This story is telling me my money is safer in a crypto wallet than in a bank

His bank account and coinbase were both compromised. So yeah maybe it was a push ACH transaction as mentioned above. I’m still waiting to hear back from him.

Or maybe it was this:

Until now, these types of purchases took between 3-5 days to complete, as Coinbase waited for funds to transfer via ACH before they credited your purchase. This wait meant that users would often get frustrated because of bitcoin’s inherent volatility — the price could fall (or rise) by 20 percent before you received your coins, but you were still locked into the price you paid five days earlier.

Instant buys aren’t totally new for Coinbase — users using a credit card to buy cryptocurrency were able to do instant purchases, but this came with a 4 percent fee, more than double the 1.5 percent fee charged for bank account purchases. Plus, credit card buys have much lower limits — sometimes only a few hundred dollars a week. Bank account purchases on Coinbase have much higher limits — ranging as high as $25,000 a week for the most verified and trusted customers.

Zach Abrams, Coinbase’s new Head of Product, explained that “Coinbase uses proprietary fraud prevention systems it has developed over the last 5 years, to determine how this instant purchase feature is rolled out to groups of customers and that the customers with access to this feature have sufficient balance in their bank account with good purchase history.”

Making sure users have enough money in their account to actually afford their purchase is important because Coinbase won’t be placing any holds on instantly purchased cryptocurrency, meaning a user will be able to buy bitcoin and transfer it off exchange before the ACH withdraw is actually completed.

Of course, this means Coinbase could potentially be left paying for a fraudster’s purchase, as banks won’t reimburse merchants for declined ACH withdraws due to insufficient funds.

This would explain why some people have to wait 3-5 days and some don’t.

I think if they used this method, your friend would have had at least a day (or longer based on how long the ACH took to clear) to cancel the ACH with the bank. I’m pretty sure that until the funds clear your bank can stop the transfer of the funds.

What that article describes is Coinbase fronting people the money while it waits for the ACH to clear. If the ACH doesn’t clear (e.g. if your friend cancelled it with his bank or insufficient funds), Coinbase should be on the hook, not your friend.

Does the bank let you cancel an ACH like that? I know all this happened in like an hour and he was doing everything he could to stop it at the time.

Big problem for crypto if not

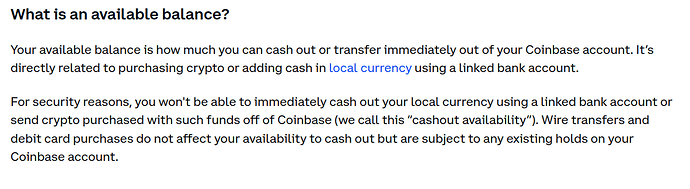

The thing that actually matters the most is the hold period on cashouts. I’ve never heard of anyone being able to move funds with absolutely no hold on any ACH. I thought the instant was just buy/sell before funds clear, but everything still subject to normal Coinbase cashout jail. Suzzer’s article quote implies instant withdrawals, but here’s what the site says:

The specific thing I wanna know is if suzzer friend’s account had this instant cashout capability with zero hold on an ACH. That’s a major security risk since they’d only need to compromise your Coinbase account to execute such a maneuver, whereas other bank-related methods that clear instantly with no hold (debit card, wire transfer) require additional compromises. They even point out that it’s a security risk on their own site!

Ok this is where it gets confusing because now “cashout” apparently means “cash out or transfer immediately out of your coinbase account”.

It’s defined right there in the image I just posted.

For security reasons, you won’t be able to immediately cash out your local currency using a linked bank account or send crypto purchased with such funds off of Coinbase (we call this “cashout availability”).

I think so.

https://www.sapling.com/6660073/stop-payment-ach

“Since ACH transfers don’t happen immediately, as long as you catch the transfer before it has been processed, you should be able to cancel ACH transfers. Some ACH transactions can be canceled directly via your online bank; some banks, however, may require you to call them or submit a form to cancel the payment. If it is a one-time payment and hasn’t been debited from your account, you should be able to stop it without difficulty.”

What happens if scammer requests an ACH deposit of $5,000 and you only have $1,000 in linked bank account?

Right. So that’s where the confusion kept coming in, because to me cashout only meant actually cashing out.

Anyway, it sounds like maybe they sort of stealth rolled out this instant cashout feature to their best customers, or something. But it’s not in their guidelines obviously because they don’t want to piss off the regular customers.

I don’t know if the bank will reverse any ACH. IIRC my friend said something like he contacted BofA and they told him the transaction was legitimately issued from coinbase, and he needed to talk to coinbase.

National Automated Clearing House Association (NACHA) rules cover if and when a simple reversal is allowed. Your bank can only reverse a payment from your account for one of the following reasons:

- The wrong amount was transferred (for example, $200 instead of $150).

- A transfer had the wrong account number, meaning the sender or recipient was not the right account.

- If a transfer goes through more than once, the duplicates would be reversed.1

The bottom line is the banks are always going to set up the rules so they don’t get hosed.

If you’ve authorized ACH payments that you want to stop, you have a legal right to revoke your authorization. To do so, call or write the biller to request that they stop taking automatic payments. Let your bank or credit union know, too, by writing a letter.

Lol writing a letter.

Yeah so this seems like it would be important to know. If they removed the jail sentence on your friend’s account, well, that seems weird because on their own site they say that would be a security risk. Since the scammer had access to the bank account, we’d need to make sure he didn’t initiate a wire transfer which is not subject to jail.

I think a reversal is different than stopping a pending ACH. Once the ACH is processed you’re fucked and the bank is not going to help other than in the limits circumstances listed (since if the merchant won’t give back the funds, the bank is on the hook). But if the ACH has not been processed I think your bank will stop it per the article I posted.

https://twitter.com/boredapeyc/status/1518590210686308354?s=21&t=k6uMHqo_-HUz3a66LOkIYA

This seems less than ideal?

Standard day in the NFT world. The land mint isn’t until Saturday the scammers could have probably made way more if they waited until then.

These girls are way more convincing than some people itt

https://twitter.com/tiktokinvestors/status/1518738660128034817?s=21&t=0HBvYO83VQ7o_M_EiUjiYg

Also the guy might give the girls a hundred bucks but he’s never giving them a bitcoin. Smart!