Swongs are one thing

Higher

We love the bitcoin etf ![]()

So instead of just buying Bitcoin I can… buy a fund that tracks Bitcoin?

this is way, way easier for normies, in particular it opens up a lot of IRAs and 401ks where it’s cumbersome or impossible to buy arbitrary assets

Isn’t it more likely the market is illiquid and it craters when much of anything is sold? An ETF wouldn’t move the needle.

I also don’t think anyone gaf about it at this point who isn’t already in the space. Who’s the new blood?

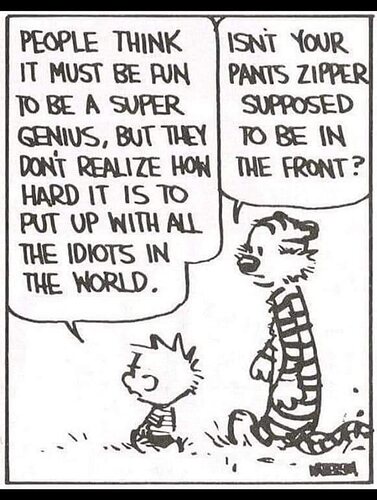

Letting people too dumb to buy Bitcoin load their 401ks full of Bitcoin ETFs seems like not the best idea imo.

I think from here a lot hinges on how seriously these firms want to shill bitcoin as a “flight to quality”. Larry Fink was talking big leading up to this and i imagine he’ll continue and probably go harder now that he gets a % on buys. Pension funds, personal retirement accounts are gonna be allocating some % and that’s gonna push up demand consistently every month as supply gets cut in half this year and cut in half again 4 years from now.

It’s going up forever

it does if you’re holding bitcoin.

Looks like Vanguard isn’t going to let people do it through their brokerage accounts.

I already thought that privatizing Social Security and allowing everyone to manage their own retirement account was a terrible idea, but if you asked me how to make that idea even worse, allowing more and more “exotic” investments inside 401ks and IRAs would be it.

Can still borrow against your 401k and invest that way imo.

so what’s the difference between any of the 11 etfs? just the fees? security? if Coinbase who is the custodian for most of the funds gets hacked would your money in the etf be at risk or is it insured now? are they all guaranteed to track bitcoin exactly or can they trade above/below par value?

I feel like speculating, so here are my uninformed opinions/guesses:

ETFs will differ in terms of:

- Fees

- Liquidity

- Security

Are coins at risk?

- Yes, it seems that cryptocurrency will not be insured by SIPC the way that cash and securities are, because bitcoin is not a security (or cash)

- Of course funds could privately insure the bitcoin, but the premiums would increase the ETF’s fee

Will the ETF’s price track bitcoin exactly?

- They should track the price of bitcoin within a rounding error, since each ETF will have authorized participants who both create and redeem shares of the ETF. This is the process by which normal stock ETFs mirror the net values of the stocks within those ETFs.

Bitcoin supply as relevant to ETF and price has nothing to with mining rewards. This is one of the most annoying narratives around bitcoin. Supply like with any other asset is based on the amount of people willing to sell at the current price. This mostly depends on peoples expectation of asset performance compared to other assets.

Coinbase argued against classifying cryptocurrencies as securities by saying that the digital coins are like Beanie Babies, more akin to collectibles than stakes in a company.

Coinbase has asked the court to dismiss the Securities and Exchange Commission’s lawsuit alleging the largest US crypto exchange is flouting its rules and selling unregistered securities.