I took all my LTC off CB and put it all into my Litecoin wallet to do what I set out to do initially, which was to ship it to Bovada to play games of chance etc. Did you know that if you accept one of the “bonuses” you can’t withdraw your maneys until you make that bet attached to it? Anyway be aware of that because it seems notable.

Thanks for reminding me to buy the dip.

crypto was going to zero until we got this news back to BULL TRAIN

is he wrong? i have no idea about these stuff

I’m surprised the House bill didn’t address this! It’s absolutely a no-no for stonx (30 days before and after the sale).

Crypto is Uber to NYSE’s Yellow Cab

Clarifying that it’s not “illegal” at least I don’t think it is, you just can’t claim the loss deduction iirc

An otherwise blameless crypto trader

Legal or not, it’s obviously price manipulation. And if you’re not the one doing the manipulation, you’re the one getting cheated by it.

I’d have to be convinced that wash sale trades in and of themselves are “obvious price manipulation” absent some type of corresponding collusion. I mean you’d potentially be outlawing day trading altogether if you made the practice illegal generally, right?

Like say I buy a hundred shares of whateverthefk.com at 9:10 am. By noon the stock tanks so I dump it. At 3:45, I get (non insider) information that scientists at whateverthefk.com have discovered a cure for cancer. Why shouldn’t I be allowed to re-purchase shares? Just because I was unlucky that morning? Seems wrong iyam.

I get and am fine with not being able to deduct my loss from the earlier trade.

I doubt a single trade like that would raise many eyebrows.

When it becomes a pattern, specifically one that IRS attention is called to dud to not claiming taxes through these dump schemes over and over… thats where you got a problem.

Dont fuck with the IRS. They are fairly incompetent, but if you get somebody looking at your returns that knows what they are doing, you can be in a world of hurt.

Except that’s not at all what happens. What is actually happens is you have say two accounts, or a partner. You buy XYZ stock or token or whatever at 1 in account A… You sell it to account B at 1.05. Then B to A at 1.10. Then A to B at 1.15. Then etc until someone else notices the price rising and buys it all from you at 2 or whatever.

According to Cornell, 70% of crypto trading volume is wash trades.

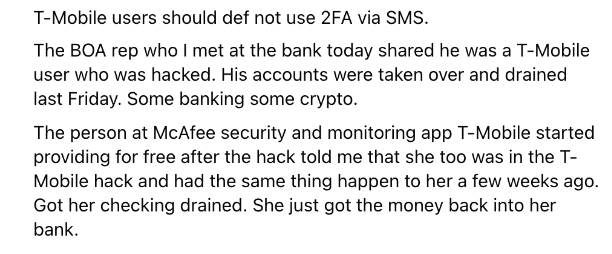

Anyone with a crypto account and t-mobile - be careful out there. Targeted attacks from the hack in August are happening now. Seems like they’re going after people with crypto wallets on sites like coinbase. They call T-mobile, armed with all your hacked information including PIN, and switch your phone over to a new SIM, then reset your bank and coinbase passwords.

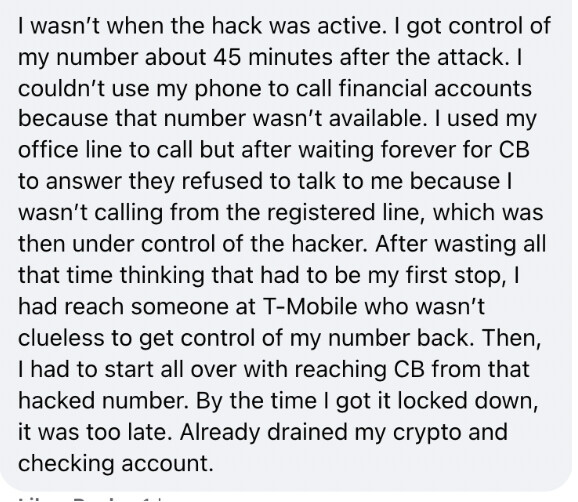

This is from a friend of mine:

He’s confusing 2FA with recovery phone.

I just logged onto T-mobile and not once in all their “beefed up security, here’s what you can do” blather did they suggest changing my PIN. Assholes.

Also how the hell does coinbase and bofa not have some setting like “hey how about we don’t let the account be drained seconds after a password reset”. The whole system is just fucked. They should all have a hack line you can call that just stops anything from happening until they can figure out what’s going on.

Also there are other types of attacks where they don’t steal your whole phone number, just your SMS, and the company who facilitates it doesnt’ even send you a text to confirm - which is possible because capitalism and reasons.

Well switching your phone to a new SIM is supposed to be hard and there are regulations involved. But apparently even after the hack, T-mobile doesn’t make it hard enough.

But hijacking just your SMS, as in the article, is a different animal with zero regulation.

Basically from comments on hackernews and elsewhere - SMS should never be used for anything security related. I just removed recovery phone from several accounts. Going with alternate email instead.

Why would you think that you couldn’t do that? And if you couldn’t, the irs is just going to force your to pay accordingly to the correct cost basis. The horror. The irs isnt going to go after 50 million robinhood crypto wash trades beyond just sending out 50 million cp notices asking for correct cost basis. You still have the right to just pay what you owe.

What you posted here is the exact point I was trying to illustrate, but somehow it reads like you are disagreeing with me

I didn’t really read the thread and read yours as maybe a question that people were worried about.

For coinbase for sure. Unfortunately banks have a nasty habit of requiring SMS as a recovery contact. 2FA is useless if all it takes is one text to reset your password.

Also for real coinbase - how hard would it be to not let an account be completely drained seconds after a password reset? Maybe cool off for a few hours just in case a hack is in progress? At least offer that as an optional security setting?

Or have a panic line that temporarily shuts down withdrawals on an account for a bit - with some reasonable verification that the person calling is probably the owner of the account.

no problems like this with ledger or trezor