Was this before or after you watched the noel diary?

Props, you called it, it was quite a green week for GME and AMC, greener than can be attributed to SPY being green. Usually the apes telegraph the bounces with some kind of hype, but to me this one was relatively spontaneous.

Given where I shorted, even a week like that doesn’t make me sweat at all (whereas someone who shorted on Monday might be nervous). Timing the dead cat bounces like you would still be preferable, but I don’t attempt that without being pretty sure of them, partly because there might not be shares available when I wanna reshort.

Congrats on the NVAX short, that ticker was never on my radar. Was it a meme, or more in the covid bubble category like ZM?

Look i like crypto and have used it and owned it as an investment … this statement seems crazy to me who would do something like this? Just typing out those words must scream something is wrong.

Tell us how you did it

Wait, so your private keys actually are stored on the wallet, and only weakly encrypted? What are we even doing here?

Did what?

Ok, so this is wonderful.

https://twitter.com/FTAlphaville/status/1615050447718420481?s=20&t=oSphG1I5kWqr0v7EVtp1YQ

I think my favorite part is the description of the founding team:

Su Zhu looks super pissed, presumably because “3AC went bust in 2022”.

Bottom line: GTX is the new FTX. Because G comes after F.

Zumbledebongbong! Vamble! Vamble!

The private key is contained on a hardware security module on which the computation for signing transactions and so forth is carried out. PIN guess limits are enforced by this chip. So the private key is stored on the chip, but there is no way to get the chip to divulge it.

These things are not easy to get into. By way of example, here is an article about a researcher from hardware wallet company Ledger demonstrating an attack against a chip with lasers at a hacking conference. If someone with the resources of a large company or a nation-state is absolutely determined to pwn you, they may well eventually get into the device, although they could easily accidentally destroy it first. Under normal circumstances, if your wallet is stolen, unless they randomly guess your PIN they have no chance of getting into the device before you go get your seed phrase and move the assets elsewhere.

Didn’t expect to wake up today to some of the loudest critics of crypto ITT taking a beginners’ crash course on “What Makes Crypto Crypto.”

oh duh, it’s fake

i didn’t notice when i looked at it earlier

i am intrigued tell me more about these bryptoz

It would save everyone a lot of time if Matt Levine columns were just auto-posted here. Until then, here’s the best part of today’s:

