https://twitter.com/InternetHippo/status/1634368719227895808?t=exgGHQ3aFuTPpDWRse41mg&s=19

Same email I just received because I have a molecule of some shitcoin left that they won’t let me convert to Bitcoin but yup

Fun! Fact!

There are five (I think?) states which have an ethics requirement as part of their CPA examination (s) and California is one of them! ![]()

I’m on PTO but had to check my startup’s slack and apparently we are impacted by this SVB stuff. However, I guess our money is in a custodial account which isn’t on the bank’s balance sheets, whatever that means. My googling lead to children’s accounts and I didn’t dig further.I guess I’ll know for sure on the 14th or 15th when payroll hits.

I would bet it’s a money market account, which is a deposit product, not a MMMF. If Fidelity goes under, they should just be custodying your assets and you should get them back in full because you’re not a creditor, you’re the owner. If the MMMF itself went under, then you’d be out of luck, except the Fed wouldn’t let that happen.

What was the motivation for these companies to bank with SVB instead of Chase - Citi - BoA?

Chase - Citi - BoA wouldn’t waste their time with the companies when they were startups w/ a handful of employees then some combination of inertia/loyalty/specialized services when the companies got bigger.

I’m no CFO but I’d I assume almost every big corp has hundreds of millions in uninsured bank accounts.

I think that even large banks have divisions serving small companies and start ups. The fees may have been high.

I am speculating, but I am guessing that another factor is that tech company decision makers are true believers about their supposed “innovation” and “disruption” and they would never in a million years choose to bank with boring old Wall Street bank full of people wearing suits when they can literally choose the one called Silicon Valley Bank where the CFO probably wears crocs to work and cooking up entirely new data driven digital ways to go bankrupt.

My thinking was that guys like Peter Thiel and Sam Altman or the investing VCs (eg Sequoia) were all using this bank due to connections and recommend it to the founders

They all used the same bank because it gave them cheap loans that no other bank would

They all used the same bank because it gave them cheap loans that no other bank would

everything that I have read about this situation indicates that this is wrong

They didn’t need loans, they had VC cash.

Sorry the VCs gave them cheap loans in exchange for using their VC bank. The entire industry bet was that interest rates would never go up.

When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off. Your clients who were “obtaining liquidity through liquidity events, such as IPOs, secondary offerings, SPAC fundraising, venture capital investments, acquisitions and other fundraising activities” stop doing that. Your customers keep taking money out of the bank to pay rent and salaries, but they stop depositing new money.

The VCs gave them cash in exchange for equity. I’m pretty sure it’s just like founders want to focus on their product and their customers and ask guys like Sequoia or Thiel what’s the easiest way to run the rest of their business.

From the bank’s perspective you have the problem right but I don’t think that explains the startup’s behaviors. Any bank would take deposits, that’s like a core part of their business and the money is fungible.

I wouldn’t be too confident if i had my money in any small bank right now.

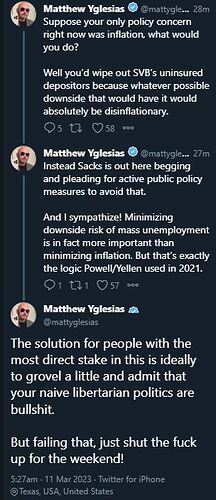

Tech bros are assholes but effects of saying every depositor for themselves clearly and obviously result in a 2008 financial crisis or worse.

Banks hold treasury bonds as a relatively safe asset, some banks bet on long term treasuries instead of short term treasuries, stupid bet their execs/investors deserve to be wiped out for but very subtle difference to vast majority of depositors-> Fed flips policy on a dime that makes those bonds suffer lose massive paper losses-> bank runs everywhere force massive liquidations that turn those paper losses into real losses-> everybody panics and contagion!

Yeah, fair to say the Fed orchestrated an economic collapse in this scenario.