most of them have spy calls expiring in 4 days, so spy moving down -0.5% is like -50% for their calls.

Oh no, the technicians are scared!

For the S&P 500, it was the first close since June 18 below its 50-day moving average—a technical measure of the previous 50 days’ closes that often ends up acting as support or resistance and that currently sits at 4436.35. For traders, it was very frightening.

This time has a different feel to it. The S&P 500’s sojourn near the 50-day has been longer, notes Jonathan Krinsky, chief market technician [LOL] at Bay Crest Partners. It’s been sitting near it for about six trading days now, without a big drop or big bounce. “The current set-up looks a bit more like a consolidation on the 50 DMA, as opposed to the prior quick ‘V-shaped’ dips,” Krinsky writes. “What we are saying is that the current way in which we got here feels a bit different than the last four to five times.”

Still, Krinsky acknowledges that one close below the 50-day isn’t enough to panic. That’s because the S&P 500 has now gone 218 days without two closes below the average, the second-longest streak since 1990. We won’t know if that streak breaks until the end of trading on Monday.

(Article seems paywalled, but I somehow read it Apple News on my phone)

BLI is a solid short based on the report by Scorpion Capital. It dipped hard after the report, but has since recovered some due to bagholders buying the dip, so I got an undeserved discount on the short and you can too.

I covered my LCID short the other day, seems like it will stay irrational for a while, since already-priced-in news is able to shoot it up (let alone if they actually start to sell a few cars). Took a small profit and avoided stress.

Jesus, not stonks today, apparently.

Starting to feel the same way about ROW stocks. Any time US down or APAC down then ROW X-US/X-APAC gets killed 2x. I pretty much never do anything (exception Feb 2020) but hold, but it makes me wonder if international index funds are ever going to pay off again.

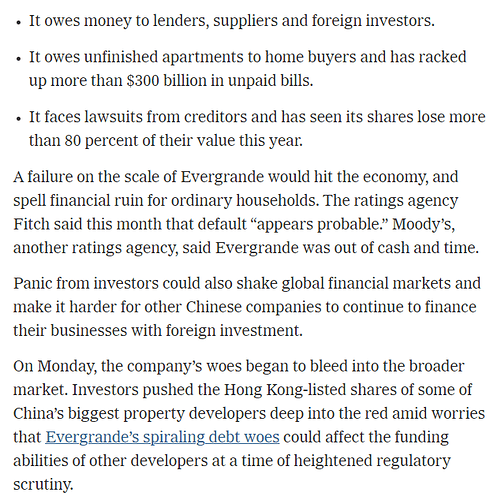

Can someone please help me understand how an overleveraged Chinese developer is causing U.S. stonks to tank? I truly don’t get this one at all.

Like here is the NYT summary. I don’t see why any of these things cause the entire U.S. market to be 2% less valuable than yesterday. Of course they’re real problems for China and maybe other Asian economies, but I just don’t see the connection to U.S. equities.

It’s PIIGS 2.0!!!

NOT STONKS with Chinese characteristics

Buy the Dip!

They are talking about doing away with it for $400k+ earners beginning 2031. Not exactly nuking.

I tried to warn y’all about the September Shmita

Can someone you who has access copypasta?

Refuse to give Murdoch a dime…

With Biden’s Inflation Crisis we’ll all be making $400k by then.

In 2012, former short-seller Andrew Left wrote a 57-page report that alleged Evergrande used shady accounting practices to mask that it was on the verge of insolvency. Left was ultimately issued a five-year ban in trading Hong Kong securities by regulators due to his report.

this shit is always amazing 9 years ago someone knew this was already busto but it takes that long before it actually goes.

the sell off reason is simple, if it dominos like lehman bros everything but like lol gold gonna go down

There is a Twitter guy “no sunk costs” who has been screaming into the void about Chinese developers for years. I think he made his account private so you may not be able to read if you don’t already follow him.

What’s amazing is the people who are right never get rewarded and the assholes doing the fraud almost always get to keep the money. Nice incentives.

It makes no sense to me. US health insurers are less valuable because a Chinese developer is bankrupt? Come on.

Just seems to be excellent timing on converting that company stock award into Vanguard funds, imo.

It’s almost certain that some financial institutions here have loaned money to this chinese developer. Which means everything goes down.

guess i have to start looking into which ones those are and how much they have cause that might get juicy.