What the fuck

:max_bytes(150000):strip_icc()/Leveraged-etf_final-ae26f0241574443cb9a81ab9e6819834.png)

Leveraged ETFs: The Potential for Big Gains—and Bigger Losses

A leveraged exchange traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.

What the fuck

It just sounds like he’s predicting a Chicago Bulls championship

Since there is some spillover between crypto and the meme stocks, for those in the audience still holding a soft spot for AMC for w/e reason, you could wrestle with the idea of getting back in it to gamble. There is some promising AI speculation going on that has, at least to some degree, pushed up cinemark as a result and maybe a little of AMC.

You knows if it will come to fruition, but you’d be definitely getting in before most of the idiots.

Nope. Made my bank heist and they’re never getting it back.

I do own some CNK though.

I dont know much about AI, but the mcrib surge is coming with the Scottie bump

https://x.com/internbrah/status/1847360009279340849?s=46&t=9mlgsGiCG4XHUHROXPQniQ

![]()

BTC has gone up ~5x since this post

I think its a bubble

Could be, but difference is that this time it’s not individual YOLO crypto nerds but rather, financial institutions, corporations (Microstrategy), and even governments that are behind the current buying spree.

Having looked at their press release

“Bitcoin yield” might be the dumbest fucking performance measure I’ve ever seen.

Yeah. They should just use the eventual 1million price in their performance nrs

i was joking

It doesn’t even relate to bitcoin price!

BTC Yield is a KPI that represents the percentage change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding.

Additionally, this KPI is not, and should not be understood as, an operating performance measure or a financial or liquidity measure. In particular, BTC Yield is not equivalent to “yield” in the traditional financial context. It is not a measure of the return on investment the Company’s shareholders may have achieved historically or can achieve in the future by purchasing stock of the Company, or a measure of income generated by the Company’s operations or its bitcoin holdings, return on investment on its bitcoin holdings, or any other similar financial measure of the performance of its business or assets.

https://x.com/Shauncore/status/1856205017268596859

Thankfully I follow this dude for sports takes not basic math. He’s arguing that given the same buying and selling price, you lose more money if the price of your BTC drops in the interim vs. just steadily climbing.

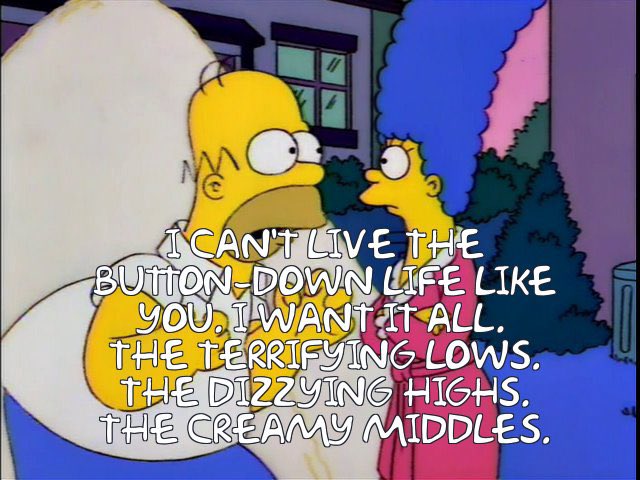

On the specific point that leveraged ETFs lose money if the price of the underlying asset fluctuates around a constant value, I believe he is correct. If the price of the underlying asset drops, the ETF manager needs to sell some of the underlying asset to maintain the proper leverage ratio. When the price recovers, the fund owns fewer units of the underlying and so you won’t get all of your money back. The reverse happens when the price fluctuates upward, again losing a small amount of money.

The section on the impact of daily resets in this article explains it:

:max_bytes(150000):strip_icc()/Leveraged-etf_final-ae26f0241574443cb9a81ab9e6819834.png)

A leveraged exchange traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.

This doesn’t apply to non-leveraged situations like just owning bitcoin though, that part was WTF.

We’re still early

https://twitter.com/ScottiePippen/status/1847437011109503083

he fucking tried to tell you all