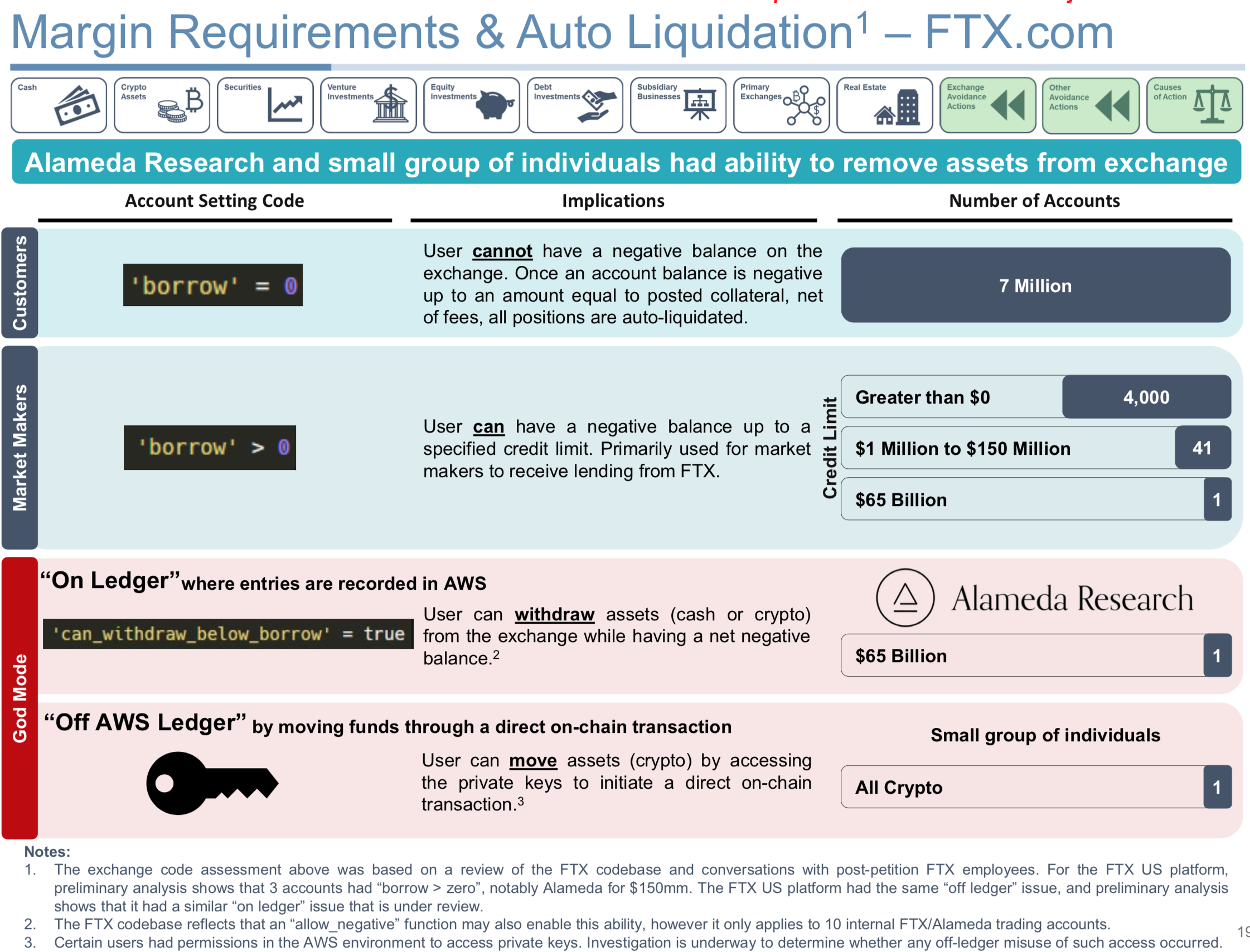

Yesterday FTX “announced that their top level management and advisors met with the members of and advisors to the Official Committee of Unsecured Creditors” to give the creditors an update on what they have found. Here is the update, [5] prepared by FTX’s advisers (Alvarez & Marsal, Sullivan & Cromwell and Perella Weinberg Partners), which covers both recoveries and explanation. I want to start with the explanation part. The basic explanation of what went wrong at FTX is that FTX loaned billions of dollars to Alameda Research, a trading firm founded and mostly owned by Bankman-Fried. Alameda lost the money, rendering FTX insolvent. And now FTX’s advisers say that they “have uncovered the mechanics behind how Alameda Research had the ability to borrow without collateral effectively unlimited amounts from customers and how a small group of individuals had the ability [to] remove digital assets from the exchange without being recorded on the exchange ledger.”

That discussion is on slide 19:

If you were a normal customer at FTX, you were not allowed to have a negative balance in your account. If you put up $100 of money to buy $200 of crypto, and your crypto lost $50 of value, then your account balance was $50. If it lost another $50 of value, then your balance was $0 and you were liquidated. Your account could never be worth -$10; you got liquidated before that.

If you were a market maker on FTX, though, you were allowed to have a negative balance: Effectively, FTX would lend you the money so you could open a position without depositing the money first, or have the market move against you without instant liquidation. In FTX’s code, most accounts had a “borrow” flag set to zero, meaning that they could not have negative balances, but some 4,000 accounts had the borrow flag set to some positive number, meaning that FTX would lend them the money up to some credit limit. Of those 4,000 accounts, 41 had credit limits of $1 million to $150 million. One — Alameda — had a higher limit. Alameda’s limit was $65 billion. (Slide 18 shows a code snippet, showing that the actual limit was $65,355,999,994.) “FTX will allow Alameda to have a negative balance of up to $65 billion” is functionally equivalent to “Alameda can use as much of FTX’s customer money as it wants.”

There was another flag in the code, though, “can_withdraw_below_borrow.” The “borrow” flag determines how negative your account can be and keep trading: If your borrow flag is set to $10 million, and you put on some trades and they move against you and you end up with a balance of negative $5 million, then you can keep the trades on. But if you went to FTX and tried to cash out $4 million to spend on groceries — giving you a total balance of negative $9 million, still within your credit limit — FTX wouldn’t give you the money. You could use your credit limit to trade on FTX, but not to take out cash. “No, you still owe us $5 million, pay us that first, we’re not letting you take any cash out before you pay us what you owe,” FTX would quite reasonably say. Unless you had the “can_withdraw_below_borrow” flag set to “true.” Then FTX would say “sure, here’s the money.”

One account had that flag set, says the presentation: Alameda. To the tune of $65 billion. Setting the borrow flag to $65 billion and the can_withdraw_below_borrow flag to true is functionally equivalent to “Alameda can take as much of FTX’s customer money as it wants, remove it from the exchange, and spend it on whatever.” (Slides 16 and 17 give you a sense of what “whatever” meant, including $253 million of Bahamas real estate — including $12.9 million for “The Conch Shack”??? — and $93 million of political donations.)

The presentation describes this setting as “God Mode,” [6] which I am not sure is a technical term found in FTX’s actual codebase or documentation, but you get the idea. FTX built a video game for other people to trade crypto, but FTX — or rather its affiliate Alameda — had a cheat code. Everyone else got to trade crypto, and if they made money, they could take out the money that they made. Alameda got to trade crypto, and it got to take out as much money as it wanted, whether or not it made money. It was playing in God Mode.

Fortune favors the God Mode

I have yet to solve my lack of access to Levine columns problem, so keep posting em.

If he had a substack I’d subscribe, but I ain’t paying for Bloomberg.

The daily email just links me to his blurred out column on Bloomberg with an $180/yr sub offer. I’ve tried to use archive.ph, but the column usually isn’t up yet.

Bloomberg is great, idk how I lived without it