Seen several different websites (including Paypal affiliated ones…??) that ask for your banking login for faster authentication. As I was typing my banking username into this legit looking website I shook my head and realized wtf was I doing. Never using any. I imagine providing my banking info to ANYONE likely violates some sort of TOS I signed and would also leave me SOL if someone used it to access my funds.

This is a genuine question and not a snarky thing: as bitcoin pulls money from the traditional economy (e.g., stocks), what’s to stop governments from regulating it as a counterattack? Am I wrong in assuming there’s considerable risk there?

- A government could shut down exchanges or even make holding illegal but it would be very hard/impossible to enforce and they can’t shut down the network.

- Taking this action legitimizes BTC as a threat to the current financial system and could have unknown consequences. For example, this could cause loss of faith in the stock market or the government/USD in general. You could also easily make the argument that this would actually increase BTC’s true value, and this opens the door for other countries/networks to take action in support of BTC in response. Blocking yourself off from this growing global market puts yourself at a competitive disadvantage.

- Rich and powerful people who are embracing it are getting richer and more powerful. Allowing bitcoin to grow under a watchful eye while collecting as much tax as possible from it is the less risky option than taking action against it.

Tax effects kick in at the moment you sell the crypto for fiat (at least in US tax law.) You compare the value at the moment you purchased vs the moment you sell to determine the tax burden.

Any crypto conversion is also taxable. If you buy 2 BTC then you use 1 BTC to purchase Ethereum using the BTC/ETH market, you realize taxable gains/losses on the difference in price for 1BTC when you bought vs when you executed the trade for Ethereum

Most dont I would assume.

For those that do, a spreadsheet goes a long way. Note the date and the amount you bought and the rate you bought it at. When you use that coin to exchange back to fiat or make a purchase note the amount you spent or exchanged and the rate it was done at.

I’m not an expert on taxes for crypto, but I assume it will work similarly to inventory. You’ll need to choose a method of recognizing the gains/loses, either first in/first out, Last in/first out, or Highest in/First out.

This is a pretty good article on the process for determining which to use.

Cryptotrader.tax/blog/cryptocurrency-tax-calculations-fifo-and-lifo-costing-methods-explained

https://bitcoin.tax/ is what i’ve used in the past

these guys can import the trade history from basically all the major exchanges, and then export to a file readable by your tax filing software.

Coming back to this, ICON has been looking super solid recently, with lots of stuff going on. Also I’ve almost recouped my initial 2018 investment. I stake my ICX on their new app and submitted some feedback/bug reports, and as a reward I received $ICX 50 ($90 at the current rate) this morning. Pretty cool.

This is not true. Mining is too centralised these days and actually trivial to interrupt if China, US and the EU agree bitcoin is a thread. Miners are too easy to find and their network connections interrupted making it not financial viable to mine. They are never going to agree or even bother though. Enforcing KYC and AML laws and governments just take part of the profits everyone is making by taxing it. Bitcoin is not a threat, it is just another place to put money and there is plenty of money to go around.

While true that a combined force of nation states combined could attempt a 51% attack that is different from shutting down the network.

For an idea of how unrealistic this would currently be to actually attempt it would require the production of approximately ~1.4 million new ASIC chips, far below the current capacity of leading manufacturers.

Withstanding governmental attacks was one of my biggest fears when first investing into BTC, but I no longer view it as a significant threat. Agree with this article’s conclusion:

"Ultimately, attempting to destroy trust in Bitcoin through a mining attack with physical hashrate just doesn’t make sense anymore, and it hasn’t for years.* Nation states who view Bitcoin as a threat are far more likely to over-regulate or (try to) ban its use than to spend billions of taxpayer dollars on mining hardware and power."*

Why would nations states want to shut down Bitcoin? Seems like a weird bit of libertarian paranoia.

