Not to jinx it, but at the rate we’re going, the Kamala Krash might instead be Harris taking the stage this week with the S&P at an all-time high.

LOL

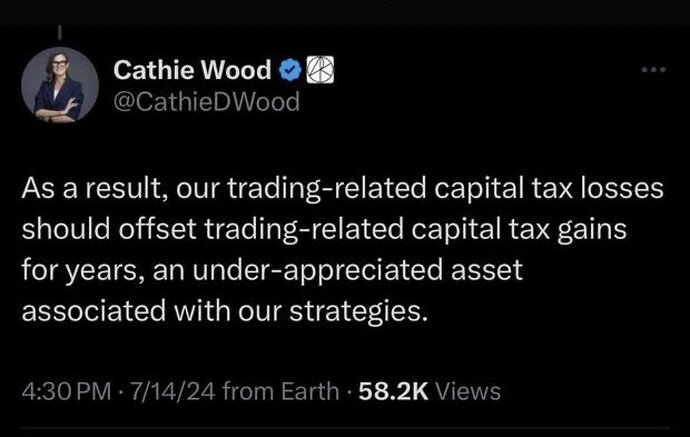

If this copium was a champagne it would be Dom Perignon

I have seen two different ARKK traders on Bloomberg and CNBC in the past couple of months. Both of them were dressed like they just came from the set of ‘Little House on the Prarie’

It feels like we could all make a nice, comfortable living in perpetuity by just buying META every time it hits $480

and selling it when it hits $530

Haven’t had the chance to post in a while, but I just got an email and needed to vent. I’ve never felt so betrayed.

We are going to look back on this Nvidia mania with absolute astonishment.

Profit of $17b on $30b revenue!

So, the stock is up after earnings right?

Do you even stonk bro?

All I keep seeing is what an unbelievable beat they had, yet stock is fine 5% after hours.

I usually doubt retail moves a stock but there were lots of folks all in on options … maybe a beat just idnt good enough when everyone is betting big on a beat?

The numbers were excellent, but the vibes were like way, way off which is much more important to serious finance people like myself.

Nvidia doing buybacks is…an interesting choice.

Wow, first I’ve heard, that’s incredible.

Simultaneously signaling that they cannot productively invest excess cash to grow their business and that they think 2.89 Trillion market cap is undervaluing their business.

Eh. Buyback is just the most tax efficient way to return $ to shareholders.

umm a company trading at 70 times earnings should be at the “invest all excess cash into growth” stage, not the “return capital to shareholders in the most tax efficient way” stage.

And these companies seem to always buy back at sky high valuations and then not have cash when hard times hit and the share price drops

points at the taco bell sign

Why?

Because high P/E ratio in theory signals high expected growth and therefore a high internal rate of return on capital