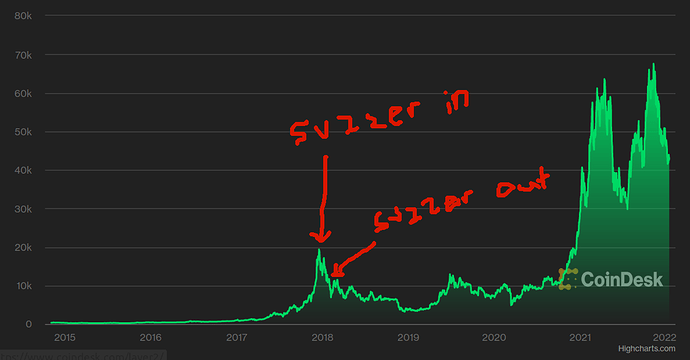

It’s nonsensical. You could call anything a “local top” picking arbitrary time windows like that. Looking at my Coinbase history, I sold about 30 bitcoins “at the local top” for a grand total of about $20k. Just completely meaningless.

Years on either side is a local top. I never said “I’m going to make the all time BTC top”. I said “I’m going to make BTC tank”, which I did in a big way.

your best efforts turned a potentially excellent investment into a loss. it’s annoying to read you lecture us about investing as if you’re better at it than we are

That’s you putting words in my mouth. I’m completely impressed with what you guys are doing and have no doubt some of you have made assloads at it. I’ve said that multiple times.

I’m just saying what I think is going to ultimately happen based on living through a couple crazy bubbles and reading about a bunch more.

We go through this weird arc where someone takes issue with me saying it’s a bubble, then I reply, then a bunch of people jump in and get mad, then by the end everyone is like “well yeah duh it’s a bubble, but we’re just having fun and making money”. Which literally I have never once said is a bad thing or not possible.

what’s the name of that cnn (maybe?) guy who always say how btc is going to crash and its the worst for like 10 years? i’ve been imagining suzzer as him for the entire thread.

edit - peter schiff

Yeah Schiff is the stopped clock. Funny thing is he was in the dotcom bubble and the housing bubble too. Pumping gold and giving people terrible advice forever, then briefly right, and then wrong again, then briefly right again, then wrong ever since.

Ultimately he may be proved right that the US money printer is a giant house of cards, hopefully after he and I are both dead.

Your posting in this thread just seems incredibly one-note and repetitive. I can see how crypto fans would find you annoying.

It’d be like me going into a travel thread and saying that I don’t see the value in travel because I end up with nothing tangible except for whatever souvenirs I purchase and I could have gained the same information from reading and looking at pictures.

It’s only that because people keep needling me and I keep replying. I made like one post today and the rest is 100% replies.

This was everything that started it. Just me taking partial issue with the word investment. I even allowed I could be wrong. I just wanted to point out that not everyone universally thinks of crypto as an investment.

Not sure why everyone has to get so rustled by a post like that.

And then by the end of all the runaround we have a bunch of posters saying “yeah of course it’s a bubble, just have fun” and no one really pushing back on them. Personally I don’t think a bubble and an investment can be true for the same asset. Maybe others have a different view.

I guess I did use some loaded terms. I’ll try to not be a pain in the ass for a while.

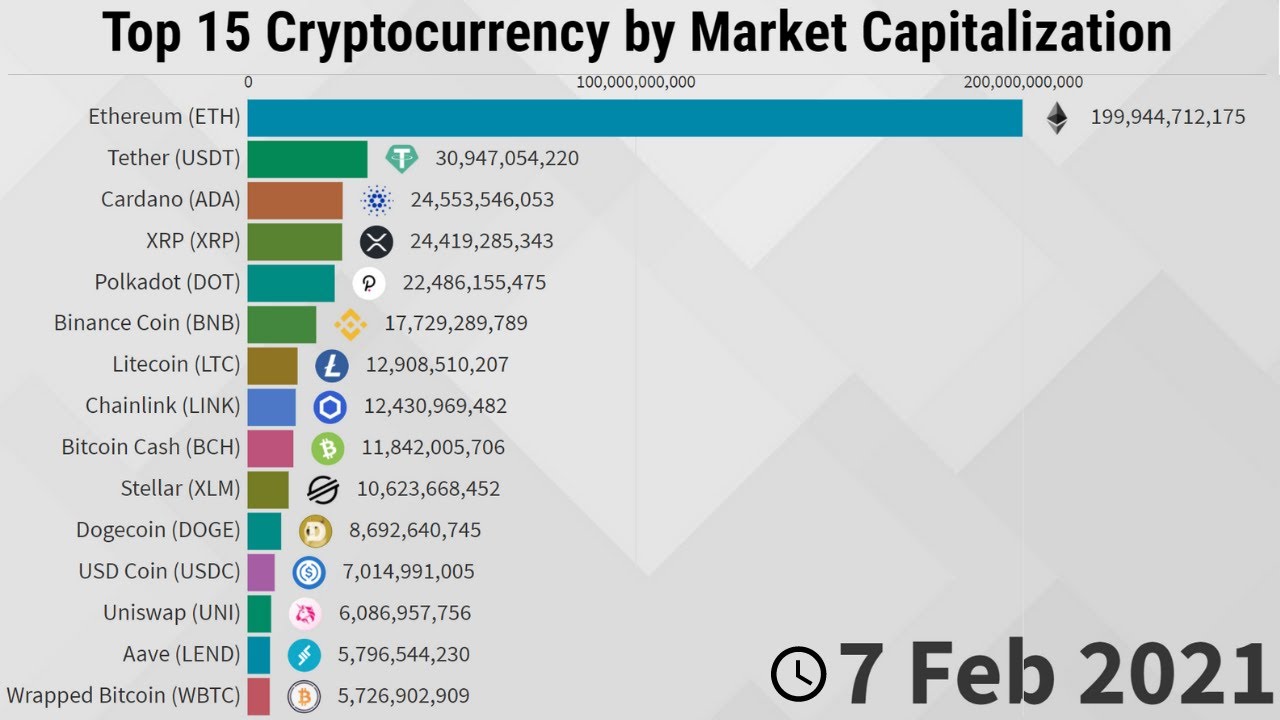

You need time and effort if you’re buying the less popular coins because those go in and out of popularity every year or so. Holding and forgetting about those is probably not a great idea.

