I take weird pleasure in people being mad at their advisors, who absolutely deserve every bit of rage but not for the reason the customer thinks.

Some comments on HackerNews caught my eye.

I work for a fortune 50 company - (not faang), on our team we had 2 openings posted back in early November - one for a developer, one for a lead developer (same tech stack) - this was for a fully remote positions, but limited to timezones that mostly overlapped with the USA - we got 3 applicants for the lead, 4 for the non-lead positions and hired from that pool.

Mid Jan we got the OK for two more developers (also 100% remote, the same tech stack and same total comp as above), we got over 330 resumes to weed thru this time - with lots of ex-faang and other big name tech companies folks applying, whereas we never saw resumes from those companies before.

Its good for us of course, but I feel bad for anyone who needs a job quickly - there is an awful lot of competition for not as many openings

Last summer and also before that, when I applied, I would get ~90% response rate and would have at least a call from recruiter/HM. Last week I sent a bunch of applications and crickets… this is something that I’ve never experienced in +10 years being in the industry. I’m not in dire need for a job but I can imagine how much,much stressful is to be unemployed now vs even 3-5 years ago.

Sounds like bullshit? A fortune 50 company was only getting 4 job applicants for developer roles? These are companies like IBM, Wells Fargo, etc.

A fortune 50 company will have their own internal recruiters reviewing resumes. his claim that he is weeding through hundreds of resumes doesn’t pass the smell test.

Got a new hat from a data provider:

I showed my (arguably volatile) wife and she, earnestly, was like, “Did you get that so that you could show the world how much you love me?”

“hot inflation report” = not stonks

I Bonds about to be so hot again

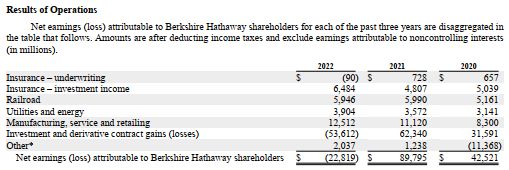

Buffett letter is out. He seems a little mad!

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).

Very brief letter this year, which is a little disappointing. But I’m choosing to focus on this line, given Buffett’s history of being incredibly understated with respect to results:

Berkshire had a good year in 2022.

Looks like I’m gonna become even more concentrated in BRK!

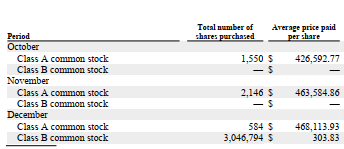

Edit: Recent repurchasing activity:

A total of $2.85 billion over the last 3 months, with the largest portion of that in December, at prices slightly higher than current.

LOL GAAP. Get this unrealized gain/loss shit out of net income. Please.

Is it really GAAP and marking investments to market that is bad, or just that it is unusual for a corporation to own a billions of common stocks of other publicly traded corporations? I really don’t see the problem with the way it works.

BRK could release a pro forma income statement showing only operating income alongside the GAAP version, but Warren is probably the loudest critic of earnings manipulation by other companies so it might appear hypocritical

Marking investments to market is good. Running the unrealized gains and losses through the income statement is bad. The old standard with marked to market balance sheets combined with unrealized gains and losses accumulated in other comprehensive income (plus impairment assessments) was perfectly fine.

What could go wrong?

Fun fact - the inevitable catastrophe that results when people use stocks as collateral for loans was one of the factors that led to the development of securities regulation in the 20th century.

I’m pretty ignorant when it comes to most things finance related. What happens when you use Amazon stock as collateral and the stock price drops?

depends on the agreement with the lender, most likely the lender is SOL, but one might have to provide more collateral or see a rise in their loan rate.

From the article -

"To protect itself from a continued slide in Amazon’s stock price, Better.com will charge a higher rate on the mortgages of employees pledging stock—between 0.25 and 2.5 percentage points above the market rate, depending on how the down payment is structured, the company said.

However, unlike in stock-based loans that carry the risk of margin calls, requiring borrowers put up more collateral or sell assets to reduce debts, Amazon employees’ loan arrangements would be protected if the stock price slides, Better.com Chief Executive Vishal Garg said in an interview."

I guess if you really don’t want to sell your Amazon stock it could be worth it, but probably better just to sell and not have to pay a higher interest rate.