Mine is up 4% over 5 years based on the Zestimate for the same unit one floor below. I don’t really trust Zillow for NYC, but I would be happy to break even in this environment.

We just sold the unit below mine for the all time highest price for a 1 bd in our coop (the seller had it on the market intermittently for at least 6 years lol), but the Zestimate for my apt is still 20% higher.

I’m assuming the inaccuracy is partially intentional to spur activity? But maybe just dumb data idk.

Yeah basically.

looks like basically companies are doing with houses like flippers do with NFT’s.

250%, 11yrs

Seems like everyone in Boston who has been liberated to work remote is buying in southern NH and southern ME coast. You would think property in Boston proper and immediate suburbs would have to go down, but not so far.

To borrow from the bard, “No one’s buying in Boston. It’s too expensive.”

18% increase. 5 yrs

https://twitter.com/MktsInsider/status/1441845441444728834

pay a ton for business school

or just follow harvey the wonder hamster, he doesn’t bite and he doesn’t squeal he just runs around on his hamster wheel

What if this story is absolute bs, but by going viral the hamster gets enough followers to make significant price movements, thus developing a real first mover advantage? And that was the plan all along? Would be pretty genius.

Babs vs hamster cappin contest

the hamster did better than you didn’t he

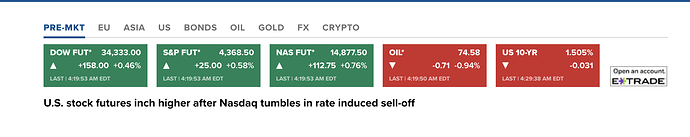

Fucked level tomorrow 1-10 scale? I’m going with… 4? 2% drop in VOO ETF is not a great look bob. Think they’ll figure out something I guess right? I mean lmao if not, controls exec house senate and going to cost rich people 10% of their net worth for… “politics”?

my 2cents

For specifically tomorrow, a 2. I’m old enough to remember the days where a 2% drop was a nothingburger but when the Dow runs up to 35k like it did, a 2% drop is going to appear pretty ugly.

If you’re semi young without a large position in something like VOO, be content in watching the market crumble to give yourself the opportunity to add some upside as opposed to turning a small position into a large position over the years in a bull market just to have it wiped out in the next recession when your position size is larger.

I think there’s a very real chance we’re in for a lost decade or worse but I don’t really see any plausible alternative for investing my money.

Yes, but one side is interested in showing that the other is incompetent.

Goddammit.

I think I was answering a 1-10 “how bad” scale for today as opposed to how many percentages the market drops.