https://twitter.com/TheOnion/status/1451567789228138501?t=aFeoWXm3ZD2hBaUFIW30Cg&s=19

Heres a question about bitcoin, maybe better about the whole crypto market but lets stick with bitcoin for ease here.

Obviously those who got in early have 836393xed there money, but there is no realistic way thats possible now right?

Isnt 3x at this point an insane, near impossible valuation? Is there any real way for bitcoin to hit 180K?

Yes and no. Cryptos have no intrinsic value and their only use cases are facilitating crimes and scams. It’s pump and dump upon pump and dump, ponzis all the way down.

So yeah, 3x current valuation is simultaneously insanely high and nowhere near as high as it can go.

Bitcoin will likely hit $1M within our lifetimes.

Bitxoin would be 500-600k if it reaches gold’s market cap.

far more likely bitcoin gets replaced as the top crypto than this

As long as US money printer keeps going brrr there’s no limit to how much 1 bitcoin can be worth in terms of USD. You’re comparing a ~deflationary asset vs an inflationary currency.

3x seems insane but as mentioned previously that still only puts it to 1/3 of the market cap of gold. Def not impossible. Meanwhile, equities are purely speculatively priced as well currently. Tesla is an almost 1 billion market cap. Can it 3x from here? Can the stonk market 3x from here? As long as people keep buying these things they can keep going up.

Would you feel the same way about crypto/nfts if everything you bought couldn’t be sold for 5-10 years? You’ve done very well flipping, but your habits also don’t quite apply a long term confidence in anything.

I have different views on NFTs/Crypto

NFTs I view as a more short-medium term play (1-3 years), that very well could evolve somewhat into a longer term position, but ultimately a lot of the flips I’ve done in NFT have been with the goal of accumulating more $$ to just put into ETFs or Bitcoin. NFT I view more as ‘art/collectible’ and I don’t think it makes sense to have a large portion of net worth tied up in art/collectible.

I have a very long-term view on crypto. A decent chunk of the cryptos I first purchased in 2017 I haven’t sold (I sold some for the first time this year at 33k and 46k). I’ve also been continuing to buy since then. I’ve held through 90% drops and 1000% gains. I view crypto (specifically bitcoin/ethereum) like any other asset class. I keep a percentage in my portfolio and when I feel over-leveraged I sell some of it, or when I feel under-exposed I buy some of it. There is no plan to sell everything in some sort of a giant flip. Barring some sort of catastrophic event I’ll always be holding some BTC/ETH.

These comparisons might make sense if bitcoin had any utility or practical application, when in fact the inverse is true: it’s a massive energy and resource suck that produces literally nothing of value.

Only a narrow band of collectibles though. For example, I have a collection of somewhat rare/vintage musical instruments and antique furniture. My dad is into collectible cars. Some people collect typewriters. There isn’t really a way to replace those things digitally. We’re mostly talking about audio / video stuff that can be digitized in the NFT space.

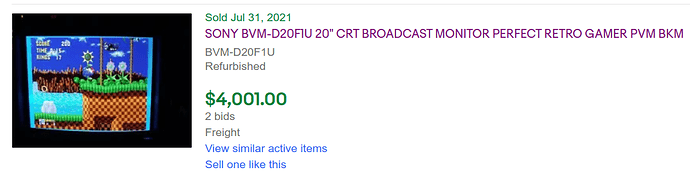

Also, digital collectibles are inextricably tied to the physical world because you need a medium to translate them into sensory experiences. Otherwise we are just talking about memory addresses and storage devices. It’s pretty easy to imagine how this could lead to the same types of problems facing physical collectibles. For example, the vintage/collectible gaming market has caused a run on professional video monitors to the point where the monitors have arguably become the bottlenecks. You can even emulate most of the gaming side of the chain but not the physical display.

I can envision a similar phenomenon with NFTs where you need to acquire some unobtanium piece of physical hardware to experience the best version of it. In other words, there must be some digital-to-analog conversion happening somewhere, otherwise you won’t be able to actually experience the thing at all. The gaming monitors are sort of weird because we assume newer = better for tech, but there’s a real effect here of needing period-correct hardware to render this stuff correctly. Similar thing with tube amplifiers costing a fortune despite some really good tube emulation existing as software that is entirely digital.

Ftfy. Seriously, though, as someone who traded on this space, it doesn’t bother you that the largest stablecoins are clearly not backed by anything? There is clearly much less fiat in the system than the total market cap. Maybe not precisely a Ponzi but certainly ponzi-ish.

Bitcoin is at 60k while a large portion of its use is for illegal dealings and for simple anon legal transactions while taking its toll on the environment. If bitcoin were to become more eco friendly or increase in the number of markets that accept bitcoin, the price will go up - all things equal.

There is an appetite for anon purchases coming from all levels of wealth and shit like the new IRS tax rules only spooks people more. I mean, everything is priced redic high and that is also playing into bitcoin rising but we could start seeing some info coming out on bitcoin that justified its last runup - but not many would be very surprised of all the shit starts crumbling down.

shib is gonna be the #1 crypto isn’t it

I think it’s overlooked just how much the entire market plays a role in the price of btc. The drops of early and late 2018 coincided somewhat with the market falling to a lesser degree. Now the market has gained 7% in the last 3 weeks and both are back at all times highs.

Lol

It’s coming, right behind personal jetpacks for everyone.

Yeah, I don’t really disagree with that.