I’m terrified of shorting anything just because the market does not make sense to me

I’m an index fund guy through and through. I use Wealthfront to invest.

I thought Wealthfront was going to be good but it can take days to get the proceeds of selling stocks, which is super annoying.

I can tell you that shorting something and losing money causes me infinitely more mental anguish than buying something that goes down. Like, DoorDash legitimately makes me angry every time I think about it. Not because I’m losing money and have to keep re-upping the cash balance in my account, but because it is so obviously an overpriced stock and I cannot understand what violations of the law of gravity are letting it float at the levels that it is.

For whatever reason, I get hugely emotionally invested in a lot of short positions, which is obviously an indication that I 100% should not be shorting stocks. (That’s on top of the already-convincing argument that I shouldn’t short stocks because I do believe markets are mostly efficient–at least to the extent that they very very rarely allow obvious abnormal profits to be made–and life is so much more peaceful if you just index and chill and ignore meaningless day-to-day variation in prices.)

Vanguard should adopt this as their new slogan and pay you royalties.

Recently listened to this episode from a guy that is sounding the alarm of potential negative consequences of passing investing once it hits a critical mass of all funds. I have to say I had trouble following the thesis. It probably would have been helpful if the hosts posed some of the counterarguments.

If you guessed before looking that this guy has worked his whole life and makes his money from actively managed investments, you win!

My understanding of the arguments around “What if everyone is in index funds?” is that (i) the % of investments in index funds would have to become so large that it’s probably not an issue to worry about any time soon, and (ii) when the % of investments in indexed funds became or approached a number that large, it would spur people to return to trying to actively beat the index funds, so you never really reach that tipping point.

Probably nobody really knows what would happen.

About as big of a problem as too many $20 bills lying around creating a fire hazard

I guess I am somewhat receptive to the argument that if you have some huge percentage of the market that is forced to invest with very rigid rules, and they cannot deviate, that it can create fragility in the system.

An example he gave is hedge funds front running new S&P entries such as SMCI. Many index funds are required to buy the requisite amount of SMCI on day one of inclusion. It’s just free money for institutions on the other side of that trade.

Is this actually true? I assumed that index funds had flexibility in how they replicate the benchmark they’re tracking. This probably isn’t the case for an S&P 500 fund, where liquidity is high enough in all of the stocks that transactions costs aren’t a big deal. But when you get into smaller cap, illiquid markets, I’m almost certain that funds are not fully replicating every stock in the index, and they’re trading off tracking error from that sampling approach (which is bad) with the decrease in transactions costs they achieve from that sampling approach (which is good).

I don’t know if it’s true, but I can paste a few excerpts from the transcript

So, to come back to the point on the Alex Chinco and Marco Sammon paper, the way they chose to test this was they went and they looked at what fraction of shares had to change hands and were traded on index reconstitution events. So, this is the most restrictive definition of passive index tracking, those who trade within the very first day of an index reconstitution. Their conclusion is the number is somewhere around 35% hit that hardest definition of passive. If you expand it to a five-day window, it climbs to about 45% passive.

Unfortunately, the easiest answer is, “Hey, I just recognize that this is happening. I can’t stop it and therefore I become I’m even more venal in my prosecution of it.” A really simple example of that would be the nonsense around SMCI and its inclusion within the S&P 500. Among the most profitable businesses out there, for the multi-strat hedge funds like Millennium or D. E. Shaw or others, is index inclusion arbitrage. And so, recognizing that something like SMCI having exceeded the 12 and a half billion-dollar threshold for the S&P 500, was going to be included in the S&P 500. They’re able to buy as many shares as they want, effectively pushing it further into the S&P 500, and guaranteeing themselves exit liquidity when the event occurs.

I can imagine there might be short-term benefits to being able to predict who’s going to be added to the S&P 500, but it’s weird to call it arbitrage, and I don’t think those benefits are huge. I know there’s academic research on this, but here’s a quick morningstar link:

Also worth noting that DECK was added to the S&P the same day as SMCI with no crazy price movement, so I feel like SMCI is not a representative example. (Blaming the podcast dude, not you)

When everybody is investing in index funds the economy will start to shrink, that is the issue

Yes, why are the people selling to the quants in advance of the index inclusion doing so at a price that’s less than what the index funds are expected to pay?

Can you flesh this out? I have no idea what the argument is, but am curious.

He’s wrong

BRK is a basket of a bunch of different stonks ![]()

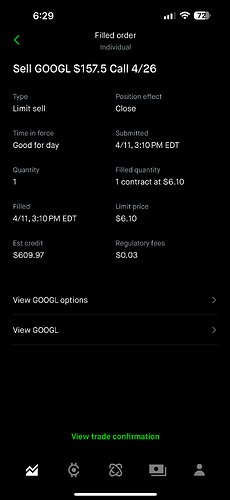

You will all be happy to know that I paper handed my GOOGL 157.5 4/26 call like the jackass I am

Last time I could bring myself to look it was worth over $1500 ![]()

I’m being an asshole

If there’s one thing I’ve learned it’s that I should be terrified when the financial industry tells me not to worry about something. There have been 4 or 5 “No one could have seen this coming!” events in my lifetime.

I pulled the trigger on TSLA puts on Friday. Some dated Sept some dated next March.

Let’s see how it goes

editing to add I am totally a fish when it comes to options