Tbf currency is meant to be a medium of exchange, not a store of value. Inflation is a feature not a bug.

Yeah and I said I’d stop doing that and since then I’ve just asked legitimate questions on things I am curious about.

Also again - I take huge issue with the idea that I came in here just randomly insulting people. What I did was ask specifically what is there to prop up the asset if/when it goes into freefall - which is an important question one should always ask in these spots. And then in the process of that discussion, I might bring up past manias as a specific response to what I considered a nonsense argument along the lines of “yeah but my X keeps going up”.

And then at some point in the middle of that exchange others jump in and get all bent out of shape. And then the next 20 posts by me are just replies and defending myself.

One more time for the record: I am very impressed with what you guys have done. I know many have made a ton of money, dwarfing my little stonk gains. I’m fascinated with the whole enterprise.

To be very clear I’m not remotely bent out of shape. I do think it is a very confusing area of finance. The reason you get the responses you do is because you come in trying to dick punch the genre as a whole and people aren’t offended, they think your viewpoints are ignorant, which they are.

The other part is you have literal experts here (i am not a top level expert there are lots of people who know more than me) who you completely dismiss rather than try and understand how they have made their fortunes. Saying well I am very impressed and want to understand is a complete cop out when your posting history is that this is a sham/tulip mania/dotcom bubble/etc.

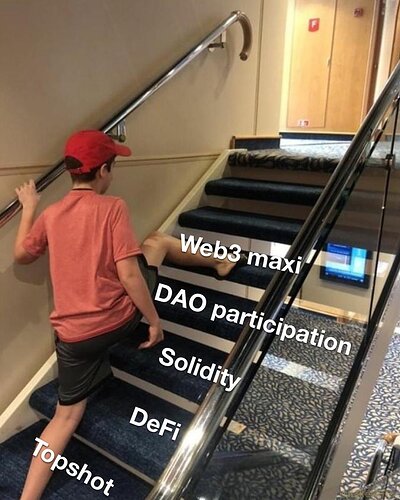

I guess the sticking point for me is that all the experts here all seem to be saying that the key to making money is getting in early, flipping, and moving on to the next hot thing. Calling it a “bubble” is taboo, but the players are all acting as though they’re riding a series of boom/bust markets.

Tell me you don’t get it without telling me you don’t get it

And? Like who really cares whether it’s a “bubble” or whatever? Literally 8 figures of wealth has been created in like 6 months and you think anyone involved cares about the fucking nuance of the word to describe it?

It’s almost like buying up all the Ninetendo Wiis in 20xx and selling them for 4x was smart even though it was a bubble. How in the world do you not get it yet?

Of course that would be smart. No one is saying you guys aren’t making extremely smart moves here. I’m quite sure I’d get cleaned out playing the NFT game. Like you say, who cares if it was a bubble or whatever?

I feel like we’re just talking past each other. I think we basically agree there’s a ton of irrationality-priced stuff in the crypto sphere that blows up and fizzles and also that smart people can take advantage of this and make crazy money flipping NFTs.

There is always irrational shit happening everywhere though. And it’s smart to take advantage of it right?

Like I agree cartoon apes are dumb. Does it matter? Not really.

Well we gotta argue about something.

But seriously tho, I’m on the sidelines cheering you guys on hoping you make all kinds of money from ape jpgs.

That’s your characterization. I don’t agree with it at all. I’ve asked tons of questions itt. I’m not dismissing anyone’s answers.

Unless they’re of the “yeah but I made a $bazillion” or “you don’t get it old man, you should just defer to the experts on this one” variety. What am I supposed to with those?

I do have a few more questions:

-

If someone buys a BAYC from me on opensea for $2.3M the fee is uncapped whatever %. Who pays that? Does it come off the sale price the seller gets, or is it added to the price the buyer pays, or other?

-

Does all this money go to opensea?

-

Whats to stop someone from making the sale on the side then just transferring the NFT for nothing? Trust between the parties?

Anyone have any insight into the economics of crypto mining?

Specifically, how much of the cost is energy?

Plenty of markets are looking at negative energy prices in the daytime for the next few years. Would it make sense for crypto to run there? Or are the capital costs so high you need close to 24 hour utilisation?

it’s a smart contract, the site fees and yacht club fees are uncapped and get taken in the same transaction that sends it to the buyer. fees come out of the seller’s cut

Energy intensive mining is on the way out. Most of the newer chains don’t do it, Ethereum soon won’t, and Bitcoin is already 90% mined.

Edit: BTW, even though BTC is 90% mined, the rate of mining is decreasing, so as things stand mining is expected to continue for ages. I’ve seen estimates of 2140 for last BTC mined.

Yeah, I’m not entirely sure when it stops being practical though. I’ve read that somewhere around 99% it just becomes too difficult to be worth the effort

It’s a hard pill to swallow but it also needs to be said that this forum BADLY misread the global market in the first half of 2020 and anyone who traded on the advice of consensus here got absolutely rekt, so the crypto nerds that gtfo’ed and aped into the madness the earliest have as much of a right to be cynical as the haters who think the spy ponzi is any different from the crypto ponzi.

Isnt mining required in order for BTC to change hands? I thought it was part of the system.

Currently, yes. I’m not really sure what happens when mining difficulty approaches the absurd. Something something exchange fees is what I’ve heard. I’m sure the maxi’s have some convoluted solution in mind, because simply moving over to any one of the many, many blockchains that have already solved Bitcoin’s inherent flaws is unacceptable to them for some dumb reason.