AMC opened at 3.52, closed at 5.19 (+78.4%) on 478MM volume ![]()

It’s up to 6.42 AH

AMC opened at 3.52, closed at 5.19 (+78.4%) on 478MM volume ![]()

It’s up to 6.42 AH

AMC now 9.42, GME over 50

It’s so stupid both are up 100+% premarket.

As dumb as it is it’s nothing compared to DJT that is trading at 1500 times sales.

That’s ONE THOUSAND FIVE HUNDRED times sales!!strong text

It these prices hold to.markwt open you could have made a mint on call options. I fear what’s going on here is hedge funds getting out in front of retail who will become exit liquidity over the next few days.

All the memes I remember memeing

BB up 25% pm too

My Yahoo finance watchlist has a bunch of memestocks that I added back in peak COVID (around the same time I was becoming a very temporary expert in oil futures). One of them is KOSS, which I can’t for the life of me remember why it’s a memestock. It’s a low-grade headphone maker with a $40 million market cap. How did it land here?

(Up 38% yesterday and another 33% premarket today)

Where do these WSB people get all this money? Like aren’t they broke by definition?

PLUG and SPWR

Reddit users dropping some knowledge:

Anyone who replies “because DFV tweeted” has utterly no idea what’s going on. Reading replies like these are frustrating as hell… a tweet does not cause 170,000,000 shares to be purchased “by retail” on a single day. In fact if you look at the volatility and volume of the share for the week prior to yesterday (starting 34 days passed the March options expiry date) you can see the volume share to drastically increase.

The answer is, the real reason is not yet understood but there are a few theories which can explain it, or potentially a few things happening concert.

Working ideas are: XRT ETF failure to delivers are getting harder and harder to rollover and kick down the road. These have increased over the last 2 years.

Long term Basket swaps are expiring and this is a cyclical event, shorts never closed they covered, there’s a difference.

Inside buy back, this is due to some interesting screen shots from Bloomberg terminals.

Option gamma thesis; it was theorized that if the stock went to around $15.XX it would rocket to $36 because of option chaining. This happened last week into yesterday. Typically the upward momentum is stopped where the chain stops at (unless it’s an expiry date and the options are exercised) because there’s no calls for higher strikes. The calls contracts stopped at 36.00 strikes, until yesterday. today they will open more up at higher strikes. The share price will continue to rise if these are filled, likely capping at $55.00 per share on May 14th. This cycle should continue into early next week if new calls are opened and purchased as we approach the expiry date of Friday.

Every day that this continues makes my degree feel more and more worthless. The upside, though, is we get more Levine columns. So that’s nice.

A+

already halted

Nah, that sub has over 15MM members, all kinds of people are there, even serious investors and whales

GameHalt

If the calls were covered, isn’t that only a “loss” compared to what he would have made if he had held the stonk without selling the calls?

Yeah, from a cash standpoint he’s still ahead, unless he did something really dumb like selling at a strike that was below his cost basis. He will keep the premium he received for selling the CC’s, plus what he gets for selling the shares at the strike price of the CC’s once they get called away, 70k x $17 in this case. But he’s definitely punching air over the fact that if he’d just held on to his shares he’d be scrooge mcduck right now compared to what he got for that play.

ETA and who knows? maybe it plummets back down below $17 by the end of the week and he keeps the shares anyway.

I just learned something that blew my mind.

WMT is my largest single ROTH holding. Today I discovered that, just this year, sometime back in February, its stock price finally clawed its way back up to where it was before…the dot-com crash of 2000!!!

Almost as mindblowing: INTC still has not gotten back to where it was in 2000:

Those are adjusted for splits obv

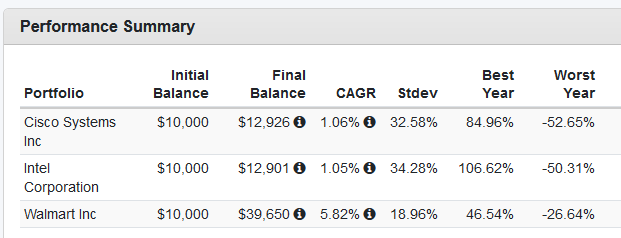

This must be ignoring dividends. If I look at returns from 1/1/2000-now for WMT, INTC, and CSCO (which I think of as the stereotypical dotcom stock) with dividends reinvested, I get this:

5.8% CAGR is not awesome, but it’s not nearly as terrible as CSCO and INTC. (Total market fund is 7.24% for the same period.) And if you start at 1/1/1999 instead of 1/1/2000, returns to WMT are virtually identical to overall market.