No no it’s mismanagement, didn’t you read the tweet?

They are based out of Orlando and it’s been big news here the past week. PE fucked them for sure but the shrimp thing was the coup de grace. People around here shit on Darden, but RL quality and standards went down considerably in the years since it was spun off from Darden. Can’t remember the last time I went in one that was more than half full even before covid. It probably wasn’t smart to sell the biscuit mix in grocery stores because that’s the best thing they consistently served.

Some are better than others. The best ones are the ones who leave the owners alone and let them run shit.

Errr this, but unironically? Company run to the ground gets liquidated is what is supposed to happen?

Yes, that was a serious statement. We can differ on whether PEs running it to the ground while extracting any bit of value to enrich themselves is a good thing or not.

Few things have been fucked over more than medicine by PE

I believe it. Surely one of many things contributing to the shitshow that is American health care

Yeah in EM alone PE runs nearly a quarter of EM visits and they’re super aggressive about a lot of shit. Good news is that they aren’t doing well now that they can’t finance taking over group after group through cheap debt

The “above market rates” lease business is a tax play, not mismanagement. The real estate is owned by a REIT, which doesn’t pay taxes, so every dollar of rent reduces RL’s taxable income in a way that’s effectively tax-free to the recipient, so the incentive is to strip out as much cash flow in the form of rent as you can.

-

Isn’t RL paying no tax anyway as it’s not profitable?

-

Isn’t the actual PE play to sign shitty above market leases so the REIT buyer overpays and the PE firm can then distribute the sale proceeds to themselves?

-

Shouldn’t RL want (1-tax rate) in cash vs over paying in rent (losing 100% of the cash overpayment - only makes sense if they’re actual plan is #2 above)?

- Sure, but presumably that’s at least in part because they’re paying a bunch of rent. And the excess losses won’t disappear. If the underlying business still works, they can restructure the leases and the other debts, sell the business, and the future buyer can use the NOLs to avoid paying taxes on future income. Even back when I was in the game, future tax benefits were cash money to the seller, and I don’t think people have gotten less sophisticated about this.

- Yeah, that’s definitely part of the play too. A sale-leaseback is just a different strand of debt, so it’s all related. Of course, one of the reasons high leverage is common is because it’s also tax-efficient compared to equity…

- You’re having it both ways if you’re saying the leases are shitty for RL but also the REIT buyer is overpaying. The money’s not disappearing, and there’s actually more of it to go around because there’s less tax. Abstractly, the buyer of the restaurant business will pay less than they would absent the burdensome leases, and the buyer of the REIT will pay more. The PE fund wants to maximize A + B. In practice, the REIT rules only let you compute rent based on gross sales (not net profits), and a well-advised planner is probably more concerned about the business doing really well (and paying lots of tax) than the business doing poorly. If things go south, the leases can just get worked out, either in BK or outside of it. It’s not like the REIT wants to own 1000 Red Lobsters separate from Red Lobster IP that would let you actually operate them. But if the business goes gangbusters, you can’t strip out more rents, for both tax and practical reasons.

I assumed the above market leases were just a way to funnel all the money that was left to the owners and away from creditors.

Did y’all bag a big one on NVDA blowout earnings??

Also buy puts/short the shit out of $LYV

Assuming no change in administrations (big assumption I know) the DOJ is going after these assholes full throttle. Seems like a slam dunk, too. This will be the 2nd time Live Nation/Ticketmaster has been in the antitrust crosshairs. First time was under Obama. That time, they got basically a slap on the wrist, then promised not to do a bunch of things. Since then, they have Done All Of The Things that they were not supposed to do, so it looks like DOJ is not going to stop short of a full breakup.

My puts are already up $100 just today.

Had 1 share of it at 887 and was waiting for it to go up 10% before getting rid of it, 2 months later and does that in a day. Got out up 16% on it and then watched everything else in my portfolio go down…

Go buy another one and in June it will multiply into 10

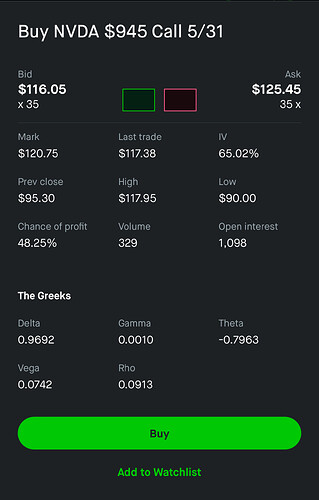

Oh I bought a single $945 call dated 5/31 for $48.50 pre-earnings. Held on despite it dropping over 50% at one point, but sold after earnings at the first sign of red on NVDA’s chart for $91.50. Not quite a bagger but great return.

Or so I thought. On Friday when the rest of the market was dying (see heat map previously posted) it closed over $1064. I logged on tonight and saw NVDA trading for $1114 at one point in overnight trading and is around $1100 now. In case you’ve not already done the math from above, the break even price for that option is $985.50. It doesn’t expire til 5/31, so I decided to take a look at what it’s trading at now, or at least what it was trading at on Friday when the market closed, option premiums do not update AH so this is based on $1064 not $1100: