And down almost 6% in the last hour. Somebody fired the coaster back up

Me: Um… I like that New York song you did with Rhianna.

Jay-Z: Actually, that was Alicia Keys.

Me: …

Jay-Z: …

Yeah not worth $500k.

How are you liking Fidelity?

Seems fine. Not sure what I should be judging it on. As long as they let me have my money back when I want it I’ll be happy.

![]()

Just wondered how satisfied you were with it. I guess if you’re just buying and holding or using it for a retirement account one’s as good as the next.

I switched my main brokerage account from Merrill to Fidelity a little over a month ago. I’d heard they were better for options and active trading generally, and ranked first by investopedia, so it seemed like to obvious choice. But I found them difficult in various ways and the website updates they recently implemented are kinda buggy. Overall I was super disappointed. The tools and charts are decent, though, so I still use it for research and that. But I moved my active trading over to Robinhood and like it much much better.

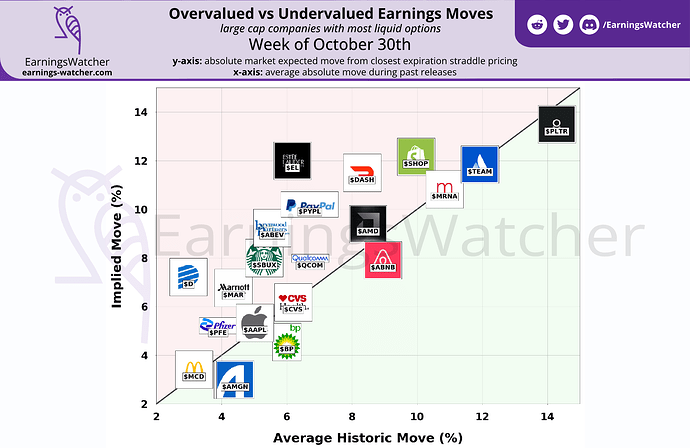

I hate stuff like this graphically cause I don’t know a bunch of them and well some of them sound like a business that’s gotta be shady.

Try this

it’s not a free site but you can hit the little left and right arrows there and it will take you through the whole week day by day, that much is free at least. It has tickers also.

Another good resource I stumbled across. You have to register to use it, and the “premium” content is behind paywall but the free version is worthwhile, tons of historical info, charts for comparisons, also a great resource for options

Question, what recourse is there if the person does not have the money to amawer the call?

well don’t pick up the phone that’s for sure

I presume they can be gone after like any other debt.

They can sell any assets you hold to decrease your margin. A margin call doesn’t mean that your account has a negative value, just that your margin ratio (amount borrowed/value of marginable securities) is too high. So your broker will sell securities from your account until your margin falls back to the required level.

If that doesn’t work and your account has a negative balance, then they can try to collect on that debt.

Yes, this. Not sure if they report it to the credit bureaus but you definitely don’t want to let this happen ![]()

It’s not in that graphic I posted but $PLTR looks like a good option play imo. I went back and checked, and its price has moved at least 18% approximately two weeks after earnings three of the past four cycles. Also this:

so I think sell short strangles on $MCD and long straddles with Nov 17 expiration dates (two weeks after $PLTR earnings, which will be 11/2) and print all the money