Yeah I’m ok with a business doing that. Like if I’m going to lose my job because upper management fucked up some key risk, I would be pissed if my previous years bonus was also pulled back.

Every bank pays bonuses in march, complete non story, also you’re going to have to pony up to keep employees working for an insolvent bank.

We get our bonuses in January.

So insane for a company to go bankrupt and lose everything because they had a savings account at the wrong bank. I never thought about it before but why doesn’t the government/private markets offer some kind of insurance on such an event?

You would have to be insane to keep your money in any bank that isn’t too big to fail right now with the current news.

Doesn’t Apple have a fuck-ton of cash? Where are they keeping all that money? A Scrooge McDuck vault on Tim Apple’s yacht?

They famously held most of their cash overseas a few years back, Trump was trying to bully them into bringing it back to the US. Having money in European banks is SOCIALISM!

Doubt anybody is going to lose everything, I would expect most companies are going to get at least 90c on the dollar back. It’s not an ftx situation where they just literally stole all the money

You are insured up to $250k, so it only affects the rich and businesses.

I feel some sympathy for businesses that kept working capital at the bank, but if you were keeping hundreds of millions at a bank, you knew there was risk of bank failure and could have just kept the money in something that isn’t at risk if the bank fails (like T-bills or a money market fund).

THAT’S SOCIALISM!

Hmm … this is complicated. I decline to get drawn into to a time consuming analysis of their balance sheet but I thought they got wrecked on long bonds when interest rates increased. They may not have stolen a lot of money, but my understanding is that the withdrawals forced them to sell long bonds at a loss. So people won’t get all their money back if their assets are less than their liabilities. Was your 90c on the dollar a real estimate of this or just an illustration?

The 90c was mostly just a guess - I did see on Levine the average duration of the bonds was around 6 years which doesn’t seem crazy long. I think it was just over half their assets in bonds so the calculation would roughly be whatever % the market value of these bonds dropped * 1/2

This oversimplifies the mechanics of how you lose money, and I recommend Marc Rubinstein’s explanation today. Basically SVB ended up with a large portfolio of held-to-maturity bonds with an average duration of 6.2 years at the end of 2022, “and unrealised losses snowballed, from nothing in June 2021, to $16 billion by September 2022.” These losses “completely subsumed the $11.8 billion of tangible common equity that supported the bank’s balance sheet,” meaning that SVB was technically insolvent. But mark-to-market losses on held-to-maturity bonds don’t count for bank accounting purposes; the theory is that you will just hold the bonds until maturity, they will pay back par, and you won’t have any losses. So SVB was still solvent and fine. “Sell even a single bond out of an HTM portfolio, however, and the entire portfolio would need to be re-marked accordingly”: If you have bonds in your held-to-maturity portfolio, you have to be really confident you can hold them to maturity. SVB’s bonds kept maturing, providing cash to pay out depositors who wanted their money back. But: “What neither the CEO nor the CFO anticipated, however, was that deposits might run off faster” than the bonds. They did, SVB sold its available-for-sale bonds, it wasn’t enough, and here we are.

The reason the companies will likely get 100% the FDICs normal drill is to find another bank to buy the failed bank who usually pays enough to cover the depositors.

Sounds like the problem with SVB was a lack of diversity.

the people making any of the important decisions at SVB was a very diverse group of older white males.

I was referring to their allocation

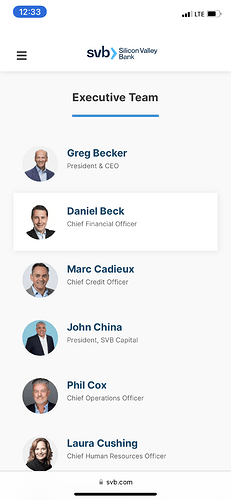

Wow just noticed their presidents name was John China. If he had been named John America, and had they hated gay people a little bit more, they may just have survived.

Yeah but come on, one of the guys’ names is John CHINA, so he’s obviously a diversity hire.

I do admit there seems to be a stunning lack of diversity between Greg Becker and Daniel Beck

Apparently it was founded by Bill Biggerstaff. I can’t help but think they would have avoided all this trouble if the reins were handed over to a member of the Biggeststaff family.

Phil Cox sounds like a Bill Biggerstaff hire to me. He must have predated Becker