Thanks for the reminder that I need to move some money out of my slow moving regional bank that has a 0.1% rate right now over to my digital bank (Wealthfront) which moves quickly and is at 4.3%.

The rate is temporary and simply adjusts with the fed lending rate. If they start dropping the overnight lending rate then these APYs adjust downward with it. About the only real difference I’ve noticed is that some banks are quicker than others at adjusting.

You can just buy a short term government bond mutual fund in your IRA. It’ll yield a little higher and I think you can get into funds with a maximum duration of like three or six months so the interest rate risk is quite low.

Yeah and then even though interest rates are high, the price of the bond fund still drops because they aren’t heading the right direction. Or something. Bonds are painful.

This is really only an issue for longer term bonds. Its why SVB got wrecked backing short term promised with long term assets, when interest rates go up the market value of long term bonds plummets, the value of mid term bonds goes down a little, and short term bonds barely move.

So I have $10k free in my fidelity brokerage account that’s just sitting there doing nothing. What fund should I buy?

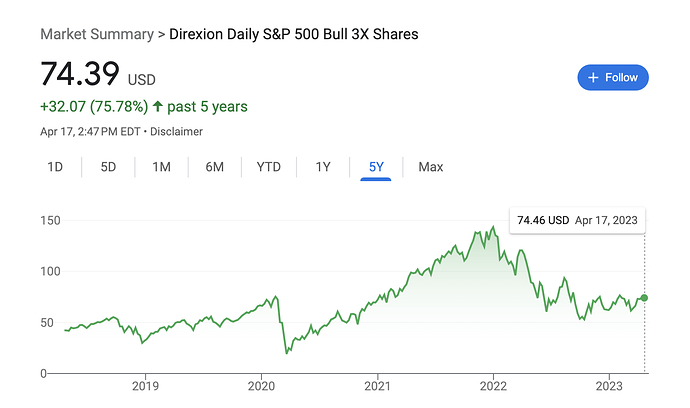

SPXL

*this is not financial advice

You could go up to one year bond funds and still not get much risk.

Ok, please explain to me like I’m 5 years old how this level of variance is anything like getting 4.15% in a savings account.

Buy boring ass treasuries through the fixed income drop down.

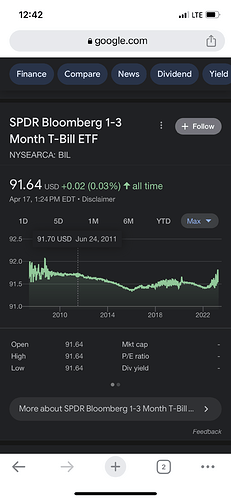

Funds are for suckers with 1 yr rates at 4.8%

Are treasuries a guaranteed 4%, or am I at the whims of the underlying price of the treasuries?

Don’t buy bond funds (basically bets on rate movements), but actual bonds (to get the yield).

Do I want treasury bills, notes or bonds?

you would not be getting 4% for the entirety of that chart until the last six months?

Right. Which is the opposite of what I want. I want a savings account that gives me 4%. Bonds are never not incredibly confusing.

I’m not positive, but I think so. I know when I upload a paper, there’s an initial period when the submission is under review (and unavailable to the public). But I have no idea what’s involved in that review, and I don’t think I’ve ever been contacted by SSRN with questions about any submission. Based on this guy’s submission, it’s hard to believe that there’s any serious review going on, other than “Was this paper written by someone who appears to be familiar with the English language at a high school level or above?”

He’s joking

There’s no difference, you have the same exact interest rate risk if you buy individual bonds. Just because the individual bond you buy isn’t marked to market in real time like a fund doesn’t mean you’re getting rid of the risk.

With individual bonds or funds, the longer the duration, the more the interest rate risk. T bills or the t bill fund I mentioned above will have the least risk.

i’m saying there were no savings account for that time period that would give you 4%. i think we all want it, but the environment is such that you don’t usually get 4% with low rates.