If Bitcoin was widely agreed upon to be the ideal solution to settle lots of different common transactions (not really sure how this could happen because its performance is garbage), then I think the thesis would be that its price would eventually stabilize (at a much higher level than it is at now).

Right, so paradoxically for it to be a reasonable investment it can’t currently be used as a currency. People aren’t using it as a currency now, but they will in the future. If that’s true then it’s going to be a great investment until it reaches a steady state of use as a currency.

I’m not really talking about BTC though. I can easily envision (but am not predicting) a future full of heavily used blockchains and cryptographic protocols that owe their existence to BTC, while it has become an artifact maintained by hobbyists and historians.

Why should I use crypto instead of these or my bank’s app?

I actually am more in line with you than you might guess, I have a decent bit more $$ in index funds than I do in bitcoin. I’m under no illusion that Bitcoin can’t go to zero. It’s just that I believe the upside for Bitcoin (bitcoin, not crypto) is massive and I want to have an allocation to capture that. It’s an EV and risk-adjusted returns play for me basically. I think we’ll see more and more recommendation for people to have a small piece of their NW in Bitcoin, especially as we see more regulations. Fidelity Report on ‘Getting off zero’ https://www.fidelitydigitalassets.com/research-and-insights/getting-zero-bitcoins-role-modern-investment-portfolios#:~:text=“Getting%20off%20zero”%2C%20in,have%20not%20considered%20it%20yet.

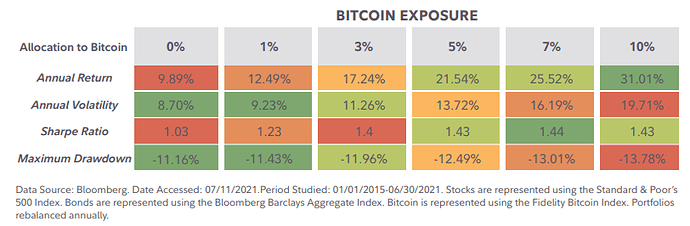

The incremental gain from owning no bitcoin, to simply putting on a 1% position appears substantial

within the analyzed time period. A 1% position in bitcoin led to 2.60% in additional annualized returns and would’ve compounded a portfolio to more than 30% greater than the benchmark over the period. Meanwhile the maximum drawdown only increased 0.27% and the portfolio’s risk-adjusted Sharpe ratio rose almost 20%.

The most powerful message that we can take away from the data shown above is that the first 50-

100 basis points had the most efficient risk-adjusted portfolio impact. Once investors get off zero

allocation, they must then determine their overall risk tolerance to decide if a higher allocation makes sense. There is a direct relationship in the historical data between increased bitcoin exposure, annual returns, and annual volatility.

They’re constantly being developed and tried out and then they don’t get implemented lol. Come on man. I looked at a blockchain solution to an industry problem personally and came away with the fact that it was simply wildly less effective than just having a regular old database with regular security.

We could be extremely early, but that’s a terrible argument for all the current crypto currencies.

This is my problem with all the pro crypto arguments. They always hinge on a bunch of unproven shit while the stuff they’re currently doing is basically just a way for upper middle class white dudes to run unregulated pump and dump plays while burning an absurd amount of energy in the run up to a climate catastrophe.

Nobody has been able to explain to me a way that crypto solves an actual problem in the world. Ever. They talk about how it could, but every time someone actually goes out and tries to execute on that it fizzles because it’s not in any way as good as the solutions we already have for those problems.

The one big datapoint in favor of crypto right now is that rich millenials liked it enough to bid it into the clouds. If I believed in the efficient market hypothesis in any way that might be persuasive to me.

How does it do this?

The “we are still in the early days” gets less and less convincing to me as the years go on. It’s been a decade+ of smart people tinkering with Bitcoin and at best it seems to solve very esoteric problems. Obv it’s impossible to say something big won’t happen five years from now.

Supporting terrorists or “freedom fighters” like navalny or isis. Settling gambling debts in places where gambling is illegal or payments are blocked by banks.

If there was a pneumatic tube network for transferring gold bullion, I think it’d be bitcoin. Used to be only super rich people could settle debts with gold bars, but with btc anyone can even for small value transfers

So digital diamonds. Is there a reason BTC is a better product than the one on offer from DeBeers?

Also correct me if I’m wrong but diamonds are much better at all of this than BTC because they aren’t anywhere near as traceable.

Yeah you don’t have to trust the post office or FedEx. You interact directly with the pneumatic tube system

With Bitcoin you don’t have to poop out the diamonds to retrieve them.

And so does every scammer on earth. You’re not arguing that BTC has a security advantage over the regular banking system in 2022 are you?

This is a valid point lol.

Read the link to Vitalik’s website I posted above and see if it changes your mind, or even the Wikipedia entry. This is advanced cryptography that was barely theoretical when BTC launched.

Ditto to @Trolly

DeBeers

This namedrop might be the best argument in favor of bitcoin amongst the other store-of-value alternatives

I mean that’s who the competition is. I have zero ethical skin in the game of ‘hard to trace stores of wealth’ as a product. I happen to think crypto is a really bad diamond substitute because of how traceable things are on the blockchain, but hey that’s me.

lots of advancements in math take decades or far longer to become reality - I’m 4 years out of CS and by no means a topic expert but I can read and understand the math involved and it does seem possible. I’m not sure what the hurdles are into making it reality.

this concept is definitely proven though, mathematically.

And so does every scammer on earth. You’re not arguing that BTC has a security advantage over the regular banking system in 2022 are you?

Read the link to Vitalik’s website I posted above and see if it changes your mind, or even the Wikipedia entry. This is advanced cryptography that was barely theoretical when BTC launched.

Ditto to @Trolly

The answer depends on where you think the weak link in the security system is. If you think it’s the cutting edge cryptograpy, the edge may go to BTC/ETH. If you think it is almost literally anything else, the edge goes to banks.

It’s definitely not the cryptology lol. It’s always always always customers who are always always always idiots.