Berkshire Hathaway’s annual letter was released this morning.

It started with a nice tribute to Charlie Munger:

Charlie Munger – The Architect of Berkshire Hathaway

Charlie Munger died on November 28, just 33 days before his 100th birthday.

Though born and raised in Omaha, he spent 80% of his life domiciled elsewhere. Consequently, it was not until 1959 when he was 35 that I first met him. In 1962, he decided that he should take up money management.

Three years later he told me – correctly! – that I had made a dumb decision in buying control of Berkshire. But, he assured me, since I had already made the move, he would tell me how to correct my mistake.

In what I next relate, bear in mind that Charlie and his family did not have a

dime invested in the small investing partnership that I was then managing and whose money I had used for the Berkshire purchase. Moreover, neither of us expected that Charlie would ever own a share of Berkshire stock.

Nevertheless, Charlie, in 1965, promptly advised me: “Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.” With much back-sliding I subsequently followed his instructions.

Many years later, Charlie became my partner in running Berkshire and,

repeatedly, jerked me back to sanity when my old habits surfaced. Until his death, he continued in this role and together we, along with those who early on invested with us, ended up far better off than Charlie and I had ever dreamed possible.

In reality, Charlie was the “architect” of the present Berkshire, and I acted as the “general contractor” to carry out the day-by-day construction of his vision.

Charlie never sought to take credit for his role as creator but instead let me take the bows and receive the accolades. In a way his relationship with me was part older brother, part loving father. Even when he knew he was right, he gave me the reins, and when I blundered he never – never –reminded me of my mistake.

In the physical world, great buildings are linked to their architect while those who had poured the concrete or installed the windows are soon forgotten. Berkshire has become a great company. Though I have long been in charge of the construction crew; Charlie should forever be credited with being the architect.

Even though the headlines are generally positive (" Buffett’s Berkshire posts record profit, quarterly results also rise"), the results seemed quite poor, and I’m less enthusiastic about owning Berkshire at this point than I ever remember being.

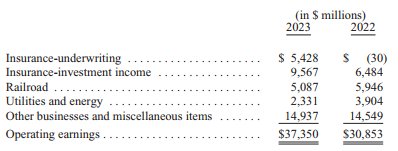

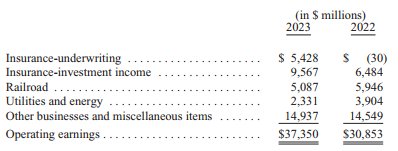

Here’s a summary of 2023’s performance:

In total, it’s great that operating earnings increased roughly 20%. The problem is that the source of those gains is the volatile insurance business and the driven-by-increased-rates investment income. The core of the actual operating companies (utilities and railroads) had very poor results - down about 25%.

The performance of these two segments is critical. You can think of Berkshire Hathaway as a simple machine with two pumps: one pump generates cash inflows and the other pump distributes that cash. Cash inflows come from the insurance side - they get premiums up front and use those premiums for as long as the policy is outstanding (years, in many cases). Not only has this provided an incredible volume of cash, it’s also been ~free. That is, because they’ve run the insurance side at a profit, they’re actually being paid to use this money, as opposed to paying interest to borrow money.

The other source of cash inflows are the many businesses that Berkshire has purchased over the years that, while profitable, have little ability to expand. (This is evident in the flat earnings from the Other businesses and miscellaneous items.) Think See’s Candies. It’s a profitable little company, but they have no real ability to invest their earnings to grow. So instead, those earnings are sent back to Berkshire headquarters for Buffett and Co. to invest.

Now, over time the company has generated absolute gushers of cash. And the cash inflow pump appears to be working perfectly fine even now. Which is great if you’ve got someplace to invest. Historically, that’s been undervalued publicly-traded stocks and bonds, outright acquisitions of companies, and (more recently) repurchases of Berkshire stock. But it’s been harder and harder for Buffett to find investment opportunities, which has left Berkshire with an ever-growing balance of cash. As of 12/31/2023 they had more than $160 billion of cash and cash-like securities.

What makes the railroad and utility segments so important is that they’ve offered a consistent channel for Buffett to invest billions of dollars at a reasonable return. In 2023, they made up about 2/3 of Berkshire’s total capital expenditures. But if those two channels no longer offer the ability to invest at reasonable rates, it represents a severe impairment of Berkshire’s money making machine.

On top of the 2023 results for these two segments being quite poor, Buffett gave some extremely negative commentary about each of them.

For BNSF (the railroad), the issue is that profit margins are declining, at least partially because of higher-than-expected wages increases. This might be improve in the future.

The bigger issue is BHE (the utility segment). As Buffett says, “Most of its large electric-utility businesses, as well as its extensive gas pipelines, performed about as expected. But the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii). In such jurisdictions, it is difficult to project both earnings and asset values in what was once regarded as among the most stable industries in America.”

In short, the cash distribution pump appears to be damaged.

Putting it all together, Berkshire right now is:

- A collection of reasonably high quality wholly-owned businesses with low growth prospects.

- An impressive insurance business.

- A collection of investments in publicly-traded entities, overwhelmingly dominated by the investment in Apple (roughly half of the overall portfolio value).

- More than $100 billion in excess cash with little prospect of reinvestment.

- A railroad segment that will require significant ongoing capital expenditures, with uncertain future profitability.

- A utility segment that offers significant investment opportunities, but also significant regulatory and litigation risk.

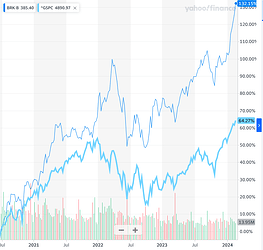

The first 4 points have been true for years, but the last 2 points are fairly recent developments. I’ve been content holding an extremely oversized position in BRK because–despite all the shortcomings–I’ve viewed it as fairly undervalued for many years. But the recent price increase relative to the S&P 500 has been pretty extreme, so it’s much harder to look at it as a no brainer investment.

I’ll probably be selling 1/3 to 1/2 of my holdings on Monday. The only thing holding me back is that I’d put it in a mix of VTI and VXUS and boy does the US market seem richly valued.