Hope they didn’t start buying the shares back at the peak

MSFT has outperformed the S&P500 since the peak of the tech bubble

Which one

When people say NASDAQ is at an all-time high, how often is that number they’re using inflation-adjusted? 0%? 100%?

It’s not, but also the indices don’t include dividends either which probably outpaces inflation on the s&p 500, dow, but probably not the nasdaq off the top of my head.

Counterpoint: still has a $3.6B market cap

0

I don’t think he would be able to cash out much without sending the stock price to under 1$.

The only buyers at this point are shorts covering and taking profit.

Honestly I think it’s plausible that people are buying it to pick up the sweet 25% lending rate (assuming your broker passes that through to you.)

Not financial advice!

Wheeeeeeee look how high I’m jumping from

In keeping with tradition, senior management will fight it out in the parking lot to anoint a successor.

I will never understand days like today. What happened at 10:45am?

Stonks

Rydell High’s “Most Likely to be Fun at Parties” Jamie Lannister Dimon has more words to say

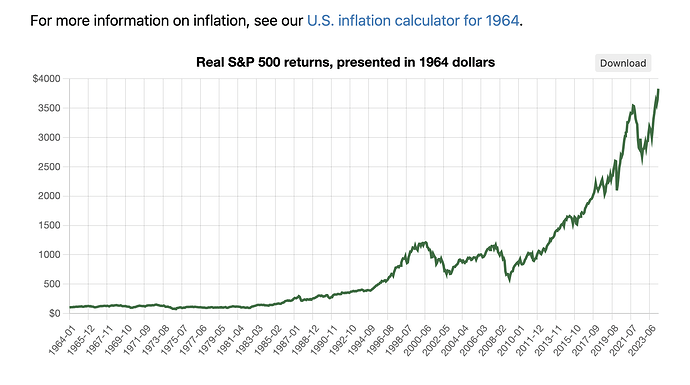

Well the stonks market has basically gone straight up since 1994, with a few minor hiccups. Whereas if you look at the 30 year period before that, it kind of sucked.

I guess it quadrupled from 1964 to 1994. But it non-upled (9x) since then.

So it would seem really normal to have a gigantic pullback that lasts a decade or two following this multi-generational bull run.

Of course at the first minor setback, this country will go full fascism.

So we’re gonna ditch the internet?

he’s been saying that once a month for the past 10 years

heres the exact same article from 2023

and another one from 2022