Agreed, which is why I am so skeptical of the we wont go into recession takes. Game is rigged, if job market doesnt crack rates just go higher.

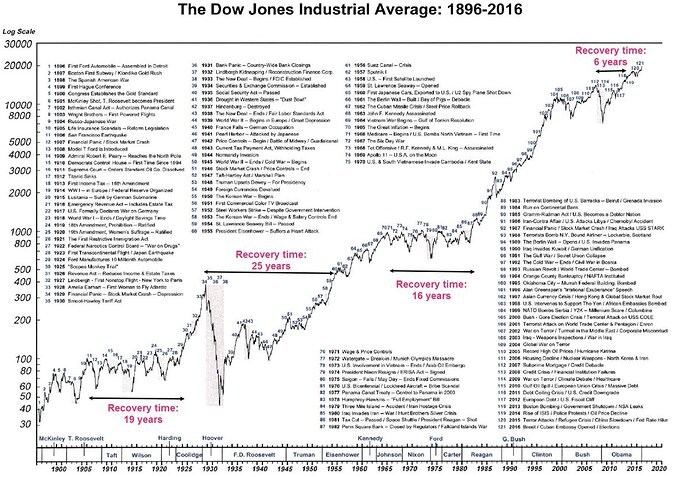

The 6 years recovery time seems off, or it seems like a technicality that we broke the 2001 high briefly in 2007 before having the second crash and breaking it again in 2013. It was really like a 12-13 year recovery from 2001 peak to 2013.

I think there’s a good argument that the dot com bubble burst and the Fed, having learned the lessons of the 1930s, went to low interest rates and then the housing bubble and bust were the market reaction to banks and investors searching for yield in a low interest rate environment.

All true, also the absolute worst catastrophe on that chart in the last 1920s happened when stock markets and securities marketing were basically unregulated. As loltastic as capital markets are now, people forget how insanely out of control the speculative “investing” behavior of people was in the 1920s when the whole universe of common shares were traded like memo stocks.

the entire market would regularly swing 10-15% in one day - now we go crazy over a 3-4% swing

It might be also interesting to review the chart adjusted for inflation. According to this chart we were (on an inflation adjusted basis) still below the 1929 peak in 1991! We had crossed a few times but always dropped back.

It was an absolutely crazy time, people have kind of forgotten about the underlying human behavior and just focus on the DJIA movements. But in the 1920s stock brokers were lending people money so that they could by common shares. It was common for people to put up their existing shares as collateral to borrow money directly from their stock broker to buy more shares. It was inevitable that eventually a drop in stock prices would trigger a runaway margin call to crush retail investors. All the rules that are in place now about securities sales and marketing and leverage accounts weren’t just invented for the fun of it, brokers and advisors will drive terrible retail investing behavior in the absence of regulation.

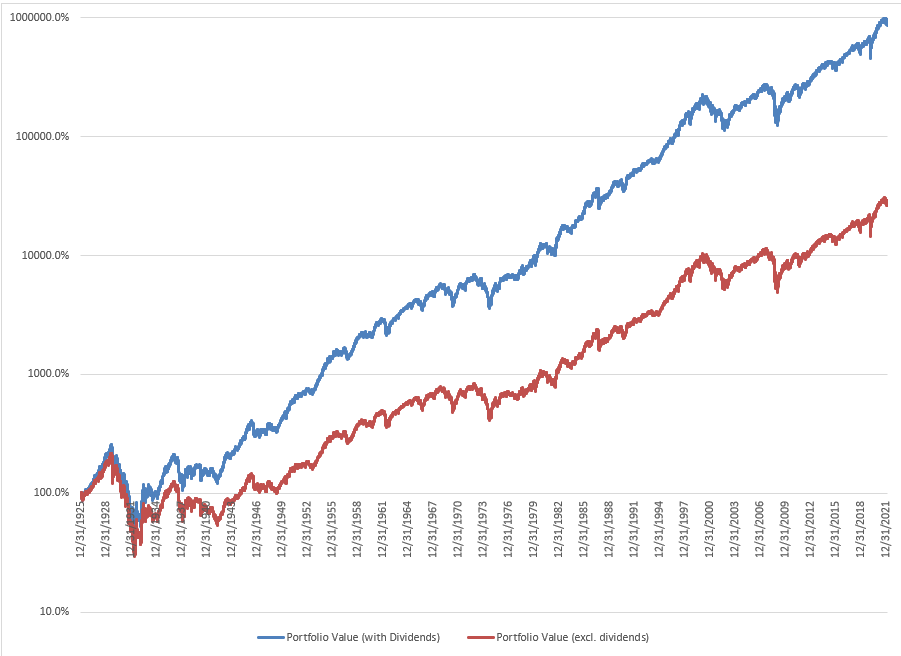

Here’s the best available data for the overall US market since 1926. It really illustrates the effect of dividends (blue line includes them, red line does not, and bear in mind this is also a log scale):

So if you look at that 25 year recovery time during the Great Depression, that’s really biased by dividends. If you include dividends, that recovery period goes to less than 16 years (roughly September 1929 to January 1945 if I’m eyeballing it right).

And dividends were much higher in olden times than today. Probably not as much stock buybacks and maybe other factors as well.

Only losers invest in companies that pay dividends nowadays, gimme companies that lose money on every sale IMO.

Not sure how reliable a measure of economic health. But my linkedin has been full of “made redundant for the first time ever. Looking for my next exciting opportunity” posts for a month.

Friend of mine just got laid off from Pandora sales after working there 7.5 years.

Probably old news to folks here, but I just heard about this company RCI Hospitality Holdings (RICK). It is a publicly traded holding company for strip clubs. +13.68% on the year, +43% over last 12 months. Perhaps an inflation hedge?

I worked in a shop on Lake City Way kitty corner from Rick’s in 1991-92. The owners were straight up mobsters, but the people watching opportunities were unparalleled.

One other trend that may be influencing this is that LinkedIn’s performative fake enthusiasm seems to have spilled over to announcing that you’ve lost your job. One of Canada’s tech darlings is the robo advisor company Wealthsimple and when they downsized this year LinkedIn was flooded with posts from laid off workers just gushing about how empathetic and supportive Wealthsimple was when they were, you know, firing them to improve profits for shareholders. It’s good to know that Wealthsimple isn’t a mean company that fires people, they’re a Progressive Company that treats people The Right Way when staff are kicked to the curb.

So, payrolls are up and unemployment is down. So stocks gonna go down because this means Fed can continue to raise rates. Of course, if payrolls went down, then stocks would go down also. Feels rigged.

Not great. Fed needs more pain!

Beatings will continue until morale improves.

As long as it keeps growing!