/February 2021 that Gamestop would still be valued at $15 billion 9 months later, I’d have bet my entire net worth against it.

Damn, I’m a day late. Just listed my house for $50k under the lolZestimate.

I mostly did the Money magazine approved 110-your age in stocks, plus a large home equity chunk, and then increased my bond allocation over the last few years. I’m not concerned too much about low returns on stocks over the next 20 years, but more about avoiding having to pull any stocks out during a 50% bear market in the first few years of retirement. Thus the large bond allocation - currently roughly 7% home equity, 38% stocks, 37% bonds, 10% cash, 7% one weird trick fund, 1% old company stock and play money.

The plan moving forward is to move money from bonds to stocks over the next 8 years, ending up with a long-term 80/15/5 ish allocation in stocks/bonds/cash.

But bonds are no longer what they used to be - a nice cushion for a portfolio with some positive real return. Now, they are correlated with stocks, and even in the best case, will not beat inflation. So not much cushioning, and not much return seems like a lose-lose situation. Inflation seems to be a real thing at least through the next year or so. It’s not as bad as the late 70’s and early 80’s, but it’s much worse than anything in recent memory.

Yes, that’s far from ideal, but I don’t think there’s really an index-based strategy that can produce cushioning and some real return. If there is, I’m all ears.

I have my cash/short-term in CDs and a short-term muni fund (which has lost like 1% this year, nice.) I’ll look into TIPS more, and see if I want to increase beyond what’s in the one weird trick fund.

Regarding the options trading, yes, the iron condor is the one I was looking at. I’m sure you’re right that the risk is way too high to put any sizable chunk into that strategy. And also right about someone bigger and smarter already taking the money if it’s there for the taking.

I don’t intend to write covered calls, but just mentioned them as the entry-level option trade.

Thanks again for the reply, and for your contributions ITT.