Someone bought the house a long time ago and property taxes are tied to purchase price in California. Just another boomer perk. It’s a problem.

It’s crazy in Beverly Hills, you’ll literally have a $20 million mansion next to a complete tear down that people won’t sell because their property taxes are locked in at like $1,200 a year. Not 100% sure but I think Prop 13 also prevents the taxes from going up at death if a child inherits the house, too.

Prop 13 also applies to country clubs and golf courses. So, many of them are paying way less than they should in property taxes.

We had Prop 15 on the ballot this last November in California, which would have closed some of the most egregious loopholes created by Prop 13. It lost 52/48.

I have a hard time understanding anyone who looks at the Bay area housing market and thinks to themselves, “Yeah, I want in on that.”

I tried to buy the last couple months. Nothing like making a crazy high offer and coming in last of 18 people. Or the one that listed for 1M and went for 1.5M in less than 24 hours. It’s not actually possible to buy a house right now.

So we’ll wait. Some day there will be properties lasting more than a week on the market who want a buyer.

Well, if I want to leave my job it’ll cost me a ton of money, so I’m here 4 more years minimum. After that… structure of my contract makes it super hard to leave. Probably end up outside the bay either in something like Livermore or a mountain town of some sort.

lol, this house is now pending sale. I think it was inside of a week since it was listed? Seems unlikely that the offer was all that much under ask if was accepted so quickly, although I probably won’t get to see for another month or so until closing.

There was a funny issue with this in 2003 when Schwarzenegger was running for governor. Warren Buffett was an advisor, and WSJ article came out where Buffett allegedly said that taxes in California were too low, and used his Omaha home as a reference point. That, obviously, did not go over well.

https://www.sfgate.com/politics/article/Buffett-s-Prop-13-comments-cause-stir-2595878.php

But the WSJ article was full of shit - Buffett’s point was that taxes in California were too low for billionaires like him who had owned valuable property for decades and whose property taxes were locked in at artificially low rates.

The WSJ article was so misleading that Buffett wrote a huge response letter to clarify it.

Loved my 15 years in Cali but financially it was suicide. I’ll keep loving it as a place to visit, but never again a place to live.

The biggest metroplexes are super fucked. Midsized cities and places that are nice to live should be fine. The tech giants are instituting all kinds of ‘you can live here but we aren’t paying you extra’ policies now that WFH has been proven viable. Once the workerbees evacuate, commercial real estate will implode and we’ll be right on target for the Escape From New York movie timeline san crazy rightwing Christian President.

I think there will always be a market for urban core CRE. Trophy markets will rebound. But I think suburban and exburban office is totally fucked.

I wouldn’t be so sure.

DoorDash, a $42 billion company with a garbage business model and negative operating income, is still not shortable at TD Ameritrade.

I am disappoint.

Seems like a Tesla situation to me, that no matter how overvalued they objectively are, they’re going up longer than you can stay solvent.

I appreciate the idea that markets can stay irrational longer than I can stay solvent. (I constantly remind myself that I lost money shorting two different companies that went bankrupt.) But I think Tesla has at least some possible outcome where the valuation might make sense. I don’t think the same is true for DoorDash. But maybe that’s just my limited imagination.

In any event, I’ve kind of been anchoring on DoorDash as an extreme example, but I was curious how many other companies there were in a similar position. I arbitrarily defined “crazy valuation” as:

- Market cap >$10 billion (excluding things like warrants and options, so this is conservative)

- Negative pre-tax income for the current year

- Price/Sales ratio>=10

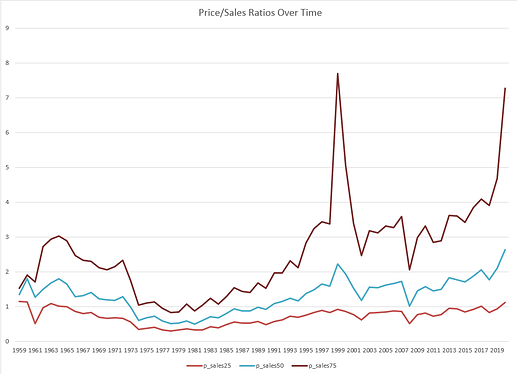

The market cap and negative pre-tax income criteria should be clear. Here’s how the price/sales metric has behaved over time (25th percentile, median, 75th percentile):

So right now, the 75th percentile of price/sales ratio is roughly as high as it was at the peak of the Nasdaq bubble. 10 is a pretty extreme value for any firm, let alone for a large and negative income firm.

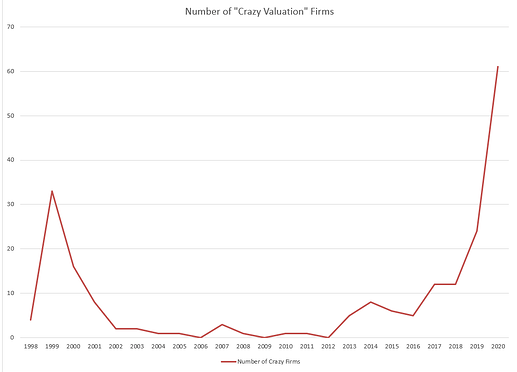

Here’s how many of those “Crazy Valuation” firms there are per year:

There are more than 60 as of last year, compared to 33 at the peak of the Nasdaq. You’ll notice that the graph starts in 1998. That’s because there weren’t any in the 40 years prior to that point.

The top 10 “Crazy Valuation” in 1999 (by market cap):

ACTUA CORP

ORANGE PLC

NEXTEL COMMUNICATIONS INC

VERITAS SOFTWARE CORP

GENENTECH INC

COLT GROUP SA

AKAMAI TECHNOLOGIES INC

KPNQWEST NV

LEVEL 3 COMMUNICATIONS INC

AMAZON.COM INC

Some of those names don’t look familiar. That’s because my data provider only offers current firm name, rather than the historical name (at least, unless you go through some bullshit matching process I don’t feel like doing). For example, Actua Corp. is more recognizable (to me, at least) as Internet Capital Group.

Top 20 for 2020:

PINDUODUO INC -ADR

SEA LTD - ADR

AIRBNB INC

SNOWFLAKE INC

SNAP INC

NIO INC -ADR

TWILIO INC

WORKDAY INC

CROWDSTRIKE HOLDINGS INC

LAS VEGAS SANDS CORP

DOORDASH INC

DOCUSIGN INC

ATLASSIAN CORP PLC

TWITTER INC

ROKU INC

PALANTIR TECHNOLOG INC

UNITY SOFTWARE INC

MODERNA INC

PINTEREST INC

MARVELL TECHNOLOGY INC

I totally don’t recognize most of these firm names, but I feel pretty safe saying that this basket of stocks is likely overvalued. The problem is, what happens if there’s an Amazon? Suppose you had taken an equal-weight position in the top 20 overvalued stocks in 1999, investing $1,000 in each? Even if the other 19 went bankrupt, the cumulative investment in Amazon would be worth about $43,000 as of the end of 2020. So investing in a basket of the most seemingly overvalued stocks at the peak of the Internet bubble still generates a positive return. Not great, but still about 3.7% per year.

But man, I’d really love to short this basket.

Between the news about generalizing the mRNA vaccines to malaria and cancer, and deep government pockets, those two I wouldn’t short. I’m not knowledgeable about finance and shorting and what have you, but my gut says to stay away from those.

The rare good article about the supposed restaurant worker shortage:

HIV too