I have the same question and have had basically that experience.

going public and keeping 99% of shares seems like the share price is almost guaranteed to increase?

In the past, I used seekingalpha.com . These days I’m just shoveling nearly everything into VTI, so I don’t have a need for it. However, I did find it to be a useful resource.

I signed up for a SA account a few weeks back, and they do have some good writers, or convincing AI maybe, but it got annoying being constantly asked to upgrade to their paid version. I suppose that will be a thing anywhere to some degree, but they seem to go harder than most. I read their free stuff.

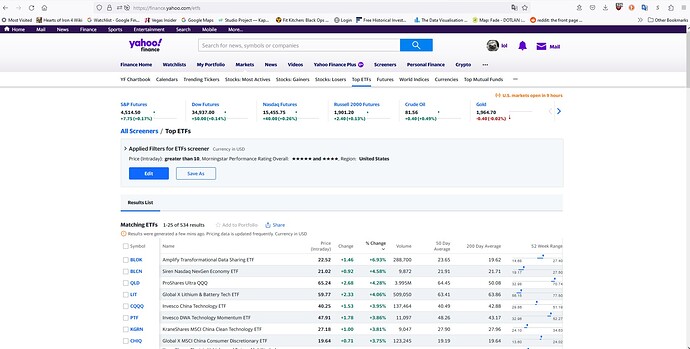

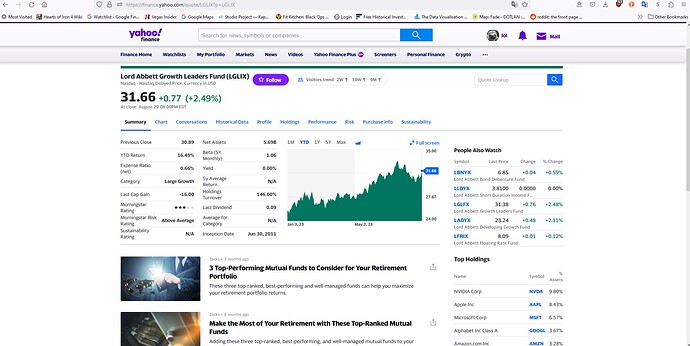

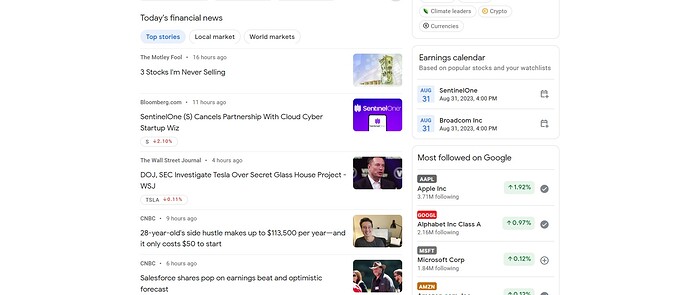

I’ve been on Yahoo a bit more since the last post and I think I may hang there a bit maybe, at least until I find something better, since I’m going to be hanging out there doing fantasy football stuff for the next few months. They don’t link to like Barron’s or WSJ’s financial stuff, and will feed you an AI article like the worst of them, but at least the site is fairly interactive without making you pay for it (though there is a pay version). Not too shabby for free:

Good summation of how Vivek pumped and dumped his way to riches: https://twitter.com/waltermasterson/status/1696528189647167715

The egos on these people… you stole a billion dollars, you’d think they’d want to stay out of the spotlight.