See this video to understand why:

Bitcoin not plotted because it’s always been #1 and would make the scaling look weird

Sure the relative positions on those change a lot. But they all seem to have significantly increased market cap over the period.

Assuming that market cap is a rough proxy for price. Wouldn’t buying and holding any of the top 3 at pretty much any point in that video have given significant return?

One legitimate question I have, not trying to stir up shit, how opaque is the NFT market? Obviously with BTC and ETH I can instantly see the price.

For NFTs, I can see what the last bored ape sold for. But I don’t know those aren’t the same person trading across two accounts, or two buddies making a swap to make the price look huge, right?

I guess in the discord you would know if the only big sales are suspect and people start talking about dropping the price? Is there any other way to tell if the market is moving up or down?

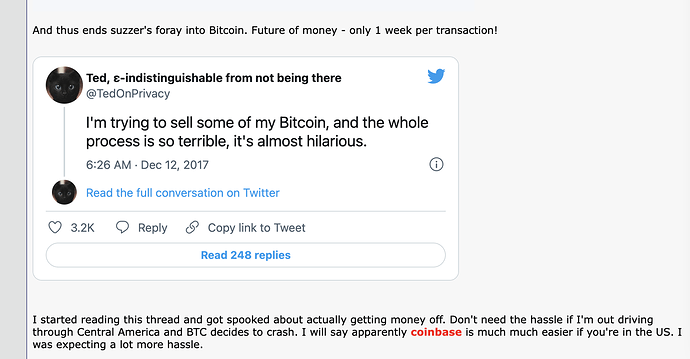

Yeah IDK dude maybe let this one go, I don’t have any $ this stuff right now but I think its awesome most people here who are putting in the time are making at least some money and will just let them do their thing and occasionally post memes from @CoinersTakingLs twitter because they’re hilarious.

Maybe another way to look at it is almost certainly is only the smallest number of people who have put money into this entire concept have lost money in it over the course it being around for ten years.

I’m just trying to understand how NFT price discovery works. Like I can see that Bored Ape #8585 sold for $2.3M 3 months ago (or whatever ETH was worth then). But he highest bid I currently see is $16k.

Clearly he’s not selling it for $16k. But it seems like the only way to find out what he would actually sell it for is to actually buy it?

I’m just trying to make sure I have that right and there isn’t some other public price discovery method. Like ebay buy it now or something.

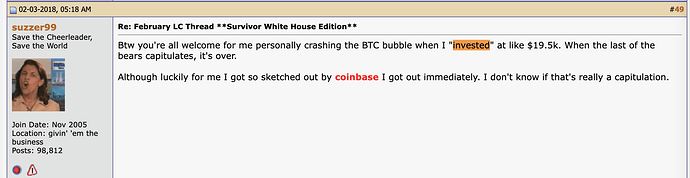

You didn’t cause anything. You bought in here and immediately panic sold for a loss. Isn’t that the exact thing you’ve been lecturing everyone about? I don’t understand why you’d ever bring up value investing if this is your approach. Value investing gets you to those giant green mountains at least.

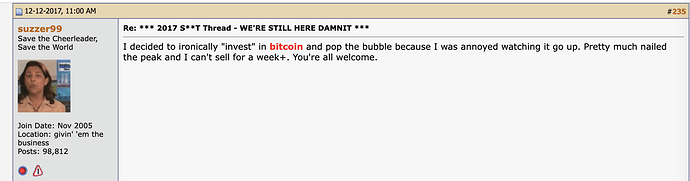

Can we stop? I agreed to stop. Go find the posts where I bought in. There was no panic. I was doing it mostly as a joke and always planned to sell the second it fell at all. I was never doing anything remotely like value investing. Also I was curious to see how painful the coinbase cash out process was because I didn’t trust them at all (turns out it was very easy). Dammit. Ok now I’m stopping.

Edit ok found some posts:

bidding is more prevalent in slow periods. lately bayc is pumping and people aren’t accepting offers, they’re listing high and getting sales. importantly, there isn’t an easy way to send global offers across a 10,000-piece collection on opensea. looksrare, the new platform trying to make a name for itself, has this feature so i imagine the offers are on there

if an ape sells for a bit over what we’d expect it to go for, it’s almost always a celebrity or famously rich person buying in on one they vibe with, not really trying to get the best price.

the idea that the big nft sales are faked is an urban legend. it can happen, but they’re paying uncapped 2.5% fees to opensea so it’s not like people can do it with impunity

i think the person who sold that ape is Matt Kalish who is also the CEO of draftkings. which is pretty insane considering the amount of activity on his account (unless he is not @kalish but i’m pretty sure he is).

dude is putting more hours than imjosh and he runs a multi billion corporation (into the ground perhaps)

Thanks - yeah it seems like unlikely someone would pay that much to pump something.

Is that the highest known sale for an ape?