He could do a lot worse than Vanguard Conservative Growth, which is 40/60.

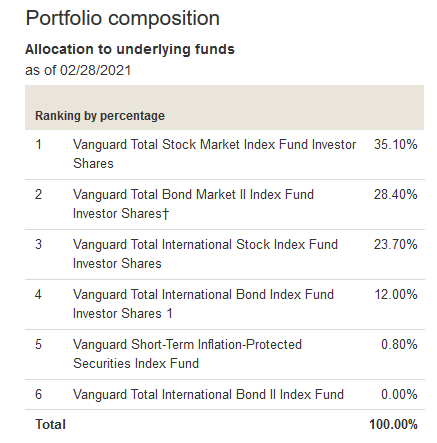

I’d probably go with a higher allocation to a Vanguard index fund, viewing the pension (plus any assumed Social Security?) as effectively a bond. Just for reference, here’s the allocation of Vanguard’s 2025 Target Retirement, which more or less inverts your proposed allocation:

That being said, personality comes into play. If he’s the kind of person who is unfamiliar with the market or skeptical about it, he might have a stronger aversion to losing money in stocks, which would lean towards more bonds. I mean, I can certainly imagine being on the receiving end of telephone calls with an angry parent saying, “Why did you tell me to buy stocks when all they do is go down?”

So never mind - 80% bitcoin, 20% TopShot

That’s too many bonds for my taste, especially because he’s got a pension, which is bond-like in its safety. I’d go 60/40 stock/bond if I were him. Maybe even 70/30, depending on the size of the pension.

It’s a blue collar union pension. So I assume it’s pretty good. Thanks for all the input. Much appreciated.

I will leave you with an additional thought, colored by my own experience as a pension actuary. Do not allow any crafty financial “advisor” to find a way to convert your dad’s pension into a lump sum to invest. Some plans allow this and will actively encourage it so that they don’t have to underwrite your dad’s income for life. He should force them to do that or transfer his pension to an insurer.

This is an interesting perspective. If I were offered a lump sum, I’d definitely take it and just stick it in a Vanguard fund. But if I were advising a relative what to do, I’d probably echo you and tell them to just leave it in the pension plan. But that’s not because I think it’s a good idea for them financially, but rather good for them emotionally (unless I knew they were comfortable with market volatility).

Everything depends on household circumstances so there’s not universally right answer. But for someone that is retirement age, usually the biggest challenge is converting accumulated assets into lifetime income, and usually if you have a defined benefit pension that you are eligible to collect then that assets is already in the most efficient form for retirement income delivery. People tend to undervalue the guarantee that the pension will be paid for life. It has a lot of economic value that is not as obvious as the value of assumed future high investment returns if you take the money.

This article is a great read. People often wonder how Wall St types can behave so callously, and psychopathy is often invoked. That is no doubt often the case, but this article touches on some of the self delusion that goes into it as well. When you’re framing investment banking as doing God’s work in accordance with the bible that’s pretty crazy.

One other thing that caught my eye and rings true to me - the lack of seriousness about multimillion dollar fines for securities regulation violations is very common. I often see articles framing “ABC Company Fined $X Million Dollars” as some monumental corrective action, but inside the industry these events are regarded by leaders as similar to parking tickets.

Yeah, I think I’d only take a lump sum if I knew I wasn’t all that long for this world. It’s way harder to predict how long one person will live than how 1000 people will die out, which is the whole point of a pension fund.

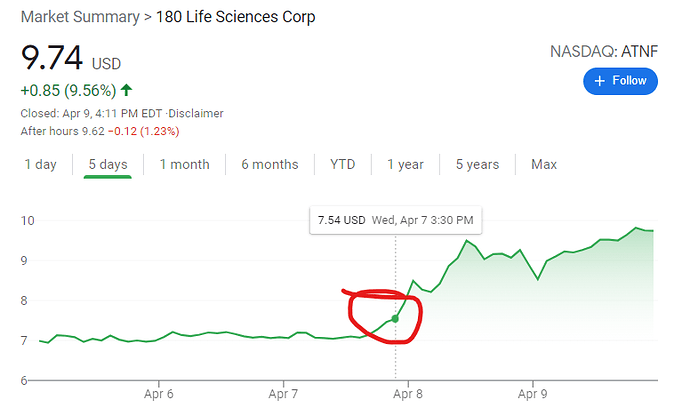

Here’s a chart of ATNF. I had August calls with a 7.5 strike. The chart below shows the exact time I closed my position:

Fuck me.

I know that this is definitely true for me.

In the accumulation phase it’s easy – just shove everything into VTI.

In the decumulation phase, there is all sorts of shit to think about. Even if you just shove in VTI (or some blended fund), you’ve got to figure out the most tax efficient way to exit your positions and which accounts to sell from and how much (e.g. tax-deferred vs taxable vs roth) in order to maximize tax efficiency.

That may not have been part of the challenge you were alluding to, but it sure seems tougher for me.

Had a long conversation tonight with my brother in law, who has been converting his taxable investment accounts into a Roth in order to take the tax hit up front. Converted several hundred k and paid a hefty tax bill for it on his current tax rate.

Conventional wisdom always said to use all of the pre tax vehicles to avoid tax today while you are earning, and when you withdraw you’ll end up paying lower tax since your income will be lower in retirement.

His belief is that a) marginal tax rates will continue to increase over the next 15 years or so toward their retirement horizon, and b) that with a high savings rate and assuming normal 6-8% annual returns over the years between now, retirement, and eventually age 72 (25 years or so) his RMDs + social security are going to be much higher than their current income and in fact this maneuver will actually result in a significant tax savings over the long haul.

Is this just silly or is there a level of wealth that jumping on the tax rake today and converting your old 401ks into IRAs and converting them to a Roth and just eating the taxes to allow it to grow tax free forever is viable?

It’s a common strategy to do annual roth conversions early in retirement for smaller amounts that are taxed at a lower marginal rate.

If he’s at the top rate already, it seems like it is unlikely that this is going to work out in his favor, but I suppose one could construct a scenario in which it would be +EV. Seems unlikely, though.

That is certainly a big part of it. The other problem that is basically unsolvable is deciding how much to spend each year so that you don’t risk running out. In a super low interest rate environment he insurance products to achieve this are priced attractively and the DIY approach is at best a pain and in all likelihood massively inefficient.

Roth conversions probably don’t make sense for someone currently in a top bracket. You have to be really, really rich to be in the top bracket (something like $20 million net worth / $500k a year in passive income) in retirement.

Is it roughly safe to say if you expect to be in a higher tax bracket when you are drawing than you are today, Roth converting today makes sense? Not sure why this seems so weird to me lol.

rocket emoji that’s better

Yeah, that’s correct, but it’s not a reasonable expectation for most. Not impossible either, though.

I like how I just shorted the market with the assumption that it was the best time in a long ass time to do so and as soon as I click send I still feel like it was a terrible idea.

Yeah I’m keeping track of these next couple weeks to see if you have some kind of inside info or at least a nose for swongs.