you really have no idea how those people think

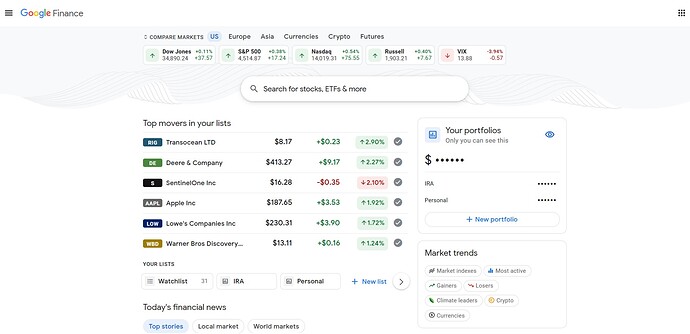

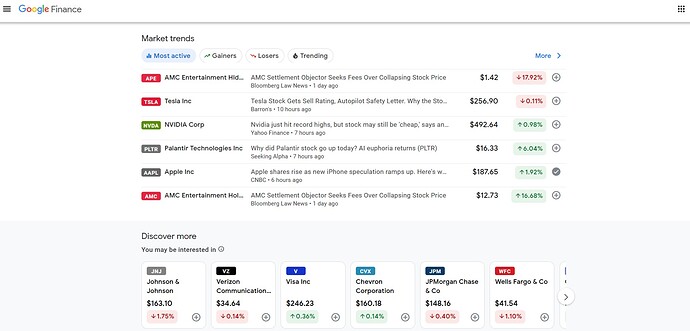

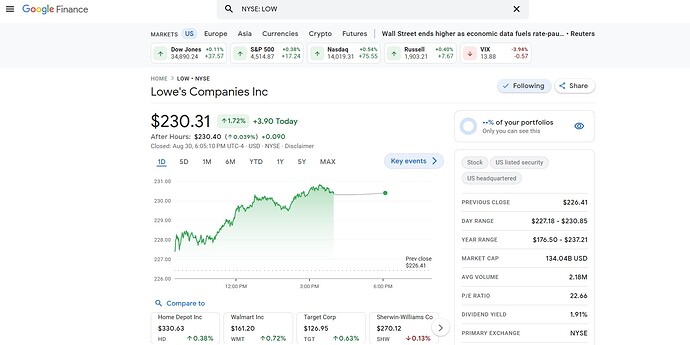

I find Google finance to be better than Yahoo finance these days

didn’t Google finance stop many years back?

It’s there, or something that is labeled “Google Finance” but it doesn’t have nearly what even Yahoo provides in terms of queries and historical data and other types of analysis unless I am just blind and missing it. They actually link to Yahoo a lot for news stuff. I set a watchlist a few months ago with all my holdings at that point, but I have not kept it updated. it seems good enough for that. everything I can get /there I also get on yahoo plus a lot more, though.

I think it’s got a nice news feed and is good for quotes or like basic highlights of financial statements. If you just want to stay up to date with what’s going on in the markets or with a portfolio of stocks that you own or follow it’s pretty good. I don’t think they have any sort of sophisticated stock screener but I would be really careful trying to do that on Yahoo as well. I think any free service that offers that kind of thing is going to have data quality issues and just be crap.

I am not sure what else Melkerson and others are looking for when we say research. To me, real research would be reading 10-k and 10-q submissions in Edgar but I’m not the type of guy who is going to do that and I don’t think the portal you use really matters since you’re just going to be looking at PDFs. If you want a bunch of free market commentary or analysis you can go to a site like Motley Fool or Bloomberg and be aware that what’s available for public consumption is probably barely better for you than watching Jim Cramer.

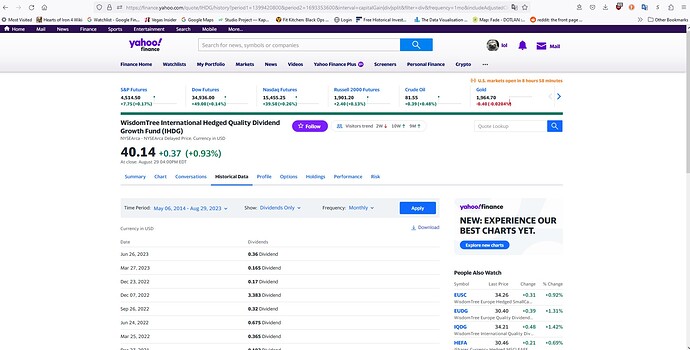

Oh I agree it absolutely works for what it is. I just like being able to see things like option chains and to be able to do ad hoc inquiries on historical prices and dividends and whatnot, and Google Finance just does not give me that. I realize that nothing matters in the end and it’s all just throwing money into a pit and hope some floats back to the top.

Powell gonna be happy to hear this

ah yeah stagflation incoming

3.8% unemployment still pretty low

And reading the article, it’s due to increased labor participation. The new jobs added actually beat the projection. Probably not alarming, right? I don’t know.

Many people are saying it was a perfect job market. Look, I don’ t know, these are the things I’ve heard. This is what people are telling me.

Wait, wat? I think you might have me mixed up with someone else.

I don’t look at “research” for the most part. I’m the dude who just goes all in on VTI.

I just watched Heat. Serious question. Have bearer bonds, where you could steal $1.6M that fits in a Fed-Ex envelope, and somehow unload it for 40 cents on the dollar or whatever, ever actually been a thing? I feel like that would be a pretty big leak in the financial system.