I’m still confused as to why we thought the market was going to drop today.

Theoretically the market should go down if there is a real threat of the US failing to raise the debt limit. Maybe that threat feels more likely to people on the board because we’re close to the politics, Wall Street probably thinks its all posturing like the past times where the Rs threatened the same thing but eventually the limit was raised.

Nit:

My version of hell is that I become responsible for writing a daily explanation for why stock prices moved, and I’m not allowed to just type “¯\_(ツ)_/¯”.

Is there something specific that raised that fear a lot higher last night to cause us to expect a big drop this morning?

I’m honestly confused here. I read Grue’s post and the replies and immediately checked all the news sites to see what happened.

Probably just that it feels different to UP because we follow closer and it doesn’t look like the progressive wing is going to budge on this.

It is all politics. I actually think Mitch folds here 99% of the time. He’s bluffing with air and has no showdown value at all. The Wall Street people think there’s no chance the debt ceiling doesn’t get raised in time, and they’re probably right.

I mean we go through this every single time. The whole point of these negotiations is to scare the public and use that as leverage.

Worst case scenario, maybe the Rs shut it down for a while, just as another stalling tactic to get to 2022. But they’ll end it before things completely blow up, and we’ll go back to forgetting about the debt ceiling for another year.

Reminder: the 1995 government shut down led to the Clinton impeachment. Paid employees were prohibited from showing up in the White House, but unpaid interns continued to work, and with greater responsibilities.

During the shutdown, Ms. Lewinsky worked in Chief of Staff Panetta’s West Wing office, where she answered phones and ran errands. The President came to Mr. Panetta’s office frequently because of the shutdown, and he sometimes talked with Ms. Lewinsky. She characterized these encounters as “continued flirtation.” According to Ms. Lewinsky, a Senior Adviser to the Chief of Staff, Barry Toiv, remarked to her that she was getting a great deal of “face time” with the President.

Ms. Lewinsky testified that Wednesday, November 15, 1995—the second day of the government shutdown—marked the beginning of her sexual relationship with the President…

Was it because he was normally getting blowjobs from a paid employee?

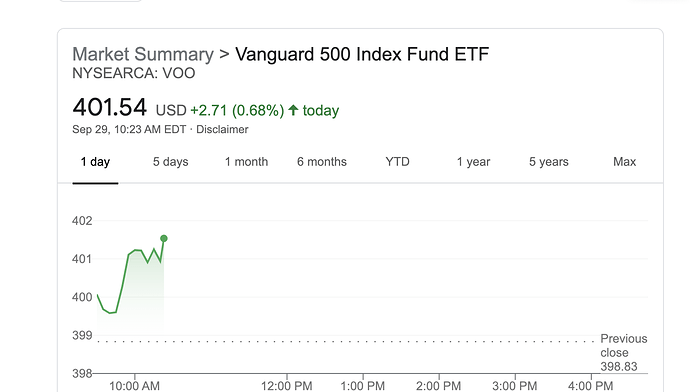

Lmao how are stocks not down at all today? I know nothing about anything.

Priced in, or something

I still hold the belief that the most lucrative strategy that any beginner or intermediate investor can use is to devise a program that will unconsciously take the opposite side of what ever trade the person feels compelled to make.

It felt like the floor was about to cave in yesterday and I never seem to see the market moving predictably like it should.

deleted

I’m still confused over what specific event happened on Tuesday to make you think stonks were going to tank on Wednesday. All this debt ceiling stuff has been going on a while.

The aggregation of the media I read (and this board) leads me to conclusion that a default will just be a new government shutdown - it’ll happen and this is the first one. Progs won’t back down manchin won’t back down GOP won’t vote yes, what else can happen? Tomorrow is the last day.

But again no one should listen to me.

It’s not though, right?

We don’t default until the middle of October unless I’m extremely mistaken.

Too bad you did all this and now because of the collapse the money you saved doesn’t mean shit.

This is the opposite of good.

What’s the best strategy for buying additional ETF shares as you get more savings?

Do you buy monthly? Or whenever you have savings over a certain amount?

Do you try to keep the portfolio balanced everytime you top up? Or is it better to save on transaction costs?

It costs me $20 per transaction, so I figured it’s worth saving until I have about $4000, then just put it all on the stock that is lowest vs my target balance. That seem okay?

Right now I’m pretty balanced, because I just started. But I’d just buy 5k of stock of the one that is 19.8% instead of the 20% target

I figure this is something i dont need to overthink. But always better to have a rule and follow than to mess around.

Right. I’m split across 4 vanguard ETFs.

- Australian market (30%)

- international shares (hedged to aus dollars) (20%)

- international shares (unhedged to aus) (35%)

- emerging markets (unhedged) (15%)

There’s also about 40% of the total above in cash that I’m still sorting out but may move to bonds when I can.

What I did when I was accumulating is set my contributions to be automatic based on my desired “new money” allocation. About once/year I reallocated existing funds, and reset my new money allocations based on either current market circumstances, aging another year, or fund changes in my retirement account.

Have you looked into other financial companies or fee-free funds at your current company? $20/transaction seems high for buying mutual funds. Is there special tax treatment for ETFs, as in the U.S.? If not, you could look into buying the corresponding mutual fund, and compare the transaction costs. I just checked Fidelity, and they have no fees for online ETF transactions.

If you can’t avoid the high costs, it might be best to do as you describe. If you consider the $4k as kind of a buffer in your emergency fund, then maybe it’s not as painful to wait. So, for example, if your EF is $5k, allow it to fluctuate between $2500 and $6500, and buy the next ETF in your plan for $4k.

But I would look for a cheaper way to invest, so that you can get the money into the market as soon as it’s available. A quick search shows Australian companies that offer fee-free ETF trades, so I would start there if you can make a change.

Whatever you end up with, I agree that having a (preferably written) plan and following it is a good idea.