+1 NFT for posting in new thread

https://twitter.com/bitbitcrypto/status/1527002176396066816

DECOUPLING!!!111111111111

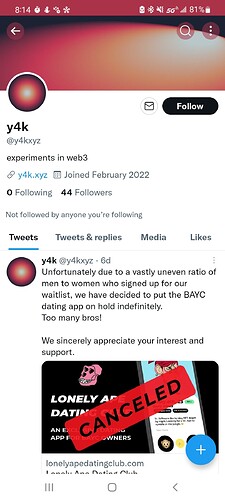

Was this real?

https://twitter.com/CasPiancey/status/1527000967136219137?s=20&t=f7wrln5HBfzoXCoDvoEPQw

doubt it but i’ve spent zero time investigating it

Looks to be real

Clicked through to the twitter:

Lol at thinking it is real. It’s a parody. Really weird how the same people totally disinterested keep stumbling on to this stuff with 44 twitter followers!

I genuinely don’t get why the SEC isn’t doing more about this. How do you have a YC-backed startup just running an unregistered hedge fund out in the open? It’s not even the scamming part–even if you did what they’re describing honestly, it’s illegal! Aren’t there any ambitious prosecutors out there who want to make a bunch of slam-dunk cases to advance their careers?

Whatever happens, though, the jagged history of crypto shows that foolish risk creates its own aesthetics. The crypto-bro investor does not evoke vicarious excitement, like a stuntman jumping motorcycles or a daredevil mountaineer, because his antics at the keyboard don’t appear to take much skill. He’s more like a bettor at the track who picks the winning horse at random, or a country-club jerk who hits a lucky hole in one. Watching him may elicit wonder at his cosmic luck—a mathematical sublimity. But no one would describe his victory as a beautiful achievement.

That’s why we end up feeling nauseated at the crypto bro’s success: It’s so unearned, it makes us sick. But our schadenfreude is a product of the same illusion. We’re not reveling in our prudence, so much as we’re indulging in an even lamer form of grandiosity. “It could have been me” was a lie from the start: Sure, we might have profited 10,000-fold—and then lost everything a few years later—but probably not. If my folks and I had purchased Netscape at its IPO, we wouldn’t now be plutocrats. We’d have put a few thousand dollars in, at most, and then sold off our stocks when their value had tripled or quadrupled. We’d have made a little money and been glad. As for crypto, I bought a thousand bucks’ worth a while back and am down by half. Whatever. The fantasy of failing to achieve a massive gain, and then also of averting bankruptcy, flatters us twice over. The truth is more banal: It could never have been me.

fwiw, Coca-Cola isn’t in the bottling business. Better analogy would have had something to do with marketing.

They don’t have anyone on their staff that understands crypto.

SEC guy said so himself that they need more money to hire crypto experts.

Typical patriarchy

The DAO makes use of blockchain to link up different female communities and to build a unified community with shared-interests, thereby creating a wonderful world that is fairer, more equal for women and more sustainable.

Amazing what blockchain can do ![]()

The number of Youtube LIVE scames recommended to me by fake accounts offering free bitcoin double ups (send 1x BTC to this and receive 2x in return!) is rather impressive.

Do Kwon, the creator of the stablecoin TerraUSD (UST) and its sister token Luna, is facing legal prosecutions in South Korea over the collapse of the two coins that have wiped billions of dollars off investors around the world earlier this month.

The Seoul Southern District Prosecutors’ Office said Friday that it has kicked off an investigation on Terraform Labs, the organization behind the stablecoin project Terra led by Do Kwon, and assigned the case to its Financial and Securities Crime Joint Investigation Team, a special financial crimes unit brought back recently by the newly appointed justice minister Dong-hoon Han, according to local media.

The announcement came a day after five Korea-based crypto investors with combined damages of 1.4 billion won (about $1.1 million) filed criminal complaints against Kwon and his Terraform co-founder Daniel Shin over charges of fraud and other violations of financial regulations.

South Korea’s financial authorities estimated that about 280,000 users owned a combined amount of 70 billion Luna in Korea.

…