Not really? I mean you can buy mutual funds online with very low fees whenever you feel like it. These “wealth managers” are dickhead guys you can call and talk to about… stonks? and they’ll take your money and do x with it for a big ass fee. At least uh thats what I think they do?

You drastically overestimate the financial literacy of everyday people. I’ve had chats with my relatively smart friends about this stuff who had no idea it was so easy to just dump money into vanguard mutual funds. They were paying an investment firm to invest for them.

I thought mutual funds usually had a guy like that, guess not.

Fucking weird. I mean I guess since you don’t see the fees until you withdraw (right?) and turn it into cash thats how they get away with it?

They want their hands held and to be told “this is the right blended fund for you at your age and risk tolerance”. That’s basically it.

Most people are unlikely to ever notice the fees. It will show up as a transaction on their account statement, something that most people are unlikely to look at, and that’s about it. The reason this works is because markets generally go up, so that if you withdraw more money than what you deposited, it’s very easy to overlook the fees during the investment period.

When I came into significant money and wanted to invest it, I looked into mutual funds through Chase Bank that had 3-4% expense ratios. I figured out for myself that was a scam, but I felt it necessary to ask in BFI to make sure. The money wound up in Vanguard.

When asked about the fees embedded in their retail mutual funds, the most common answer from investors is that there are no fees, they think its free. The mutual fund salesperson will tell them that the fund goes up 10% per year and the bank keeps just 2% and the client gets to keep the rest. What do you mean “fee”? The stupid bank is letting me keep most of the winnings!

Was updating my financial stuff last night, and this is the time of year where I update actual college costs as colleges release their 2021-2022 estimated costs.

My reference tuition school is the University of Chicago, for no other reason than I used to live there. In any event, costs for the 2021-2022 year are estimated to be $82,848. That’s obviously an enormous amount, but it’s meant to be an aspirational goal/ceiling rather than my expectation of what my kids’ college will actually cost.

Anyway, the reason I’m posting this is that the good news here is that college tuition inflation continues to be less than the 5% I originally budgeted for 15 or so years ago when my first kid was born. This year’s tuition is a 3.2% increase over last year’s. And last year’s was frozen relative to the prior year. Over the last 10 years or so, it’s gone up by an average of 3.4% or so. So that’s a very small silver lining for the dark cloud that is the estimated cost of sending my kids to college, and the question of whether or not I’ll have enough saved.

$330,000 gets you a 3 bedroom house in pretty much any city under a population of 500k. Insanity.

It’s obviously done imperfectly, but the college tuition game is…extremely progressive? I’m sure there are major issues with implementation but basically the only people paying full freight are upper middle class and above families.

My sense is middle class big city types get crushed though, if you live on Long Island or in Boston and make $80k - $100k as a family you’re still probably expected to contribute like $40k a year.

I always wonder what would have happened if my parents or I had known that when I was looking around at colleges. I got into (once-respectable) UPenn and we visited there and I liked it, but IIRC my parents kind of dismissed it out of hand because the headline tuition was so high. But we were basically a middle middle class family and I now feel pretty confident that the actual cost for me wouldn’t have been nearly as high.

Such is life.

It still seems to be much less wealthy Black folks with the most outstanding debt, however. I think “extremely progressive” is far too charitable. It doesn’t seem to be progressive enough for PoC without much familial wealth.

In the early 80s, I received a scholarship offer of 5K per year from UPenn, but that still would have left me short every year. Consequently, I chose to attend one of the SUNY university centers instead.

$80k+ per year - that’s just insane.

UK isn’t much better and I really feel for kids, and their parents, these days.

When I was a lad…

When I was a lad…

I went to a decent university here in 1985. I got a full “maintenance grant” of ~£1900 per annum (~£6000 in todays money) and we had no tuition fees. Rent in a shared house was around £25 a week, and my 1st yr hall of residence wasn’t much more when food included and Stella/1664 was 80p a pint in the student bars. I worked in the holidays and left with a degree after 3 years with £200 in the bank and zero debt.

Systems fucked up - we should want our populations educated … (and healthy, and happy) - yet here we are.

This article is overly harsh, their business really doesn’t sound different from dollar shave club or lots of other marketing businesses. It is something of a service to sift thorugh all the cheap stuff on Alibaba or wherever and find the suppliers that have a level of quality acceptable to the American consumer and then market that stuff to them, process orders, and take their cut.

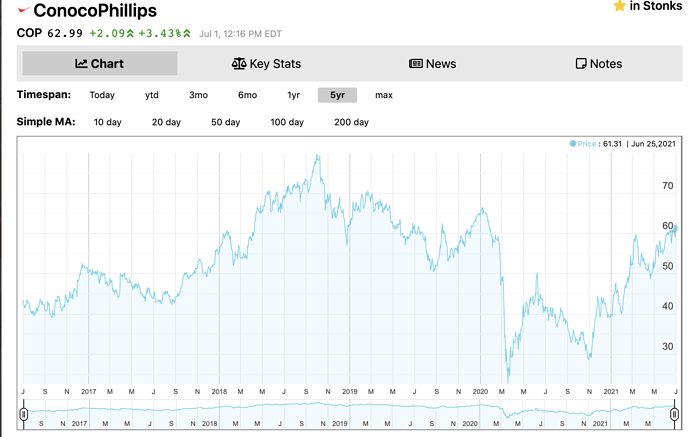

COP my first recovery stonk (since AMZN, DGX, MSFT in the early days) getting close to pre-covid high. Now the big decision do I sell or try to ride the wave to all time high? And if it hits all time high, do I have the discipline to sell?

From Matt Levine, this is incredible. More than 5% of Robinhood’s total revenue is attributable to transactions in fucking Dogecoin.

For the three months ended March 31, 2021, 17% of our total revenue was derived from transaction-based revenues earned from cryptocurrency transactions, compared to 4% for the three months year ended December 31, 2020. While we currently support a portfolio of seven cryptocurrencies for trading, for the three months ended March 31, 2021, 34% of our cryptocurrency transaction-based revenue was attributable to transactions in Dogecoin, as compared to 4% for the three months ended December 31, 2020.

SC,

Thoughts on Door Dash having a $60 billion market cap? For reference, that’s 1 (one) Honda or Ford - take your pick.

It’s completely ludicrous, obviously. I’ve tried to short it a bunch of times, but thankfully TDA hasn’t let me because there haven’t been any available shares to borrow. I feel completely confident that you could short here and cover 25% lower at some future point if (AND THAT’S AN ENORMOUS “IF”) you can tolerate the interim volatility emotionally and margin-wise. So basically, this is a stock that’s destined to lose me a lot of money as soon as I am able to short it.

What’s interesting to me is that DoorDash’s increase in price is happening along with a rise in super-overpriced Chipotle, which doesn’t make a ton of sense to me. Good news for restaurants (assuming that’s a reflection of like increased store openings or people’s willingness to eat out or something) should decrease the demand for DoorDash. But whatever.

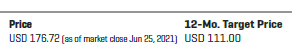

Also, complete LOL at CFRA’s report on DASH right now:

Yes, I agree. Good target. So what should an investor or potential investor do with that information?

Obviously