This seems really good. Only thing I would add, and maybe it’s in there, is a huge increase in IRS funding.

https://twitter.com/jstein_wapo/status/1374325400621449217?s=21

Haven’t clicked through to the article, but a couple questions for those who have:

-

Top tax rate is currently 37%. So increasing the top rate to 39.6% doesn’t seem like that huge of a change. I guess it depends on where the new rate kicks in.

-

I assume “tax assets passed on death” means no step up in basis rather than setting the estate tax exemption to 0.

Blockquote

The president has said that his tax increases will not affect people earning less than $400,000 per year.

While I fully expect to see some truly hilarious Wall Street Journal “Look how much more this heiress with $900,000 of annual trust income will pay” stories, I can’t imagine really anyone complaining about that cutoff.

Idiot Republicans who make less than $35k/year absolutely love to bitch about tax increases, even on those making more than 10x what they will ever make. Because, ya know, they will one day be rich too as soon as the lazy Mexicans stop taking their job. Or something like that.

The cutoff for the current top bracket of 36% is $518,401 for single filers and $622,051 for married couples. I imagine they would keep these thresholds (adjusted for inflation) and just add a new higher threshold for the 39.6% rate.

This will happen no matter what they do.

Press secretary clarified that was the number for married people. So might be something like $200k for individuals. Not bringing the SALT deductions back at least, so at least not

giving back ground on taxing the professional class. All in all a good start, we will see what Sinema allows to pass.

Look buddy, $900,000 isn’t even that much on the Upper East Side. By the time you’ve made all your tax deductible investments for the year, paid for your kids to go to the most expensive private school in NYC, and covered the cost of the stables in Hudson there’s barely enough left to cover brunch at the Carlyle (let alone tips for the cleaning staff).

Ending cap gains for income over 1m is pretty huge imo. SALT is a mistake. Should end SALT while raising taxes on the higher income individuals who are taking SALT so we stop shipping so much fucking money to red states. But I guess the messaging on that would be complicated.

On the other hand an exodus of college educated voters from high tax blue states to low tax red states is pretty good for the country long term.

There is really no independent justification for SALT, IMO. It’s only really an issue at all because of inertia - people got used to it. Much like the mortgage interest deduction, preference for capital gains, basis step up, gain exclusion for primary residence and the employer health care deduction, it is dumb policy that you would never include if you were designing a tax regime from scratch.

The IRS funding point made above was a key one. There needs to be a massive increase in IRS funding to go along with this or else we are going to have a major problem. The IRS already is barely functional. Piling on another major tax code rewrite without adding personnel is going to be very problematic to the agency performing basic functions. Tax rates and a functioning IRS should be two separate issues, and the right wing obviously gutted the IRS, but if the IRS isnt actually working for the average person (as described by a number of anecdotes on this site) it isnt going to be great for Dems in the '22 election or for their priorities longer-term.

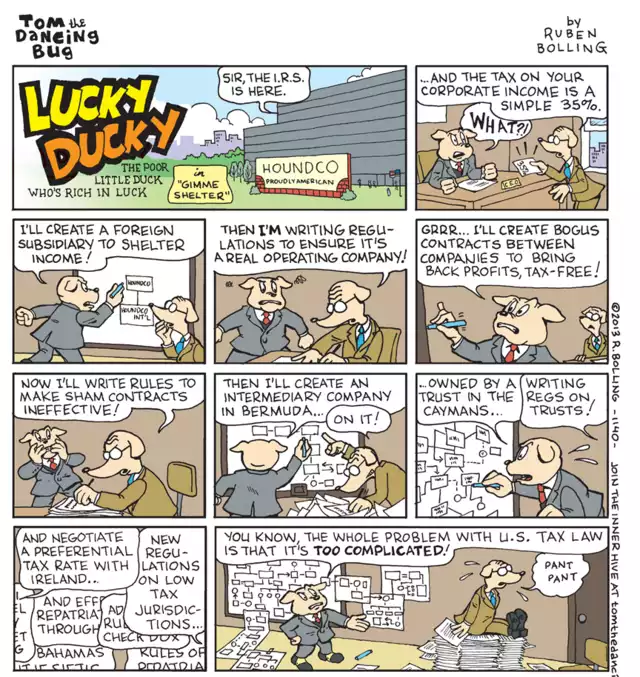

Adjustments like higher rates for individuals will still sort of work fine outside of the super rich basically not being effected because they can still scam they system with little risk. Raising the corporate tax rate isnt going to do a lot if there is no capacity to deal with aggressive envelope pushing.

I need to understand the “global minimum of 21%.” If that effectively ends all the bullshit moving income to low tax countries that’s a huge deal, who knows if they can actually implement it.

He’s not even trying.

https://twitter.com/sahilkapur/status/1374377306236456968?s=21

Relevant:

https://twitter.com/beardedcrank/status/1373957778583195654?s=21

This is why VAT taxes are strictly superior to income taxes. Yes they’re regressive, but it’s easier to fix their problem with being regressive than it is to fix income taxes evasion problem. It’s a textbook example of how something (in this case progressive income tax) can look better on paper and be significantly worse IRL.

The most important thing in taxation is that it’s hard to avoid.

Yeah that is the problem with the tax issue. A huge number of people are completely delusional about their future circumstances and protecting that future at all costs.