Shouldn’t the pandemic ending hirt DD’s business model? I don’t know how to stonk.

I’d think so. I mean, you can always come up with different possible future paths and explanations. If you forced me to go and camera and come up with an explanation for why the pandemic ending was actually good news, I’d probably say:

“Well, Becky, t’s true that a lot of our customers started using DoorDash during the pandemic, and they valued the combination of convenience and security that came with having food delivered safely to their doors. I think what you’re going to see is that as the country starts opening up, and families are spending more time commuting and transferring the kids around, those consumers are going to face greater time constraints and are going to place EVEN MORE value on what DoorDash provides. So overall, I think the pandemic really opened consumers’ and restaurants’ eyes to the value DoorDash provides, and we expect that DoorDash becomes an even more ingrained part of people’s lives going forward. We think the stock is worth at least 15 times what it’s currently trading for.”

I don’t believe that at all, but if I were an equity analyst pulling down a million a year, I could probably say that with a straight face, except the last line.

Everyone hates them! Restaurants, employees, even their customers hate them! All these shitty companies like Uber and Door Dash and a million others are basically the same, leverage dystopia to force people into semi-indentured servitude and STILL fail to ever make a profit.

If I were of a conspiratorial mindset I’d say all of the free money thrown at specifically these types of companies (from where?) is because it’s worth “spending” paper trillions to adjust all of our mindsets to the on demand service economy (technological serfship)

As a reminder of how terrible their business is:

Unlike most companies, they report revenue on a net basis. Which means that an incremental dollar of reported revenue doesn’t generate any incremental expenses the way that it would for, say, Chipotle. (If Chipotle generates additional revenue, it has to generate additional food costs to provide the burritos reflected in that revenue.)

From their most recent 10-Q:

We recognize revenue from Marketplace orders on a net basis as we are an agent for both partner merchants and consumers. Our revenue therefore reflects commissions charged to partner merchants and fees charged to consumers less (i) Dasher payout and (ii) refunds, credits, and promotions, which includes certain discounts and incentives provided to consumers, including those for referring a new customer. Revenue from our Marketplace is recognized at the point in time when the consumer obtains control of the merchant’s products.

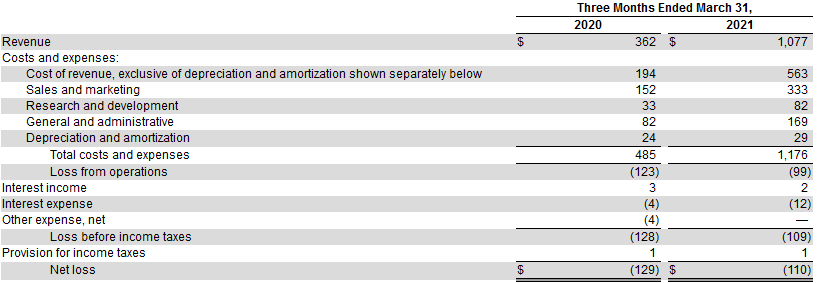

Given that their reported revenue is already net of the associated costs, you’d expect that as their revenue grows, more and more of that revenue would flow to their bottom line (because they woudn’t need to scale up their infrastructure in a linear way). But nope, you just say absolute garbage results like this:

Great job. Increase your net revenue by $700 million and improve your pre-tax income by about $20 million. I’m usually a pretty emotionless person, but a very few companies have driven me absolutely crazy, and this is one of them. (Kodak and A&P are the two others that come to mind.)

It’s the “fail to make a profit” thing that is just nuts. Everyone hates private equity firms too, but there’s no doubt that they generate capital gains for people. All the “disruptor” companies incinerate capital but, uh, new paradigm, etc., etc.

There are two types of mutual funds:

-

Actively managed funds–where you usually pay exorbitant fees to a person who believes their picks can beat the market

-

Index funds–these are pegged to various indices and are not actively managed and are typically low-fee.

WSP structural is a huge structural engineer. They have a couple of offices in south Florida and a billion other offices around the country and world. Stonk is WSPOF.

Excellent post. Blew my mind a bit tbh.

They should have given 1 billion to lobbyists right away, then laws would be passed immediately to protect their other 49 million.

TELL ME, HAS IT EVER HAPPENED TO YOU? It’s 2010, and you’re a Wharton MBA student just struggling to get by. You wake up late for class, and it isn’t the first time. For your entire life, you have slept on inadequate mattresses you were pressured into buying at one of those borderline-criminal cartels they call mattress stores. You’ve barely slept in years. Then you reach for your glasses, but—ugh—they’re last year’s style! So, you toss them in the trash. You slip in some contact lenses instead, but you’re annoyed because they’re too high-quality, expensive, and last too long. You have to wait a month before you can throw them away, which is a drag. Getting ready to shave, you realize that you haven’t changed your blade in months, but you’d rather kill yourself than go to the drugstore to buy new razors, so you suffer through.

When you finally make it to class, your fuddy-duddy professor is giving a lecture about how impossible it is to break into markets with long-established brands. “None of you will ever become rich, powerful business people,” he says, “you shouldn’t even try.” You intuit that he’s wrong, because you are a problem-solver, well-connected, and/or wealthy. Huge, swollen piles of time and capital lay in your future, ready to be shoveled at any problem that comes your way.

Walking from class, you see your friend Tina jetting off to meet her dad in Jackson Hole with a rolling suitcase. “Where’d you get that suitcase?” you ask. “From a store,” she says foolishly. “You mean you didn’t buy it directly from a lifestyle brand on the internet?” you say incredulously. “It doesn’t charge your phone, or anything?” “No, it doesn’t” she says. “Wow,” you reply, forward-thinkingly.

Paragraphs introducing “aha” moments often terminate with some version of the line “that got him thinking.” As in: “Cogan was buying a new supply of soft contact lenses for himself and learned that the price had gone up. This got him thinking,” or “The conversation got Dubin thinking,” or “Then [she] found herself rummaging with frustration in her lingerie drawer looking for a bra she liked. That made her think.” Every story is a shaggy dog tale where the stakes are so low as to be imperceptible, and every bout of adversity quickly and inexplicably resolves.

Really fun read. Thanks for sharing.

Anyone else remember when the media breathlessly ran with endless INFLATION INFLATION INFLATIONNNNNNNNNNN stories? Like a month ago?

10 year treasury is now at 1.37%, shout out to all the fucking morons out there like Stanley Druckenmiller and his willing cadre of similarly clueless media nuthuggers. I won’t hold my breath for the mea culpa.

Two weeks ago every other CNBC guest was “Inflation!!!”

Now, with a (checks notes) 20 basis point drop in the 10 year treasury yield it’s “no confidence in the Biden economy!”

Ok guys.

I’m not sure what the 24 hour news cycle is worse for, politics or finance.

Sometimes shit is just boring and that’s ok.

It’s not boring when my cruise lines are going down like the Titanic.

Economy opening and booming, no inflation, naturally the Dow down 500+ points. Lol stonks.

WHY CANT BIDEN GETS STOCKS TO GO UP!

More rumours of fed stimulus reducing. This will reverse in two days as always and assets will continue to be as unaffordable as ever!