Well, bitcoin purists certainly view it at as a direct threat/competitor to the USD. I think the incentives for the US government to quench threats to its currency are obvious–although as I’ve stated many times I have hope that both currencies can coexist peacefully for quite a while.

There are also a lot of people who are currently or were recently involved in government who come from the crypto space. Biden’s current nomination to head the SEC for instance, Gary Gensler, taught a 12-week crypto course at MIT in 2018 and has testified before congress about cryptocurrency multiple times. This gives me added confidence that there are no imminent plans from the US to significantly attempt to slow bitcoin’s growth.

Not how you shut down the bitcoin network as a nation state. Miners need to communicate to each other and do that all at the same time every time a block is found. If you have thousands of small miners like originally envisioned then a nation state can’t do much about this. With concentrated mining it is trivial to mess with these communications as a nation state making mining a risky business as your income is then no longer predictable based on your hash power.

Again have to stress this is all theoretical. In practice nation states only care about bitcoins anonymity and they can force that to disappear over time pretty easily which these days won’t impact its price much or its potential.

Yeah, you’re not wrong Edc, don’t be mistaken by thinking I was offering a rebuttal. The fact that I took a quick 2x of a relatively small position and missed out on 5x should be one proof of that. Making a swing trade is different from backing up the truck and hodling.

In addition to learning about what you’re investing in, I think basic education about reading a graph is necessary. I don’t mean technical analysis, I just mean literally not planting your flag here:

I have a friend who always says “bitcoin is up 8%” or “bitcoin is down 4%” and I always mess with him by asking “up 8%/down 4% from what?”

That’s all really just a long version of saying “don’t FOMO for the love of God”.

In terms of specifically Fantom and similar projects, I think it’s fine if it’s on Binance, if we just want to establish a super generic rule and baseline. Right now the equivalent to getting “super burned by altcoins and ico’s in 2017/18” is… Well, lol ICOs still but to a way lesser degree, but mainly smaller projects on small and disreputable exchanges and especially the deFI exchanges.

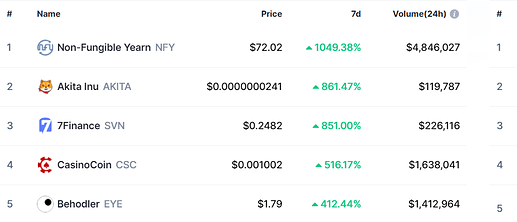

Like, we could open up coinmarketcap and see the biggest 7d gainers,

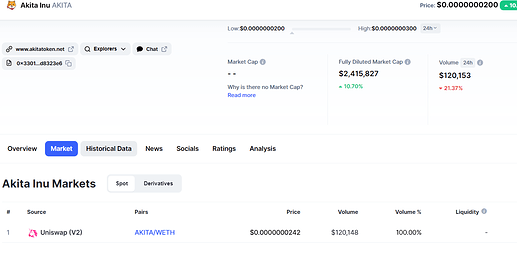

click on the dog coin, see this,

and be like, uh, nah. But some people will look and say fuck yeah, that’s where I’m gonna park my kids’ college fund. And some people will make a lot of money but a lot of people will lose and get scammed, and that’s not ‘scam’ as in how we use ‘ponzi’ or pyramid’ very imprecisely when we mean something speculative that might lose us money, but actual scams.

Etc. Compared to that relatively, shoving on Fantom is like CDs or savings bonds.

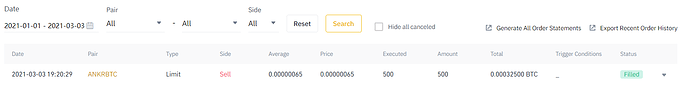

That’s 15000 trades just on the newest binance account, wtf.

Anyone have experience using Bancor, Uniswap, or other DeFi platform to stake your crypto?

I just tried staking some crypto on Bancor, but the Eth gas fee was insane, like over $100.

Is this normal?

Never mind. I found the answer to my own question, and the answer is yes.

BTC 50k again, working hard thank you!