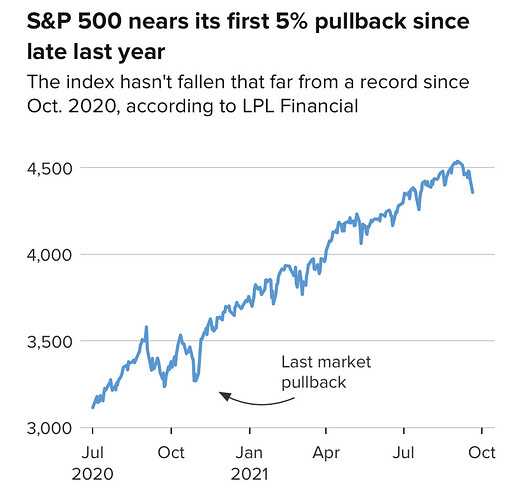

Still looks like STONKS to me

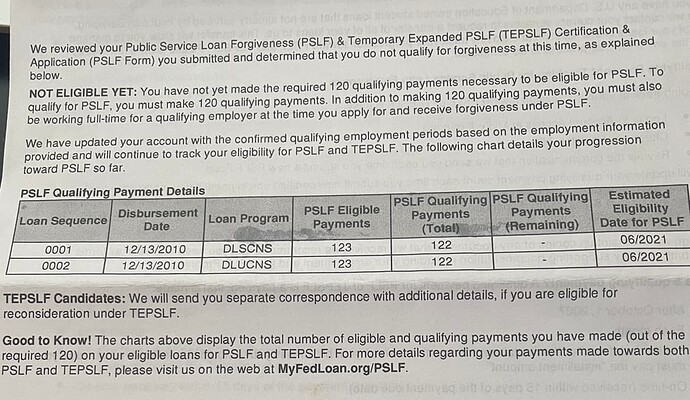

So we heard back today about the PSLF application.

It was in fact not a smooth finish. Someone smarter than me is going to have to explain how this chart marries with the preceding three paragraphs. Apparently making too many payments is problem?

Not posting the next page because it lists her places of employment but it all matches up and was approved as a qualifying employer, which she still works for.

Wifey called them and apparently they updated her file two days AFTER the letter was sent but would still be another 4-6 months to get confirmation it was approved. Lol at this process.

Luckily I’m the calm one so no property damage happened lol. Mrs Cooler is the fiery one but managed to remain calm after her brain processed what she read.

All fed loans are still deferred until January due to Covid so those “payments” are $0. Still count towards PSLF Program though. But if that wasn’t in place I think I’ve read the advice is to continue paying and they would reimburse you for payments you didn’t have to make. LOL to that advice though as I’m sure it would take months/years, if ever, to get reimbursed for payments you didn’t have to make. I’d just move for a deferment or forbearance during that time period.

They should make an ETF called The Corruption Fund, ticker CRPT.

Glad I didn’t sell all my stonks 2 days ago when the Chinese PIIGS threatened the global economy.

STONKS

They’re going to completely change the way we think about bread!

Company valued at 20 billion. Wonder how much it makes in profit?

With sales and marketing costs rising along with research and development expenses, Toast’s net loss swelled to $135.5 million in the second quarter from $53.7 million a year earlier.

Oh. Makes sense.

ETA: corrected company value from 8 milliion (billion) to 20 billion!

What do they do? Cut out the middle man?

Founded in 2012 in Cambridge, Massachusetts, Toast started building payment technology for restaurants and eventually developed a full point-of-sale system. Before pandemic, Toast was thriving by helping restaurants combine their payment systems with things like inventory management and multilocation controls for eateries with more than one site. Investors valued the company at $5 billion in February 2020.

why stonks stonk today?

I miss the days of Spring 2020, when +/- 5-10% was a STONKS or NOT STONKS day…not this up/down 1.5% child’s play stuff.

coming from crypto, 5% is child’s play stuff

Hop on board the cruise line stonks if you want to feel the rush of daily +/- 5%.

Rental income for a house in a middle class neighborhood outside HCOL areas is like double bond yields, minimum. The leveraged return is probably at least 10% including tax benefits. This is a real problem.

Guess they are putting their money where their mouth is with the Zestimates