AMZN absolutely welded to 180-185 range for 2 weeks. Did Bezos say the n word?

idk but the Dow needs to just fade away into boomer memory at this point. It’s not in any way a reflection of “the market” and stocks with higher prices have much greater effect on the index than ones with lower prices, irrespective of the market cap of the individual companies, so even if the entire “market” was the Dow, the Dow index would still be skewed toward higher-priced stocks rather than larger companies.

AVGO massively crushed earnings, announced 10:1 split

Massively crushed is generous. They had small beats on rev and earnings, not unusual as analyst always underestimate those numbers. They guided up full year revenue by a whopping 2% from 50 billion to 51 billion.

The large bump in share price came from the increase in AI spend. Something like 2.8 billion which was up considerably higher from the prior quarter. It was the AI business that off set the weakening in there other business .

It seems ridiculous that a projected 2% increase in full year future revenue is worth 100 billion dollars in market cap. Oh yeah they announced a stock split. And there you go, bubble gets bigger!!

https://www.wsj.com/finance/banking/wells-fargo-credit-card-rent-rewards-8e380852?mod=hp_lead_pos2

lol Wells Fargo

Don’t be a boglehead.

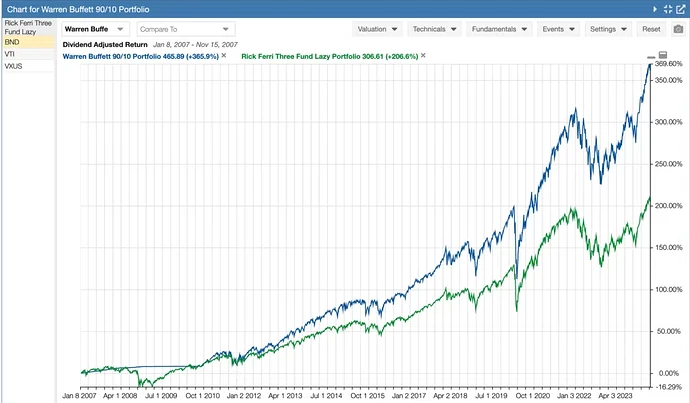

Warren Buffett’s “boring” retirement mix of 90% S&P and 10% short-term bonds crushes it every time

Also a good argument (with receipts) on why foreign stonks just drag your portfolio down over time.

Damn I am probably overinvested in international. It was originally for diversification and hedging against full dependence on the country where I live and work but based on that it definitely wasn’t worth it. And if we go down everyone else is probably going down too.

Yeah this is pretty much it. No other exchange will survive a collapse of ours.

It’s certainly possible that what happened over the last 15 years, will not happen over the next 15, no? Or 30? International certainly hasn’t performed great recently.

Yes, it is dangerous to assume past trends continue in the future. Here is what I know as a consumer of institutional asset management information as part of my job:

Argument for overweight in the US: Europe and Japan have even worse demographic headwinds to corporate earnings than the US; European regulatory environment is not as friendly to investors; the US government is uniquely predisposed to crush pesky workers and boost corporate earnings with their policy decisions.

Argument for agnostic weightt o the US: Everyone knows everything above so it is already priced in.

I have clothes I still wear that are older than the timeline on this graph.

This doesn’t seem like a compelling argument to me, other than “US over the last 40 years, scoreboard”. This isn’t bonds vs. stocks, where you’re looking at two different asset classes that should have predictably different returns. There’s no theoretical reason why US stocks should outperform International. If anything, the theory would say that the US has a relatively strong legal system and rigorous disclosure requirements, and therefore warrants a lower required rate of return than most other countries. That low required rate of return translates to higher current prices, but lower future returns. I can’t even come up with a theory that says the US is actually riskier than most other countries, and therefore has a higher required rate of return.

I mean, this is so simple that it almost sounds sarcastic, but I think it’s right.

I think I’m at around the market weighting of US vs. International (somewhere around 70/30 or 60/40). It hasn’t been great for returns, but I don’t regret it, just like I don’t regret not YOLOing QQQ the last several years.

I have no complaints about the long-term returns from both my emerging market ETFs and my IEFA (Europe plus first world economies in Asia and Far East),

compare them to SPY over the same time period

I think the main argument boils down to: on average, US domestic stocks outperform the world, ergo, your portfolio will perform better, on average, the more weight it has in domestic stocks. Obviously we don’t know what the future holds. but 40 years gives a good enough amount of data for me to agree with this conclusion.

I’ve had around 20% of my Roth holdings in LVHI for the past year. It’s given decent returns, plus a nice quarterly dividend. It would have done even better if they had bothered to include TSM. But it’s simply no match for the S&P/Nasdaq so I let them go. ETA I also don’t have to concern myself with exchange-rate fluctuations diddling with my returns. ymmv

ETA and NVDA is now the most valuable company in the world

This is–literally–begging the question. It’s assuming the conclusion that US stocks outperform the world. I don’t think there’s any sound theory underlying that assumption/conclusion. It’s equally true of Bitcoin.

Is the US government more corrupt than other First World governments so that domestic stocks are more likely to benefit from unethical government action to benefit corporations and, thus, stock prices?

Obviously we don’t know what the future holds, but 40 years gives a good enough amount of data for me to agree with this conclusion. probability theory and risk spreading is for losers.

YOLO

It could be as simple as “US companies take more risk”, so their expected returns are in fact higher but their risk adjusted returns are the same.

I realize it’s theoretically priced in, but the regulatory and legal environment is just so unbelievably favorable to US companies relative to the rest of the world. These firms just do whatever the fuck they want with zero fear.